Global Low Carbohydrate Bars Market - Key Trends and Drivers Summarized

How Do Low Carbohydrate Bars Cater to Evolving Dietary Preferences and Health Goals?

Low carbohydrate bars have become a go-to nutritional product for health-conscious consumers and fitness enthusiasts due to their ability to support various dietary goals, from weight management to maintaining steady blood sugar levels. Designed to provide convenient and balanced nutrition with minimal carbs, these bars typically replace high-glycemic ingredients like refined grains and sugars with protein, fiber, and healthy fats, making them an excellent option for individuals following low-carb or ketogenic diets. With growing awareness of the role that carbohydrate intake plays in metabolic health and obesity, low carbohydrate bars offer a practical solution for those looking to reduce their carb consumption without sacrificing energy or satiety. These bars often feature ingredients like nuts, seeds, protein isolates, and low-glycemic sweeteners such as stevia, erythritol, or monk fruit, which contribute to a lower carb content while still providing desirable taste and texture. Additionally, low-carb bars are frequently fortified with vitamins, minerals, and functional ingredients like MCT oil or collagen to further support metabolic health, muscle maintenance, and overall well-being. Their portability and ease of consumption make them ideal for busy lifestyles, offering a quick, nutritious snack or meal replacement that aligns with low-carb dietary principles.What Innovations Are Shaping the Development of Low Carbohydrate Bars?

The low carbohydrate bar market is experiencing significant innovation as manufacturers respond to increasing consumer demand for better-tasting, more nutritious, and highly functional products. One of the primary areas of advancement is in ingredient technology, where the focus has shifted to using novel low-carb components that enhance texture, taste, and nutritional profile without increasing the glycemic load. Ingredients such as soluble corn fiber, chicory root fiber, and resistant starches are being incorporated to provide a satisfying texture and sweetness while maintaining low net carbohydrate content. Moreover, advances in sweetening technologies have enabled manufacturers to replicate the mouthfeel and flavor profile of traditional high-carb bars without the associated blood sugar spikes. These sweeteners, such as allulose and tagatose, mimic the properties of sugar closely but are metabolized differently, making them suitable for low-carb and keto-friendly formulations. Another key innovation is the inclusion of protein sources beyond the conventional whey and soy, such as pea, pumpkin seed, and hemp proteins, which not only broaden the appeal of these bars to a wider audience but also cater to the growing demand for plant-based and allergen-free options. Additionally, functional enhancements are becoming more common, with low-carb bars now featuring adaptogens, probiotics, and nootropics to offer targeted benefits like stress management, digestive health, and cognitive support. This trend towards multifunctional products is transforming low-carb bars from simple snacks into sophisticated health solutions that cater to a variety of dietary needs and lifestyle preferences.Where Are Low Carbohydrate Bars Being Positioned, and What Benefits Do They Offer to Different Consumer Groups?

Low carbohydrate bars are being positioned in diverse market segments, targeting everyone from fitness enthusiasts and dieters to those managing chronic conditions like diabetes or simply seeking healthier snacking options. In the sports and fitness community, low-carb bars are favored for their high protein content and ability to promote muscle repair and recovery without the risk of excess carbohydrate intake that could derail weight management goals. They are often used as pre-workout or post-workout snacks to provide sustained energy and prevent muscle catabolism, making them ideal for bodybuilders and athletes adhering to low-carb or ketogenic diets. Among weight-conscious consumers, these bars serve as a convenient meal replacement or appetite-suppressing snack, helping to curb cravings and prevent overeating by providing a balanced macronutrient profile that supports satiety. For individuals managing diabetes or those concerned with blood sugar stability, low carbohydrate bars are a practical way to enjoy a satisfying treat without causing sharp spikes in blood glucose levels, thus aiding in better glycemic control. The appeal of these bars also extends to the general population looking for nutritious, on-the-go options that do not compromise on taste. With flavors ranging from chocolate fudge and peanut butter to more exotic options like matcha and salted caramel, low carbohydrate bars offer a guilt-free indulgence that fits into a variety of health-conscious diets. Their versatility and broad applicability make them a staple in health food stores, gyms, and online wellness marketplaces, catering to the needs of a diverse and growing consumer base.What Are the Key Factors Fueling the Growth of the Low Carbohydrate Bar Market?

The growth of the low carbohydrate bar market is driven by several factors, including the rising popularity of low-carb and ketogenic diets, increased awareness of the negative health impacts of high-sugar consumption, and the demand for convenient, healthy snacks that align with modern dietary trends. One of the primary drivers is the global shift towards low-carb eating patterns, spurred by the growing recognition that reducing carbohydrate intake can promote weight loss, improve metabolic health, and support better energy levels throughout the day. The ketogenic diet, in particular, has gained traction for its emphasis on high-fat, low-carb eating, pushing the demand for snacks that are not only low in carbohydrates but also rich in healthy fats and proteins. Additionally, there is increasing concern about the health risks associated with excessive sugar intake, including obesity, diabetes, and cardiovascular disease. This has led to a surge in demand for products that offer sweetness and satisfaction without the drawbacks of added sugars and high-glycemic ingredients. Another factor is the rise of the 'snackification' trend, where consumers seek smaller, more frequent meals that provide balanced nutrition and cater to busy, on-the-go lifestyles. Low carbohydrate bars, with their compact size, long shelf life, and balanced nutritional profile, perfectly meet these needs, making them a popular choice for health-focused snacking. Furthermore, advancements in food technology and ingredient innovation are enabling manufacturers to create low-carb bars with improved taste and texture, addressing one of the main challenges in the category and broadening their appeal to a wider audience. As awareness of the benefits of low-carb eating continues to grow and consumers seek healthier, more convenient options, the low carbohydrate bar market is poised for sustained expansion, driven by these converging trends and the continuous development of new, innovative products.Report Scope

The report analyzes the Low Carbohydrate Bars market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Packaging Type (Wrappers, Boxes); Nature Type (Conventional, Organic).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wrappers segment, which is expected to reach US$357.5 Million by 2030 with a CAGR of a 4.4%. The Boxes segment is also set to grow at 4.6% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Low Carbohydrate Bars Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Low Carbohydrate Bars Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Low Carbohydrate Bars Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

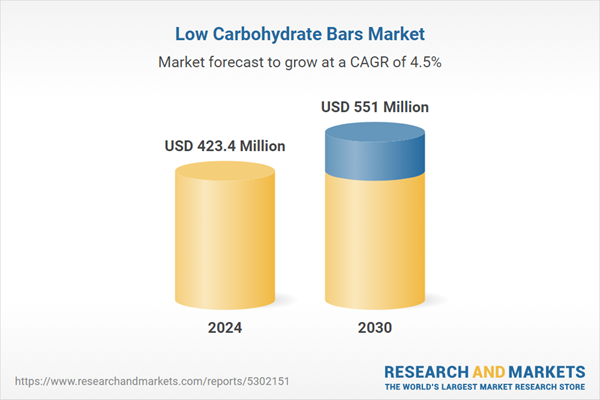

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Nutrition Manufacturing, Atkins Nutritionals, Caveman Foods, Clif Bar & Company, Hormel Foods and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Low Carbohydrate Bars market report include:

- Abbott Nutrition Manufacturing

- Atkins Nutritionals

- Caveman Foods

- Clif Bar & Company

- Hormel Foods

- Mars

- Quest Nutrition

- The Nature's Bounty

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Nutrition Manufacturing

- Atkins Nutritionals

- Caveman Foods

- Clif Bar & Company

- Hormel Foods

- Mars

- Quest Nutrition

- The Nature's Bounty

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 423.4 Million |

| Forecasted Market Value ( USD | $ 551 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |