Mashed potato is one of the foremost prevalent side dishes served in numerous nations, particularly within the European and American regions. Rising urbanization has essentially expanded the sedentary lifestyle, which has definitely increased the utilization of packaged and ready-to-eat food. Mashed potatoes are a sound elective to numerous ready-to-serve foods, as they are great sources of starch and carbohydrates and are for the most part eaten as food increments and sides.

Mash potatoes are picking up more popularity as a result of the rising multi-cuisine culture and a preference for a balanced diet. Besides, a surge in the geriatric population, as well as rising dental and stomach-related issues have expanded the market demand for mashed potatoes for the different age groups. For example, the World Bank evaluated that 10% of the world's population was 65 years of age or older in 2022. This corresponds to 5.12 billion individuals in 2021 and 5.16 billion in 2022

Besides, the flourishing hotels, restaurants, and catering (HoReCa) industry has expanded the requirement for quick services, which has energized the utilization of packaged and frozen food, and so the serving of mashed potatoes. In addition, mashed potato blend gives the same consistency and flavor to each time a dish is prepared while decreasing the preparation time.

Moreover, the ubiquity of flavor customization has driven a part of choices for mashed potato garnishes and seasonings. Buyers are experimenting with distinctive herbs, flavors, cheeses, and sauces to improve the taste and look of mashed potato items. Blending and matching flavors is perpetual; from conventional choices like butter, garlic, and herbs to exploratory ones like bacon bits or truffle oil, the conceivable outcomes are unsetting. The rising popularity of plant-based diets and veganism has led to a rise in the request for plant-based and vegetarian mashed potato alternatives.

The Mashed potato market is anticipated to rise to the growing investments in potato processing, coupled with the general boom in potato production, and per capita utilization. In addition, the developing fast-food culture, increment in demand for ready-to-eat feast choices, and changes in shopper inclinations have encouraged the way for future market growth globally.

MARKET DRIVERS:

The increasing demand for convenient food and the rising vegan population is anticipated to boost the mashed potatoes market expansion.

Mashed potatoes are a simple and common side dish that is simple to get ready and eat, which makes them a perfect choice for busy individuals who need a straightforward meal to create. Pre-packaged, ready-to-eat mashed potatoes, which are accessible in general stores and convenience stores, are in higher requirement as a result of this.Besides, the rise in feasting out and increment demand for packaged and frozen food utilization has expanded the region's potato production. For example, the United Nations Food and Agriculture Organization detailed that the UAE delivered 1,342 tons of potatoes in 2021 which expanded from 1,051 tons in 2020. This increased production has also led to profitable opportunities for market expansion.

Moreover, in April 2022, the first-ever Mashed Potato Easter Egg was introduced by Mash Direct as the newest addition to their creative line of potato-based products. Ahead of the Easter celebrations, the products are made on the family's farm in Northern Ireland using heritage varieties of potatoes.

Furthermore, the market players are well versed in the changing food preferences of the audience as their lifestyle has changed over the past years. Many countries are economically expanding, which has led to an increase in disposable income. The population is willingly shifting towards a changing lifestyle. Health outcomes have also improved with increasing living standards. A huge proportion of the population is driven toward mashed potatoes as they are considered a good source of starch and carbohydrates. They also help maintain the required diet and are generally eaten as food additions and sides.

The United States region is expected to contribute significantly to the market expansion.

The growing trend of convenience food consumption in urban areas and, the surge in demand for pre-packaged food and easy meal options has provided a major boost to the overall mashed potatoes market in the United States. Moreover, baked or mashed potato when blended with milk forms fast-food type dishes, and with the booming culture of fast-food and quick-service eateries in the nation, the request for mashed potato is expected to witness a noteworthy surge. According to the National Restaurant Association, in 2023, the number of quick-service restaurants within the United States stood at 7,49,404. Major quick-service restaurant chains such as Kentucky Fried Chicken (KFC) are planning to present mashed potatoes in their product list portfolios.Moreover, the overall potato production and consumption is also experiencing positive growth in the country which has led to a further upward market trajectory. According to the joint data provided by Statistics Canada and USDA’s National Agricultural Statistical Service (NASS), in 2023, potato production experienced 9% growth in the United States, with the production volume reaching 434 million cwt (hundredweight).

According to the 2023 U.S. per capita consumption report, the country’s per capita potato consumption stood at 117 pounds per year and the same source stated that potato is amongst the major vegetables consumed by the Americans.

Owing to its rich inexpensiveness, versatility, and flavor the mashed potato is expected to witness a positive growth as a base dish or side dish. Major US-based fresh potato products provider namely Idahoan Foods is looking to invest in such food type and investing in new product development which is anticipated to provide new growth prospects for the US market.

Key Market Developments:

- October 2023- Branston is working to operate a mashed potato facility in the UK by spring 2024, focusing on delivering and supplying prepared family favorites to major supermarkets. The facility, which right now handles 350,000 tons of potatoes, will extend Branston's capabilities and improve its long-term maintainability.

- August 2023- Idahoan Foods introduced its most recent product line, highlighting a strong flavor combination including Idahoan® Mashed Potatoes seasoned with Hidden Valley® Original Ranch®, a combination that will offer to a wide group of consumers.

Market Segmentation:

The Mashed Potatoes Market is segmented and analyzed as below:

By Application

- Food Ingredient

- Food Product

- Snacks

- Culinary

By Form

- Powder

- Solid

By Distribution Channel

- Foodservice

- Retail

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Hungry Jack’s

- Pomuni

- Unilever Food Solutions

- Post Holdings Inc.

- Agristo

- McCain Foods Limited

- Idahoan Foods LLC

- Hormel Foods, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | July 2024 |

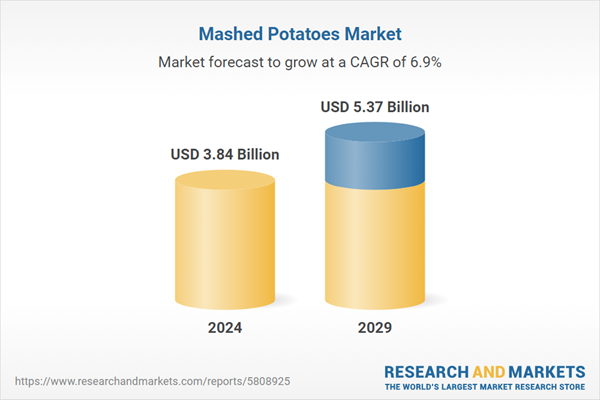

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 3.84 Billion |

| Forecasted Market Value ( USD | $ 5.37 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |