Global Meal Vouchers Market - Key Trends & Drivers Summarized

Why Are Meal Vouchers Still Relevant in the Era of Digital Wallets and Food Delivery?

Meal vouchers, traditionally distributed as paper-based or prepaid card solutions by employers, remain a widely adopted employee benefit and social welfare mechanism, particularly in Europe, Latin America, and parts of Asia. These vouchers subsidize employee meals, increase disposable income, and improve workplace satisfaction while enabling tax benefits for both employers and workers. Even as digital wallets and on-demand delivery platforms gain ground, meal vouchers have adapted by embracing digitization, offering QR codes, mobile apps, and API integrations with point-of-sale systems and food delivery aggregators.The utility of meal vouchers extends beyond employee wellness - they support local food businesses, promote workday nutrition, and enable governments to implement targeted subsidy programs in the form of food assistance. Their tax-advantaged nature and cross-platform compatibility with restaurants, supermarkets, and delivery services ensure continued relevance in both formal and informal economies.

How Is Technology Modernizing Voucher Distribution and Redemption?

The transition from physical to digital meal vouchers is being enabled by fintech partnerships, mobile app ecosystems, and embedded card payment systems. Cloud-based platforms now offer centralized management of voucher issuance, spending limits, compliance, and real-time analytics for employers. Employees can receive and spend vouchers via digital wallets or prepaid cards linked to NFC or QR code payments, removing the friction associated with traditional voucher processing.Integration with food delivery platforms and contactless terminals has further broadened acceptance points, allowing users to spend vouchers at home or on the go. Customization tools allow HR departments to set usage parameters, track redemption trends, and align voucher schemes with employee dietary preferences and health goals. Enhanced security protocols, fraud prevention features, and smart budgeting tools are elevating the appeal of meal vouchers as part of modern corporate wellness programs.

Which Regions and Segments Are Driving Demand for Meal Voucher Solutions?

European countries such as France, Belgium, Italy, and Spain continue to be the largest markets for meal vouchers, with longstanding regulatory frameworks supporting employer-sponsored food programs. In Latin America, countries like Brazil, Mexico, and Argentina maintain strong voucher adoption driven by inflation protection and employee retention strategies. Emerging economies in Asia and Africa are witnessing growth in voucher usage through government-led welfare initiatives and startup-led platforms targeting the gig and informal workforce.In the corporate segment, tech firms, BPOs, and manufacturing companies are investing in flexible benefit platforms that include meal vouchers alongside wellness and commuting support. The public sector uses vouchers to support school lunch programs, food-insecure populations, and disaster relief efforts. Startups are increasingly targeting SMEs with turnkey digital voucher systems that eliminate the administrative burden and enhance employee satisfaction.

The Growth in the Meal Vouchers Market Is Driven by Several Factors…

The growth in the meal vouchers market is driven by increasing employer focus on employee well-being, regulatory support for tax-incentivized food benefits, and the widespread digitization of corporate HR services. A major driver is the integration of meal vouchers into digital benefit platforms, which simplifies distribution, enhances personalization, and increases transparency. The rise of hybrid and remote work is pushing providers to integrate vouchers with home delivery networks, broadening their utility beyond office cafeterias.Rising food inflation and demand for workplace incentives are encouraging both employers and governments to adopt voucher systems that provide targeted support without distorting wage structures. Additionally, fintech and HR tech collaborations are enabling real-time tracking, fraud prevention, and scalability for multinational deployment. Meal vouchers are also gaining popularity in sustainability and wellness-focused programs, where healthy eating is promoted as part of ESG and talent retention strategies - ensuring their continued growth in both developed and emerging markets.

Report Scope

The report analyzes the Meal Vouchers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Digital Card, Book Card).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Digital Card segment, which is expected to reach US$54.2 Billion by 2030 with a CAGR of a 3.4%. The Book Card segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.2 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $18.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Meal Vouchers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Meal Vouchers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Meal Vouchers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Broadcom Inc., Cypress Semiconductor (Infineon), Espressif Systems, Infineon Technologies AG, Intel Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Meal Vouchers market report include:

- Accor SA

- Alelo

- Asinta

- Axis Bank Limited

- Cinqo Group

- Circula GmbH

- CIRFOOD International

- Edenred SA

- Emburse, Inc.

- Hoppier

- Monizze NV SA

- Pluxee

- Rakuten Group Inc.

- Sodexo Group

- SPENDIT AG

- Swile

- Unum Group

- Up Group

- VR Benefícios

- ZRO Cards (Electrum Fintech)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accor SA

- Alelo

- Asinta

- Axis Bank Limited

- Cinqo Group

- Circula GmbH

- CIRFOOD International

- Edenred SA

- Emburse, Inc.

- Hoppier

- Monizze NV SA

- Pluxee

- Rakuten Group Inc.

- Sodexo Group

- SPENDIT AG

- Swile

- Unum Group

- Up Group

- VR Benefícios

- ZRO Cards (Electrum Fintech)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

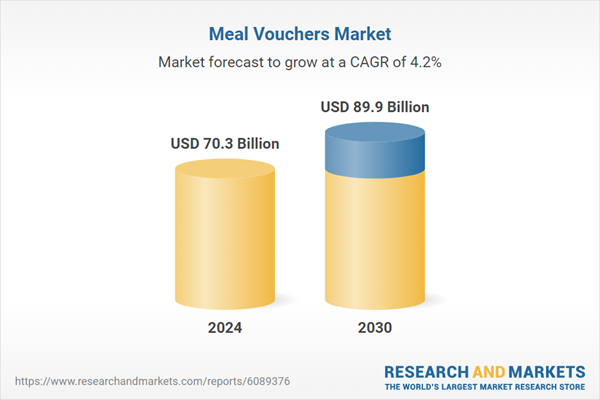

| Estimated Market Value ( USD | $ 70.3 Billion |

| Forecasted Market Value ( USD | $ 89.9 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |