These materials are versatile, offering durability, biocompatibility, and flexibility, making them suitable in a wide range of medical applications, such as medical tubes, bags, and gloves. The growing healthcare costs in developing economies coupled with technology advancements will further fuel the increasing demand for these critical commodities, rendering them even more indispensable to meet growing healthcare needs across the world. Additionally, the expanding population in emerging economies along with the rising prevalence of chronic diseases is creating a demand for medical elastomers.

Based on application, implants are the fastest growing application in medical elastomer market during the forecast period, in terms of value.

Implants are the fastest growing application of medical elastomers due to increasing demand for biocompatible, durable and flexible materials in medical procedures. The rising prevalence of chronic diseases and aging populations are driving the need of durable implants in medical elastomers, as it provides superior orthopedic, dental, and soft tissue implant performance. Flexibility and comfort with least complications further make them appealing. Moreover, the ability of elastomers to be molded into complex shapes and the excellent biocompatibility enhances the future applications of customized implants, thereby further fueling the demand for medical elastomers.Based on end-use industry, hospitals & clinics account the largest share in medical elastomer market during the forecast period, in terms of value.

Hospitals and clinics account for the largest share in the medical elastomer market due to their heavy dependence on medical devices and equipment that utilize elastomer materials. These institutions need a wide range of products based on medical elastomers such as catheters, medical tubing, seals, gaskets, surgical gloves, and implants, in order to ensure appropriate patient care and treatment. However, the growing need for healthcare services due to growing ageing population and rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders further boosts the demand for these medical devices.The properties of medical elastomers such as biocompatibility and excellent flexibility & durability along with chemical resistance makes them highly functional for various applications in hospital and clinic applications. These factors, along with the stringent regulatory requirements from healthcare authorities like FDA, ensure that hospitals and clinics are adopting high-quality elastomer-based products. All these factors combined strong healthcare needs, adherence to regulatory requirements, and the drive for advanced, reliable medical devices ensure make hospitals & clinics account largest market share by industry in the medical elastomer market.

Based on region, Asia Pacific accounts the second largest market for medical elastomer, in terms of value.

Asia Pacific accounts the second largest market for medical elastomers because of various factors such as economic development, rapid population growth, a good healthcare sector, and increasing demand for medical devices. The rise in investments for healthcare infrastructure in emerging economies like China and India is driving the demand for adoption high-quality medical elastomers into healthcare equipments such as medical tubing, implants, and diagnostic equipment. Large and aging population in the region have added up to this demand as prevalence of chronic diseases is rising among this population. Asia Pacific is, therefore, a growth product concerning medical facility organizations dedicated to better healthcare access, positioning it as a major player in the global medical elastomer market.In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

Research Coverage

This report segments the medical elastomer market based on type, technology, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the medical elastomer market.Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the medical elastomer market, high-growth regions, and market drivers, restraints, opportunities, and challenges.The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for medical devices, Technological advancements in healthcare and Prevalence of chronic diseases), restraints (High production costs), opportunities (Growing healthcare investment in emerging economies) and challenges (Stringent regulatory requirements).

- Market Penetration: Comprehensive information on the medical elastomer market offered by top players in the global medical elastomer market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the medical elastomer market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for medical elastomer market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global medical elastomer market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the medical elastomer market

Table of Contents

Companies Mentioned

- Dow

- Exxon Mobil Corporation

- Celanese Corporation

- Basf

- Wacker Chemie AG

- Eastman Chemical Company

- Syensqo

- Kuraray Co. Ltd

- Mitsubishi Chemical Group Corporation

- Momentive Performance Materials

- Envalior

- Zeon Corporation

- The Lubrizol Corporation

- Kraton Corporation

- Foster Corporation

- Biomerics

- Rtp Company

- Romar Engineering

- The Rubber Group

- Kent Elastomer Products

- Raumedic AG

- The Hygenic Company, LLC

- Hexapol Ab

- Tekni-Plex, Inc

- Trinseo

- Trelleborg Ab

- Saint-Gobain

Table Information

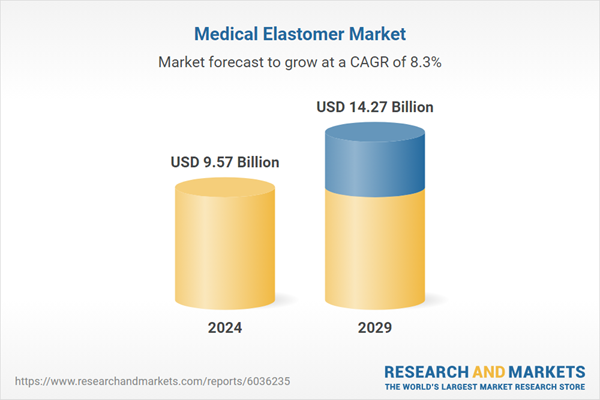

| Report Attribute | Details |

|---|---|

| No. of Pages | 333 |

| Published | December 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 9.57 Billion |

| Forecasted Market Value ( USD | $ 14.27 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |