This increase in the old age population led to an uptrend in need for minimally invasive procedures with medical tubing featuring a key element in drug administration and fluid delivery systems. Moreover, companies' strategic moves, including product launches and mergers, are broadening market coverage and visibility. Finally, rigorous regulatory requirements and government spending on healthcare infrastructure are driving market growth by providing high-quality tubing products for various applications. All these factors together put the medical tubing market in line for long-term growth in the next few years.

Rubber is the second fastest-growing material in the medical tubing market during the forecast period.

Rubber is the second fastest-growing medical tubing material because of its better flexibility, durability, and biocompatibility, which make it suitable for numerous medical applications. Natural and synthetic rubbers, including silicone, latex, and thermoplastic elastomers (TPE), provide good resistance to harsh temperatures, chemicals, and multiple sterilization cycles. This makes rubber tubing ideally suited to be used in catheters, respiratory therapy units, peristaltic pumps, and surgery drainage systems. Silicone rubber is specifically used on a large scale owing to its superior biocompatibility, for which it is considered a material of choice for implantable and long-term medical uses.In addition, rubber products have higher resilience that allows medical tubing to withstand bending and stretching without loss of integrity, hence offering enhanced patient comfort and device performance. The growing prevalence of chronic conditions, such as cardiovascular and respiratory diseases, has fueled the demand for medical devices that incorporate rubber tubing. In addition, advances in rubber formulations, including antimicrobial coatings and increased tensile strength, have contributed to its applications in critical care. With advances in healthcare innovation, rubber tubing continues to be a top contender, thus qualifying it as the second fastest-growing material in the medical tubing market.

Braided tubing is the second fastest-growing structure in the medical tubing market during the forecast period.

Braided tubing is the second fastest-growing medical tubing structure because of its excellent combination of strength, flexibility, and versatility that can address a broad spectrum of sophisticated medical uses. Its structure, with a reinforcing braided layer commonly composed of materials such as stainless steel or nylon inserted inside polymer tubing, provides the best resistance to high pressure and kinking than its non-reinforced counterparts. This makes it most appropriate for high-performance applications such as catheters, endoscopes, and cardiovascular devices, where durability and precise fluid delivery are of the highest priority.The growing need for minimally invasive procedures, which require tubing that can navigate through intricate anatomical pathways without compromising performance, significantly enhances its application. Braided tubing can withstand sterilization processes and maintain structural integrity under stress conditions also helps in meeting the strict safety requirements of the medical sector. Rising prevalence of chronic diseases, coupled with the aging population and their requirement for advanced diagnostic and therapeutic equipment, also fuels its market growth. New braiding technology and material science enable it to be even more flexible and enable customization to fulfill particular medical needs. While single-lumen tubing may be the culprit by way of simplicity and ubiquity, the greater mechanical properties and biocompatibility of braided tubing with high-performance uses position it as a fast-rising market that responds well to shifting needs of modern healthcare.

Catheters & cannulas is the second fastest-growing structure in the medical tubing market during the forecast period.

The catheters & cannulas market is the second fastest-growing application of the medical tubing market owing to a number of major driving factors behind its demand. As the global healthcare systems focus on minimally invasive interventions, catheters & cannulas are becoming the tools of choice, providing safer and less traumatic alternatives to conventional surgeries. These soft tubes play a vital role in uses such as cardiovascular interventions, urinary drainage, and intravenous therapy, where accuracy and patient comfort are of utmost importance. Growing prevalence of chronic illness, including cardiovascular conditions, diabetes, and renal disorders, mainly in aging communities, also catalyzes such expansion.Demand for catheterization in treatment of heart problems or urinary incontinence automatically increases demand for special tubing. Advancements in technology also are contributing factors with improved biocompatible materials, including silicone and polyurethane, improving functionality, longevity, and safety for catheters & cannulas. Besides, the move towards outpatient treatment and home healthcare increases their application in portable equipment, like infusion pumps. The segment is helped by the increasing investments in healthcare, particularly in sectors that are emerging, as enhanced infrastructure and availability of medical services increase the demand for disposable and sterile tubing.

The Middle East and Africa (MEA) market is projected to register the second fastest growing market for medical tubing during the forecast period.

Middle East & Africa (MEA) is the second fastest-growing market for medical tubing owing to mounting healthcare investment, enhancing medical infrastructure, and rising demand for high-tech medical devices. Regional governments, specifically those of Saudi Arabia, UAE, and South Africa, are greatly investing in the modernization of healthcare, generating the demand for superior medical tubing for usage in hospitals, clinics, and diagnostic centers. The growth of healthcare facilities, coupled with the creation of medical free zones and manufacturing centers, is increasing local production and distribution of medical tubing and associated devices.The increasing incidence of chronic diseases like diabetes, cardiovascular diseases, and respiratory diseases has boosted the use of medical tubing in drug delivery systems, catheters, and respiratory devices. The increased geriatric population in the region also demands advanced medical treatment, thereby propelling the use of medical tubing-based applications.

The transition towards home healthcare and wearable medical devices, including insulin pumps and oxygen therapy devices, is another key driver for market growth. Worldwide medical device companies are expanding their reach in the MEA region through collaborations, joint ventures, and establishing regional production units. All this growth increases the number of better-quality medical tubing products available and reduces dependency on imports, and consequently healthcare becomes affordable. Medical tubing technologies such as biodegradable and antimicrobial medical tubing grow more popular in MEA as healthcare professionals continue to prioritize infection control and eco-friendliness.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, Middle East & Africa 5%

The study includes an in-depth competitive analysis of these key players in the authentication and brand protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the medical tubing market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material, application, structure, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the medical tubing market.Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall medical tubing market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.The report provides insights on the following pointers:

- Analysis of key drivers (Increase in geriatric population, Increasing demand for minimally invasive medical procedures, Stringent quality standards and regulations, Advancements in extrusion technology), restraints (Limited material compatibility), opportunities (Customization and innovation in polymers and tubing structure, Increasing government expenditure for upgrading and developing healthcare infrastructure), challenges (High cost of producing and marketing medical tubing products).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the medical tubing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the medical tubing market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the medical tubing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Saint-Gobain (France), Freudenberg Medical (US), W. L. Gore & Associates, Inc. (US), The Lubrizol Corporation (US), Nordson Corporation (US), TE Connectivity (Switzerland), Elkem ASA (Norway), Trelleborg AB (Sweden), RAUMEDIC AG (Germany), Teknor Apex (US), Spectrum Plastics Group (US) Zeus Company LLC (US) among others are the top manufacturers covered in the medical tubing market.

Table of Contents

Companies Mentioned

- Saint-Gobain

- Freudenberg Medical

- The Lubrizol Corporation

- W. L. Gore & Associates, Inc.

- Nordson Corporation

- Te Connectivity

- Elkem Asa

- Trelleborg Ab

- Raumedic AG

- Teknor Apex

- Spectrum Plastics Group

- Zeus Company LLC

- Atag Spa

- Davis Standard

- Fbk Medical Tubing

- Proterial Cable America, Inc.

- Ico Rally

- Icu Medical, Inc.

- Kraton Corporation

- Microlumen Inc.

- Mdc Industries

- Newage Industries

- Optinova

- Parker Hannifin Corp.

- Teel Plastics

- Vesta Inc.

- Smooth-Bor Plastics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 253 |

| Published | March 2025 |

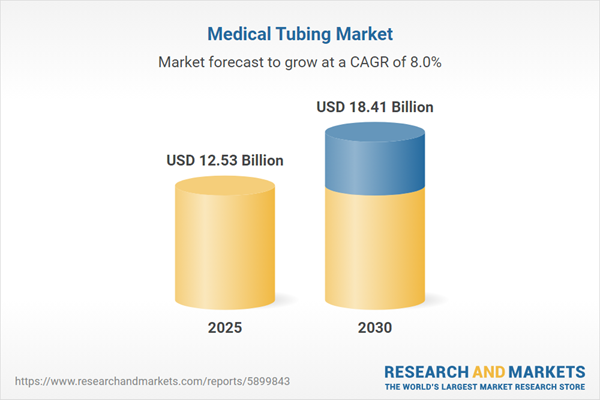

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 12.53 Billion |

| Forecasted Market Value ( USD | $ 18.41 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |