Global Microsatellites Market - Key Trends & Drivers Summarized

What Are Microsatellites and How Are They Manufactured?

Microsatellites, also known as simple sequence repeats (SSRs) or short tandem repeats (STRs), are repeating sequences of DNA typically consisting of 1 to 6 base pairs in length. These sequences are found throughout the genome and are characterized by their high level of polymorphism, making them valuable tools for genetic studies, population genetics, and forensic applications. Microsatellites play a significant role in the analysis of genetic diversity, paternity testing, and the mapping of traits in plants and animals, as they can provide insights into genetic relationships and population structures.The manufacturing process of microsatellites involves several key steps, including the identification, amplification, and characterization of specific microsatellite loci. Initially, genomic DNA is extracted from the organism of interest, followed by the amplification of microsatellite regions using polymerase chain reaction (PCR). This technique involves designing specific primers that flank the microsatellite region, allowing for the selective amplification of the target sequences. Once amplified, the resulting PCR products can be analyzed using various methods, such as capillary electrophoresis or gel electrophoresis, to determine the length and variation of the microsatellite regions. Quality control measures are critical throughout the process to ensure accuracy and reliability in the results.

Recent advancements in microsatellite analysis focus on improving detection sensitivity, automation, and multiplexing capabilities. Innovations in sequencing technologies, such as next-generation sequencing (NGS), have enabled more comprehensive and efficient analysis of microsatellites, allowing researchers to study larger genomes and more complex populations. These technological improvements are expanding the applications of microsatellites in genomics, evolutionary biology, and conservation genetics.

What Are the Primary Applications of Microsatellites Across Industries?

Microsatellites have a diverse range of applications across several industries, including agriculture, forensic science, medical research, and conservation biology. In agriculture, microsatellites are used for genetic mapping and breeding programs. They help researchers identify desirable traits, such as disease resistance or yield potential, by linking specific microsatellite markers to these traits. This application enhances the efficiency of breeding programs, allowing for the development of improved crop varieties that can better withstand environmental challenges.In forensic science, microsatellites are employed in DNA profiling and paternity testing. Their high level of polymorphism makes them suitable for distinguishing between individuals based on genetic variations. Forensic experts utilize microsatellite analysis to analyze biological samples, such as blood or hair, providing critical evidence in criminal investigations and legal proceedings. The reliability and accuracy of microsatellite-based DNA profiling have made it a standard method in forensic laboratories worldwide.

In medical research, microsatellites are used to study genetic disorders and cancer genomics. Researchers analyze microsatellite instability (MSI) in tumor samples, which can indicate the presence of certain types of cancers, particularly colorectal cancer. By examining the patterns of microsatellite variations, scientists can gain insights into tumorigenesis and identify potential biomarkers for early diagnosis and targeted therapies. This application highlights the significance of microsatellites in advancing personalized medicine and improving patient outcomes.

Conservation biology is another critical area where microsatellites are applied. They are used to assess genetic diversity within and between populations of endangered species, providing valuable information for conservation efforts. Understanding the genetic structure of populations helps conservationists develop effective management strategies, such as habitat preservation and breeding programs, to enhance species survival. The ability to monitor genetic diversity using microsatellites is essential for maintaining healthy and resilient populations in the face of environmental changes.

Why Is Consumer Demand for Microsatellites Increasing?

The demand for microsatellites is increasing due to several key factors, including the growing emphasis on genetic research and biotechnology, advancements in sequencing technologies, and rising awareness of their applications in various fields. One of the primary drivers of demand is the increasing focus on genetic research across disciplines. As scientists seek to understand the complexities of genetics and its implications for agriculture, health, and conservation, microsatellites serve as invaluable tools for studying genetic variations and relationships. This trend is propelling the adoption of microsatellite analysis in both academic and commercial research settings.Advancements in sequencing technologies are also contributing to the rising demand for microsatellites. Innovations such as next-generation sequencing (NGS) have made it easier and more cost-effective to analyze large numbers of microsatellite loci simultaneously. These technologies enable researchers to perform high-throughput genotyping, significantly expanding the scope of studies involving microsatellites. As sequencing becomes more accessible, the demand for microsatellite applications in various research areas is expected to grow.

The increasing awareness of the applications of microsatellites in forensic science, medical research, and conservation biology is further influencing demand. As forensic and medical professionals recognize the reliability and effectiveness of microsatellite analysis for DNA profiling and genetic studies, the adoption of these methods is becoming more widespread. In conservation efforts, the ability to assess genetic diversity and population structure using microsatellites is gaining recognition as a critical component of effective species management, driving interest in their use among conservation biologists.

Additionally, the expanding agricultural biotechnology sector is boosting the demand for microsatellites in crop improvement and breeding programs. As the need for sustainable agricultural practices grows in response to climate change and food security challenges, the application of microsatellites in identifying beneficial traits is becoming increasingly relevant. The ability to link microsatellite markers to specific traits enhances breeding efficiency, driving greater interest in their use within the agricultural industry.

What Factors Are Driving the Growth of the Microsatellites Market?

The growth of the microsatellites market is driven by several key factors, including the increasing investments in genetic research and biotechnology, advancements in sequencing technologies, and rising regulatory support for genetic analysis in agriculture and healthcare. One of the most significant factors influencing market growth is the ongoing expansion of genetic research across various fields. As funding for genetics and biotechnology increases, researchers are increasingly incorporating microsatellites into their studies to gain insights into genetic diversity, population structure, and disease mechanisms. This trend is expected to continue as the importance of genetic research becomes more recognized.Advancements in sequencing technologies are also playing a crucial role in driving the growth of the microsatellites market. The development of high-throughput sequencing methods has made it easier and more affordable to analyze microsatellites, enabling researchers to explore larger genomes and more complex populations. These technological innovations are expanding the applications of microsatellites, making them more appealing to scientists in various disciplines.

Rising regulatory support for genetic analysis in agriculture and healthcare is another important factor contributing to market growth. As governments and regulatory bodies recognize the value of genetic testing and biotechnology in enhancing food security and improving healthcare outcomes, they are promoting policies that encourage the use of genetic markers, including microsatellites. This supportive environment is likely to drive increased investment in research and development related to microsatellites and their applications.

Furthermore, the increasing emphasis on sustainability and conservation efforts is influencing the demand for microsatellites in ecological studies. As concerns about biodiversity loss and habitat degradation grow, the ability to monitor genetic diversity and population dynamics using microsatellites is becoming increasingly important. This trend is prompting greater interest in microsatellite applications in conservation biology and ecological research, further driving market growth.

In conclusion, the global microsatellites market is poised for significant growth, driven by the increasing investments in genetic research and biotechnology, advancements in sequencing technologies, and rising regulatory support for genetic analysis in agriculture and healthcare. As researchers and industries seek effective solutions for studying genetic diversity and relationships, microsatellites will play a vital role in advancing knowledge and improving outcomes across various fields. With ongoing innovations and a commitment to addressing industry challenges, the market for microsatellites is expected to experience sustained expansion in the coming years.

Report Scope

The report analyzes the Microsatellites market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Commercial, Defense & Security, Government, Civil).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

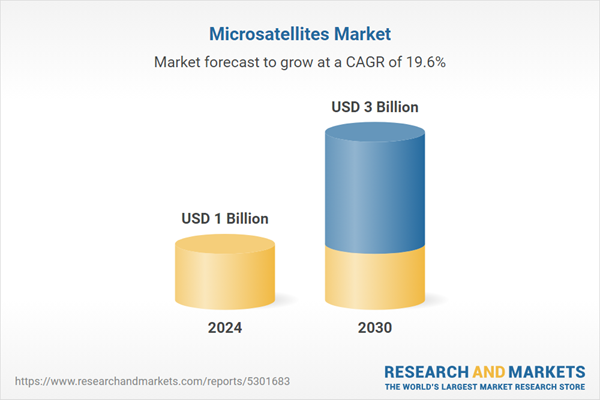

- Market Growth: Understand the significant growth trajectory of the Commercial End-Use segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 21.3%. The Defense & Security End-Use segment is also set to grow at 18.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $254.2 Million in 2024, and China, forecasted to grow at an impressive 25.2% CAGR to reach $835.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Microsatellites Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Microsatellites Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Microsatellites Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AAC Clyde Space, GomSpace, L3Harris, Lockheed Martin, NanoAvionics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Microsatellites market report include:

- AAC Clyde Space

- GomSpace

- L3Harris

- Lockheed Martin

- NanoAvionics

- Planet Labs

- Raytheon

- Sierra Nevada Corporation

- SpaceQuest

- Tyvak

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAC Clyde Space

- GomSpace

- L3Harris

- Lockheed Martin

- NanoAvionics

- Planet Labs

- Raytheon

- Sierra Nevada Corporation

- SpaceQuest

- Tyvak

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 19.6% |

| Regions Covered | Global |