Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Utilizing technologies such as mass spectrometry, polymerase chain reaction (PCR), fluorescence, and spectrophotometry, microbiology analyzers provide rapid and reliable results. This capability is critical in clinical settings where timely diagnosis can directly influence patient outcomes and treatment decisions. In clinical laboratories, microbiology analyzers are indispensable tools for diagnosing infectious diseases, monitoring outbreaks, and supporting antimicrobial stewardship programs. They help in identifying pathogens and determining their susceptibility to various antibiotics, enabling targeted therapies and reducing the risk of antibiotic resistance.

Key Market Drivers

Growing Cases of STD and Other Diseases

The significant rise in the incidence of sexually transmitted diseases necessitates the prompt utilization of microbiology testing. For instance, according to the WHO 2024 report, there has been a significant rise in sexually transmitted infections (STIs) globally. The report also highlights ongoing challenges in combating HIV and hepatitis, emphasizing the urgent need for strengthened public health responses, improved access to diagnostics and treatment, and greater awareness to curb the growing burden of these infectious diseases. As per the World Health Organization's published data, over 1 million sexually transmitted infections are contracted globally each day, with the majority of cases expected to be asymptomatic in 2022.The report also indicates an annual occurrence of approximately 374 million new infections, with chlamydia, trichomoniasis, gonorrhea, and syphilis accounting for one in four sexually transmitted infections. These diseases require immediate testing to identify the responsible viruses for expedited treatment processes. Microbiology analyzers can rapidly and accurately detect the presence of STD-causing microorganisms, such as bacteria, viruses, and parasites.

Early detection is crucial for timely treatment and preventing the spread of infections, especially in cases of asymptomatic or mild symptoms. Many microbiology analyzers offer multiplex testing capabilities, which means they can detect multiple STD pathogens in a single sample. This is especially beneficial for detecting co-infections or identifying multiple pathogens contributing to similar symptoms. Consequently, this factor contributes to the growth of the market.

Key Market Challenges

Limited Reimbursement in Developing Regions

In numerous countries, delayed reimbursement poses a significant obstacle to market expansion. The process of reimbursing microbiology testing is intricate and convoluted. The complexity of this reimbursement process serves as a major impediment to market growth. The absence of standardized reimbursement policies in several countries hinders the progress of the market. The lack of standardized reimbursement policies across different countries or regions can create confusion and barriers to market entry.Varying reimbursement rates, criteria, and procedures can make it difficult for manufacturers and healthcare providers to navigate the reimbursement landscape effectively. Consequently, the lack of reimbursement in emerging nations severely hampers market growth. Delays in reimbursement can create financial uncertainties for healthcare providers and laboratories. When reimbursement for microbiology testing is slow or unpredictable, it can discourage investment in advanced testing equipment and technologies. This can lead to underutilization of modern microbiology analyzers and hinder their market expansion.

Key Market Trends

Increasing Strategic Product Launches Associated with Microbiology Testing

The increasing prevalence of infectious diseases and various strategies implemented by key market players, such as product launches and service expansions, are expected to drive the growth of the Microbiology Analyzers market. For example, in 2022, STEMart introduced microbiology and sterility testing for both sterile and non-pyrogenic medical devices. As a result, the growing number of services launches by major market players is projected to enhance market growth throughout the forecast period. New product launches often introduce advanced technologies, improved features, and enhanced capabilities.This can attract the attention of healthcare providers, researchers, and laboratories looking to upgrade their testing equipment to stay at the forefront of diagnostic and research capabilities. Strategic product launches can address accuracy concerns and offer enhanced precision in microbial testing. Improved accuracy leads to more reliable results and higher confidence in the testing process, which in turn drives demand. New product offerings might streamline testing workflows, reduce turnaround times, and increase laboratory efficiency. This can be particularly appealing in high-volume settings where rapid and efficient testing is crucial. Consequently, this factor contributes to the advancement of the market.

Key Market Players

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Corporation

- Danaher Corporation

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- bioMérieux Inc.

- QIAGEN N.V.

- F. Hoffmann-La Roche AG

- Abbott Laboratories Ltd.

- Ortho Clinical Diagnostics Inc.

Report Scope:

In this report, the Global Microbiology Analyzers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Microbiology Analyzers Market, By Type:

- Automated Analyzers

- Clinical Analyzers

- Molecular Analyzers

- Fully Automated Analyzers

Microbiology Analyzers Market, By Product:

- Molecular Diagnostic Instruments

- Microscopes

- Mass Spectrometers

- Others

Microbiology Analyzers Market, By Application:

- Microbial Infection

- Antibiotic Susceptibility

- Urine Screening

- Blood Cultures

- Others

Microbiology Analyzers Market, By End User:

- Hospitals & Diagnostic Centres

- Custom Lab Service Providers

- Academic & Research Institutes

Microbiology Analyzers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Microbiology Analyzers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Corporation

- Danaher Corporation

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- bioMérieux Inc.

- QIAGEN N.V.

- F. Hoffmann-La Roche AG

- Abbott Laboratories Ltd.

- Ortho Clinical Diagnostics Inc.

Table Information

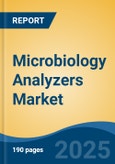

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.98 Billion |

| Forecasted Market Value ( USD | $ 1.43 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |

![Clinical Microbiology Market by Product (Instrument (Incubators), Analyzer (Microscope), Reagent, Kits, Media], Disease Area (Respiratory, Gastrointestinal, STD, UTI), End User (Hospitals, Diagnostic Center, Research Institutes) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/11979/11979906_60px_jpg/clinical_microbiology_market.jpg)