Speak directly to the analyst to clarify any post sales queries you may have.

A concise orientation to the technical, regulatory, and commercial forces elevating microplastic fillers as a strategic material consideration across multiple industrial value chains

Microplastic fillers occupy a rapidly evolving intersection of materials science, regulatory scrutiny, and commercial demand. As polymer formulations are reengineered for performance, affordability, and recyclability, fillers play a decisive role in balancing mechanical properties with processing economics. Recent years have seen supply chain disruptions, elevated scrutiny on environmental persistence, and heightened interest in circularity, all of which influence formulation decisions across industries from automotive to packaging. Consequently, understanding the technical, regulatory, and commercial forces shaping filler selection is now essential for product developers and procurement leaders alike.This introduction distills the converging drivers that elevate microplastic fillers from a commodity line item to a strategic vector for innovation and risk mitigation. It underscores why technical teams must weigh flame retardancy, density variants, and polymer compatibility alongside lifecycle impacts and end-use performance. Moreover, it frames how downstream applications impose distinct constraints that ripple upstream into raw material sourcing and additive design. By clarifying these dynamics up front, the reader is oriented to the themes that recur throughout the analysis - regulatory pressure, substitution pathways, and value-chain adaptation - ensuring readiness for deeper technical and commercial discussion in subsequent sections.

How technological innovation and tightening regulatory expectations are reshaping material selection, forcing rapid adaptation across supply chains and product design teams

The landscape for microplastic fillers is undergoing transformative shifts driven by technological innovation, evolving end-use requirements, and an accelerating regulatory agenda. Novel compounding techniques and compatibilizers have made it possible to achieve targeted mechanical and thermal properties with lower filler loadings, enabling formulators to meet higher performance thresholds while reducing the proportion of added particulate matter. Simultaneously, industry players are investing in engineered microscale additives that deliver features such as enhanced flame retardancy or improved impact resistance without imposing processing penalties.At the same time, policy and public sentiment are shaping procurement and product design choices. Extended producer responsibility frameworks, restrictions on intentionally added microplastics in certain jurisdictions, and heightened reporting requirements for material provenance are compelling manufacturers to reassess long-standing material selections. This regulatory momentum has accelerated the search for alternatives, including modified polymers, bio-based fillers, and novel masterbatch technologies that can deliver comparable performance with reduced environmental persistence. Together, these forces are creating a bifurcated market dynamic where high-performance, compliance-driven solutions coexist with cost-sensitive substitutions, generating both risk and opportunity for suppliers and end users as they navigate a more complex product-development landscape.

Evaluating the cascading effects of new United States import tariffs introduced in 2025 on sourcing strategies, supplier relationships, and regional supply chain resilience

The introduction of tariffs in the United States in 2025 introduced a new layer of economic friction that reshaped sourcing strategies and supplier relationships across the polymer value chain. Import duties altered relative cost structures for certain resin grades and compounded additives, prompting buyers to reassess supplier portfolios and logistics networks. As a result, companies adjusted procurement windows, increased buffer inventory for critical feedstocks, and, in many cases, accelerated qualification of local or regional suppliers to mitigate exposure to tariff volatility. These shifts were not evenly distributed; organizations with diversified global sourcing and flexible supply agreements navigated the change more smoothly than those with concentrated supplier dependencies.Beyond immediate cost implications, the tariffs exerted a strategic pull toward regionalization of supply chains and an emphasis on supplier resilience. Manufacturers began to prioritize contractual clauses that provide greater pricing transparency, pass-through mechanisms, and options for material substitution without lengthy requalification. In turn, some upstream producers pursued vertical integration or strategic partnerships to secure downstream commitments and stabilize volumes. The combined effect was a reorientation of procurement, with procurement and R&D teams collaborating more closely to identify technically acceptable substitutes that also satisfy new commercial constraints, thereby maintaining product performance while containing landed costs in a tariff-influenced environment.

In-depth segmentation analysis revealing how polymer type, end-use application, and filler form converge to shape formulation choices, processing constraints, and compliance pathways

A granular segmentation lens reveals distinct technical and commercial dynamics that inform filler selection and application suitability. When viewed through polymer type, formulations span across acrylonitrile butadiene styrene, polyethylene, polypropylene, polystyrene, and polyvinyl chloride, with each base resin requiring tailored filler approaches to achieve target properties. Acrylonitrile butadiene styrene is addressed differently when flame retardant grades are required versus standard grades for general use, necessitating either specialized additive packages or adjusted filler loadings to balance impact and thermal performance. Polyethylene variants such as high density, linear low density, and low density introduce different crystallinity and processing behaviors that influence filler dispersion and mechanical outcomes, while polypropylene’s copolymer and homopolymer forms present distinct melt-flow and toughness considerations that affect compounding choices. Polystyrene applications diverge between general purpose and high impact grades, which changes the tolerance for particulate inclusions and necessitates attention to interfacial adhesion. Polyvinyl chloride, with its flexible and rigid grades, further illustrates how substrate stiffness and plasticizer interactions shape filler selection and surface finish expectations.Application-driven segmentation underscores how end-use demands dictate material priorities. Automotive components impose strict dimensional stability, fatigue resistance, and flame retardancy requirements that differ markedly between exterior and interior components, leading to differentiated filler chemistries and treatment processes. Construction applications such as insulation, pipes and fittings, and wall panels require durability, long-term weathering resistance, and often fire performance, which guide choices toward fillers that support mechanical reinforcement and thermal performance. Consumer goods-from household appliances to sports equipment and toys-balance tactile feel, aesthetics, and safety, prompting careful selection of filler form and surface treatment to ensure regulatory compliance and consumer acceptability. Electrical and electronics applications separate the needs of casings and internal components, with thermal management and electrical insulation becoming decisive factors. Packaging applications, whether flexible or rigid, emphasize barrier properties, processability, and end-of-life considerations, which influence filler particle size and compatibility with recycling streams.

Form factor is a final, practical segmentation: granules, pellets, and powder each offer distinct handling, dosing precision, and dispersion profiles during compounding. Granules and pellets typically increase ease of handling and reduce dust, facilitating automated dosing and consistent melt blending, whereas powders can offer finer dispersion at the cost of increased processing control measures. Collectively, the polymer, application, and form segmentations create a matrix of technical constraints and commercial trade-offs that must be navigated when selecting fillers for specific product families and manufacturing environments.

Comparative regional outlook showing how policy intensity, industrial demand, and infrastructure investments shape divergent pathways for filler adoption across global regions

Regional dynamics materially affect supply chain strategy, regulatory compliance, and innovation pathways. In the Americas, procurement teams are balancing the aftermath of trade-policy shifts with strong demand from transportation and packaging sectors, prompting investments in domestic compounding capacity and supplier risk mitigation to ensure continuity of supply. Market participants are also bullish on collaborations that accelerate approvals for alternative formulations and support roadmaps for circularity, especially in jurisdictions with active discussion around microplastic regulation.Europe, Middle East & Africa present a different mix of drivers where regulatory rigor and public scrutiny are particularly pronounced. The region’s regulatory environment continues to push manufacturers toward transparency in material composition and lifecycle impacts, accelerating adoption of additives and fillers that demonstrate lower environmental persistence. Additionally, innovation hubs in the region are advancing compatibilizer chemistries and recycling infrastructure that enable higher incorporation of reclaimed content, which is reshaping the value proposition for certain filler types.

Asia-Pacific remains a center of production scale and rapid end-use demand growth, yet it is heterogeneous in regulatory posture and technological maturity. Some markets are pushing aggressive recycling targets and material efficiency initiatives, while others are prioritizing cost-competitive supply and manufacturing throughput. As a result, companies operating across Asia-Pacific are tailoring strategies to local regulatory signals and customer expectations, investing in both high-volume compounding for large-scale applications and specialist formulations for advanced manufacturing segments. Across all regions, the interplay between policy, industrial demand, and infrastructure investment drives divergent pathways for filler adoption and value-chain restructuring.

How industry leaders are blending technical differentiation, collaborative development, and flexible operations to create resilient, high-value offerings in a changing regulatory and commercial environment

Leading companies in the filler ecosystem are responding through a combination of technological differentiation, strategic partnerships, and operational resilience. R&D efforts are concentrated on improving filler-matrix compatibility, reducing required loadings while preserving or enhancing mechanical properties, and developing surface treatments that facilitate recycling without compromising performance. Collaborative models between resin producers, compounders, and end users are increasingly common, enabling co-development of formulations that reduce time to market and lower qualification barriers for new materials.Commercially, firms are sharpening value propositions by offering not just raw materials but technical service packages that include processing advice, trial support, and compatibility testing. This shift toward solutions-based selling helps capture higher-value engagements with OEMs that require rapid change-control processes and documented performance. At the same time, companies are investing in analytics to monitor downstream performance in fielded products and inform iterative improvements. Operational strategies emphasize regional manufacturing hubs and flexible production lines capable of switching between grades and forms to meet variable demand, as well as greater transparency in traceability to meet regulatory reporting needs. Together, these moves indicate a competitive landscape where technical differentiation and integrated service capabilities are becoming as important as price and lead time.

A practical set of prioritized actions for manufacturers and suppliers to align innovation, supply chain resilience, and regulatory preparedness in the evolving filler landscape

Industry leaders should pursue a coordinated set of actions that align technical innovation with procurement flexibility and regulatory readiness. First, integrate cross-functional teams that pair material scientists with procurement and compliance experts to accelerate qualification of alternative fillers and manage substitution risk. This approach reduces the time from concept to deployment while ensuring that performance and regulatory considerations are addressed concurrently. Second, prioritize investments in surface modification and compatibilizer technologies that can lower filler content without degrading performance, thereby supporting both cost and sustainability objectives.Third, strengthen supplier diversification and nearshoring strategies to buffer against trade-policy shocks and logistic disruptions, while negotiating contractual terms that allow faster material swaps when needed. Fourth, expand pilot programs for recycled-content and bio-based fillers, coupling these trials with robust testing protocols to quantify long-term durability and processing impacts. Fifth, enhance traceability and documentation systems to meet increasingly granular regulatory reporting requirements and to support claims about reduced environmental persistence. Finally, cultivate partnerships with downstream customers to co-develop application-specific solutions and to ensure that any transition in filler chemistry is synchronized with product qualification timelines, thereby minimizing commercial disruption and preserving brand reputation.

A robust mixed-methods research approach combining primary interviews, technical validation, and triangulated secondary analysis to ensure rigor and practical relevance of findings

This research blends primary interviews, in-depth technical assessment, and comprehensive secondary-source synthesis to deliver actionable and validated insights. Primary research included structured interviews with material scientists, procurement leaders, and regulatory specialists across multiple end-use sectors to capture emergent technical preferences and procurement responses to policy shifts. These conversations were supplemented by detailed compounder and OEM case studies that illuminate how formulation trade-offs are resolved in practice.Secondary research incorporated peer-reviewed literature, standards documentation, and publicly available regulatory filings to establish a factual baseline on polymer properties, filler treatment methods, and compliance frameworks. Data from supply chain audits and production footprint analyses were triangulated with interview inputs to identify regional capacity trends and adaptation strategies. Quality controls included cross-validation of technical claims with laboratory performance data where available, and iterative review cycles with subject-matter experts to ensure that interpretations are grounded in industry realities. Where uncertainty remained, sensitivity checks were deployed and documented to transparently reflect the range of plausible operational outcomes. This mixed-methods approach ensures that recommendations are both technically rigorous and practically relevant for decision makers.

A strategic synthesis highlighting why integrating filler decisions into product design, procurement, and regulatory planning is essential for competitive resilience and innovation

The cumulative picture is one of a landscape in transition: technical advances enable performance improvements that reduce reliance on higher-volume particulate loadings, while regulatory momentum and commercial pressures are catalyzing shifts toward more transparent, circular material strategies. Procurement, R&D, and regulatory teams must therefore operate in closer tandem than ever before, balancing cost pressures with performance and compliance imperatives. Organizations that build adaptable sourcing strategies, invest in compatibilizer and surface-treatment technologies, and proactively engage with regulators will be best positioned to navigate the emerging complexity.In closing, the imperative is clear: treat filler strategy as an integral aspect of product design and supply-chain resilience rather than a downstream commodity decision. This perspective unlocks opportunities to improve performance, reduce lifecycle impact, and create competitive differentiation. The trends documented in this analysis emphasize that proactive coordination across technical, commercial, and regulatory functions will determine which firms convert disruption into durable advantage.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Microplastic Fillers Market

Companies Mentioned

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Clariant International Ltd.

- Covestro AG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- ExxonMobil Chemical

- H.B. Fuller Company

- Honeywell International Inc.

- Huntsman Corporation

- INEOS Group Holdings S.A.

- Lanxess AG

- LG Chem Ltd.

- LyondellBasell Industries

- Mitsubishi Chemical Holdings Corporation

- RTP Company

- SABIC

- Solvay SA

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- The Dow Chemical Company

- Toray Industries, Inc.

- Tosoh Corporation

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

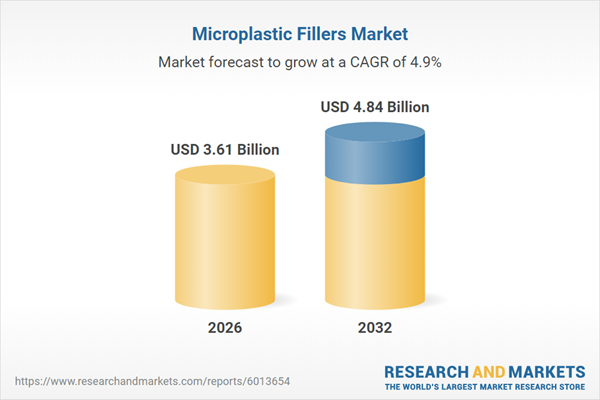

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.61 Billion |

| Forecasted Market Value ( USD | $ 4.84 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |