Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

At the heart of the Middle East & African CDN market's growth is a significant shift in how individuals and businesses consume digital content. The advent of high-definition streaming, online gaming, and the proliferation of mobile devices has led to an unprecedented surge in online traffic. CDN services have become essential in ensuring quick and efficient delivery of data-heavy content like videos and large files, enhancing the user experience across various applications, from streaming platforms to e-commerce transactions. The COVID-19 pandemic acted as an accelerator for digital transformation across Middle East & African businesses. Lockdowns and social distancing measures led to an exponential increase in online service reliance. From remote work solutions to virtual events and e-learning platforms, CDN providers played a pivotal role in maintaining the accessibility and reliability of digital services during this period of heightened demand.

In addition to performance optimization, CDN providers have heightened their focus on security. As cyber threats continue to evolve and become more sophisticated, Middle East & African businesses are increasingly concerned about protecting their online assets and user data. CDN services now offer robust security features, including Distributed Denial of Service (DDoS) protection, Web Application Firewalls (WAFs), and real-time threat monitoring. These security measures ensure websites and applications hosted on CDNs are shielded from malicious attacks, providing peace of mind for both businesses and their customers. The Middle East & African CDN market has seen a proliferation of competition and innovation. Global giants and agile local players have entered the market, offering diverse services and pricing models. This competition has driven innovation, resulting in more efficient CDN solutions, advanced edge computing capabilities, and cost-effective pricing options for businesses of all sizes. This diversity of providers allows organizations to select CDN partners that align with their specific needs, whether focusing on performance, cost-effectiveness, or specialized services.

Data privacy and regulatory compliance have also played a significant role in shaping the Middle East & African CDN market. Regulations like the General Data Protection Regulation (GDPR) have imposed stringent rules on handling personal data. This has driven businesses to collaborate with CDN providers that ensure compliance with GDPR and regional data privacy laws. CDNs have responded by implementing data protection measures like encryption, access controls, and data residency options, along with tools to help businesses meet GDPR requirements and maintain transparency in data processing, enhancing consumer trust.

Looking ahead, the Middle East & African CDN market is poised for further growth and transformation, driven by the ongoing expansion of 5G networks. 5G technology promises ultra-fast, low-latency connectivity, aligning perfectly with CDN providers' goals to optimize content delivery. As 5G infrastructure expands, CDN services will leverage this network evolution to deliver content even more efficiently, opening up opportunities for enhanced user experiences and innovative applications. The increasing popularity of online video streaming, e-commerce platforms, and cloud services ensures robust demand for CDN services. These digital trends show no signs of slowing down, and CDN providers will continue to play a pivotal role in shaping digital experiences for businesses and consumers across the Middle East & Africa. Efficient content distribution, whether for high-definition video streams, immersive augmented reality experiences, or real-time gaming, will remain a critical factor in the success of online businesses and content providers.

In conclusion, the Middle East & African CDN market has experienced remarkable growth and transformation due to the rising demand for high-quality content delivery, accelerated digitalization from the pandemic, heightened security concerns, and evolving data privacy regulations. With a competitive landscape, ongoing technological advancements, and the promise of 5G, the future of the Middle East & African CDN market is highly promising. CDN providers will remain instrumental in ensuring seamless digital content and service delivery, contributing to the continued growth of the digital economy in the region.

Key Market Drivers

Rapid Digital Transformation in the MEA Region

The Middle East & African (MEA) Content Delivery Network (CDN) market is being propelled by the rapid digital transformation sweeping across the region. This transformation encompasses a multitude of industries, from finance and healthcare to education and e-commerce, and is fundamentally changing the way businesses operate and engage with their customers. In recent years, MEA countries have witnessed a surge in internet penetration, mobile device adoption, and a growing tech-savvy population. As a result, businesses are compelled to expand their digital presence, offering online services, e-commerce platforms, and multimedia content to cater to the evolving preferences of consumers. This digital shift has placed immense pressure on organizations to ensure that their online offerings are not only accessible but also perform seamlessly, regardless of the user's location or device.CDN providers in the MEA region have seized this opportunity by offering solutions that optimize content delivery, minimize latency, and enhance the overall user experience. They have played a pivotal role in enabling businesses to navigate the complexities of digital transformation, ensuring that their online services are both reliable and scalable. As the MEA region continues its digital journey, the demand for CDN services is expected to surge, further driving the growth of the market.

Soaring Online Video Consumption:

The consumption of online video content in the Middle East & Africa (MEA) region has reached unprecedented heights, acting as a significant driver for the CDN market's growth. The proliferation of high-speed internet connectivity, coupled with the popularity of smartphones and streaming platforms, has fueled this surge in online video consumption. In particular, the MEA region has witnessed a surge in user-generated content, video-on-demand (VoD) platforms, and live streaming services. Consumers are increasingly turning to online video for entertainment, education, news, and social engagement. This surge in demand for video content places substantial pressure on businesses and content providers to deliver high-quality videos efficiently, ensuring a seamless viewing experience. CDN providers have risen to the challenge by optimizing video delivery, implementing adaptive streaming technologies, and minimizing buffering and load times. These services not only enhance the user experience but also reduce the strain on network infrastructure. Furthermore, the shift towards 4K and even 8K video resolutions, along with the advent of augmented reality (AR) and virtual reality (VR) content, requires robust CDN solutions to deliver these data-intensive experiences without interruptions. As online video consumption continues to rise across the MEA region, CDN providers are well-positioned to play a pivotal role in meeting this burgeoning demand.E-Commerce Expansion:

The e-commerce sector in the Middle East & Africa (MEA) is experiencing rapid growth, driven by changing consumer behaviors, increased digitalization, and expanding access to online shopping platforms. This surge in e-commerce presents a significant drive for the CDN market in the region. Consumers across MEA countries are increasingly turning to online shopping for convenience, choice, and competitive pricing. The COVID-19 pandemic further accelerated the shift to e-commerce, as lockdowns and social distancing measures pushed more consumers to make online purchases. For e-commerce businesses to succeed in this competitive landscape, the efficient delivery of web content, product images, videos, and transactional data is crucial. CDN providers offer solutions that ensure fast and reliable content delivery, reducing page load times and enhancing the overall online shopping experience. Furthermore, the expansion of e-commerce has prompted businesses to adopt content-rich strategies, including high-resolution product images, 360-degree product views, and video demonstrations. These content types demand efficient delivery, and CDNs are instrumental in optimizing their distribution. CDN providers in the MEA region are poised to capitalize on the e-commerce boom by offering services that not only enhance the performance of online stores but also support secure online transactions. As e-commerce continues to thrive, the CDN market will benefit from sustained growth.Growing Demand for Cloud Services:

The Middle East & African (MEA) region is witnessing a growing appetite for cloud services, both among businesses and consumers. This surge in demand for cloud-based applications, data storage, and software-as-a-service (SaaS) solutions is a significant driver for the MEA Content Delivery Network (CDN) market. Businesses in the MEA region is increasingly adopting cloud-based technologies to streamline operations, enhance scalability, and reduce capital expenditures. Cloud services offer flexibility and accessibility, allowing organizations to access data and applications from anywhere, at any time. This trend has been further accelerated by the need for remote work solutions and digital collaboration tools during the COVID-19 pandemic. As organizations migrate to the cloud, they require efficient CDN solutions to ensure that their cloud-hosted applications and data are readily accessible and perform optimally. CDN providers play a critical role in optimizing the delivery of cloud-based content and applications by minimizing latency and improving responsiveness. Furthermore, the burgeoning popularity of streaming services, online gaming platforms, and software updates delivered from the cloud places considerable strain on network infrastructure. CDN providers offer solutions that alleviate this strain by distributing content closer to end-users, reducing the load on original servers, and ensuring uninterrupted access to cloud-based services. As the demand for cloud services continues to rise across the MEA region, CDN providers are poised to benefit from this growth, positioning themselves as essential partners in the seamless delivery of cloud-hosted content and applications to businesses and consumers alike.Key Market Challenges

Data Privacy and Compliance

One of the significant challenges facing the Middle East & Africa Content Delivery Network Market is navigating the complex landscape of data privacy and compliance regulations. As organizations increasingly rely on Content Delivery Network to collect and analyze user data for various purposes, they must contend with a patchwork of data protection laws and regulations across different countries and regions within Middle East & Africa. These regulations often impose strict requirements on how data is collected, stored, processed, and shared. For example, the Middle East & African Union's General Data Protection Regulation (GDPR) has extraterritorial applicability, affecting businesses in the Middle East & Africa region that have dealings with Middle East & African customers. Ensuring compliance with GDPR and similar regulations can be a daunting task, requiring organizations to implement robust data protection measures, obtain informed consent from users, and establish stringent data access controls. Furthermore, individual countries within Middle East & Africa, such as Japan, Australia, and India, have their own data protection laws that organizations must adhere to when collecting and handling user data. Navigating this complex regulatory landscape while ensuring the responsible and ethical use of data in Content Delivery Network can be a significant challenge for businesses operating across borders within the region.Security Risks and Cyber Threats

The Middle East & Africa Content Delivery Network market faces a growing challenge concerning security risks and cyber threats. Wi-Fi networks, which serve as the foundation for Content Delivery Network solutions, are attractive targets for cybercriminals due to the wealth of sensitive data they transmit and store. Organizations must safeguard both the data collected through Content Delivery Network and the networks themselves from a range of security threats. One of the key security challenges is the potential for unauthorized access to Wi-Fi networks and the data they transmit. Cyber attackers may exploit vulnerabilities in network security protocols or use tactics such as credential theft to gain access to sensitive data. Breaches in Wi-Fi network security can result in data leaks, unauthorized data modification, and network disruptions.Moreover, the rise of IoT devices interconnected with Wi-Fi networks introduces additional security concerns. These devices often have varying levels of security, making them potential entry points for cyber threats. For example, unsecured IoT devices can be compromised and used as vectors for attacks on the Wi-Fi network itself or for data exfiltration. To mitigate these security risks, organizations in the Middle East & Africa region must adopt comprehensive cybersecurity strategies. This includes implementing robust encryption protocols, regularly updating and patching network infrastructure, conducting security audits, and deploying intrusion detection and prevention systems. Additionally, educating employees and users about cybersecurity best practices and fostering a culture of security awareness is crucial. regulations.

Key Market Trends

Edge Computing Integration:

One of the most significant trends reshaping the Middle East & Africa CDN market is the integration of edge computing. Edge computing brings computation and data storage closer to the data source, reducing latency and enabling faster processing of data. This trend is particularly relevant in Middle East & Africa, where data privacy and regulatory concerns have driven the need for local data processing and storage. CDN providers are increasingly deploying edge nodes at strategic locations across Middle East & Africa. These edge nodes act as mini data centers, allowing for real-time content delivery, data processing, and even running applications at the edge of the network. This is essential for latency-sensitive applications such as augmented reality (AR), virtual reality (VR), and autonomous vehicles, where delays can be critical. Furthermore, edge computing enables CDN providers to offer more sophisticated services, including dynamic content personalization, real-time analytics, and IoT (Internet of Things) support. Businesses in Middle East & Africa are leveraging these capabilities to deliver tailored content and services to users, enhance user experiences, and gain deeper insights into user behavior. As edge computing continues to evolve, CDN providers in Middle East & Africa will play a crucial role in facilitating the growth of this trend, making it easier for businesses to harness the power of edge computing.Video Streaming Optimization:

The explosion of online video streaming services is driving a notable trend within the Middle East & African CDN market: a focus on video streaming optimization. Streaming platforms, including global giants like Netflix and Amazon Prime Video, as well as regional players, have become an integral part of entertainment consumption in Middle East & Africa. With the rise of 4K and even 8K video quality, the demand for high-quality, low-latency video streaming is at an all-time high. To meet these demands, CDN providers are investing heavily in video delivery infrastructure. They are optimizing their networks to handle the immense bandwidth requirements of streaming high-definition content, reducing buffering, and ensuring uninterrupted playback. This optimization is not limited to entertainment streaming but extends to live events, gaming, and other interactive video experiences.Moreover, content providers are exploring advanced video delivery technologies such as adaptive streaming, which dynamically adjusts video quality based on a user's network conditions, ensuring a seamless viewing experience across devices and varying internet speeds. These trends are driving CDN providers in Middle East & Africa to continuously innovate and collaborate with content creators to deliver an exceptional video streaming experience. The Middle East & African CDN market is also witnessing the convergence of video streaming and e-sports. As e-sports gain popularity across the continent, CDN providers are helping e-sports platforms deliver high-quality, low-latency streams to millions of viewers, making it a rapidly emerging subsegment within the video streaming landscape.

Multi-Cloud and Hybrid Cloud Strategies:

Another notable trend shaping the Middle East & African (MEA) Content Delivery Network (CDN) market is the widespread adoption of multi-cloud and hybrid cloud strategies among businesses. Many organizations are opting for a multi-cloud approach, leveraging multiple cloud providers to diversify their infrastructure and reduce reliance on a single vendor. This strategy offers several advantages, including enhanced flexibility, scalability, and redundancy. In this context, CDN providers play a pivotal role by enabling businesses to effectively implement multi-cloud and hybrid cloud strategies. They facilitate the distribution of applications and content across various data centers provided by different cloud vendors, ensuring that users can access services and content from the nearest and most responsive cloud source. This approach minimizes latency and elevates the overall user experience.Moreover, CDN providers are now offering services that streamline secure connections between on-premises data centers, private clouds, and multiple public cloud environments. This is particularly critical for MEA businesses that prioritize factors such as data privacy, regulatory compliance, and seamless data transfer between various cloud platforms. As the adoption of multi-cloud and hybrid cloud strategies continues to gain momentum, CDN providers in the MEA region are expected to expand their service offerings further. They will likely provide even more robust solutions to assist businesses in optimizing their cloud infrastructure. Additionally, given the growing popularity of containerization and microservices architectures, CDN providers are likely to incorporate these technologies into their portfolios to better support modern cloud deployments. This adaptive approach ensures that MEA businesses can leverage CDN services to thrive in an evolving digital landscape.

Segmental Insights

Adjacent Service Insights

Based on adjacent service, the website & API management segment emerges as the predominant segment, exhibiting unwavering dominance projected throughout the forecast period. This segment's unwavering dominance can be attributed to several compelling factors that underscore its critical role in MEA's digital ecosystem. Firstly, in an era defined by online interactions and digital experiences, businesses across the MEA region increasingly rely on efficient website and API management to deliver content and services seamlessly to their users. This includes ensuring fast loading times, minimal downtime, and robust security for websites and APIs, all of which are facilitated by CDN providers specializing in this segment. Secondly, the surge in e-commerce, mobile app usage, and web-based applications across MEA has amplified the demand for reliable website and API management. With the proliferation of online transactions and user interactions, businesses prioritize the optimization and security of their web assets and APIs to deliver a superior user experience. CDN providers offering website and API management services are well-positioned to meet these evolving needs, contributing to their sustained dominance in the MEA CDN market. Furthermore, the ongoing digital transformation across various industries in the MEA region, including finance, healthcare, and e-government services, necessitates robust website and API management solutions to ensure data privacy, compliance with regulatory requirements, and seamless connectivity. As the MEA CDN market continues to evolve, the website and API management segment's enduring dominance underscores its pivotal role in facilitating the digital growth and success of businesses and organizations throughout the region.End User Insights

Based on end user, the healthcare segment emerges as a formidable frontrunner, exerting its dominance and shaping the market's trajectory throughout the forecast period. This prominence of the healthcare sector can be attributed to a convergence of factors that highlight the critical role of CDN services in this domain. Firstly, the healthcare industry in the MEA region has been undergoing a rapid digital transformation, with a surge in telemedicine, health information exchange, and remote patient monitoring services. As healthcare providers seek to deliver these services seamlessly to patients and healthcare professionals, the need for efficient content delivery, including medical images, records, and real-time telehealth sessions, has become paramount. Secondly, the COVID-19 pandemic has accelerated the adoption of digital healthcare solutions across the MEA region, making reliable CDN services indispensable. Healthcare organizations have turned to CDN providers to ensure the swift and secure delivery of critical medical information, educational content, and telemedicine platforms, fostering a robust and accessible healthcare ecosystem. Furthermore, the healthcare sector places a premium on data privacy and security, and CDN providers offering specialized solutions cater to these stringent requirements. With healthcare data being highly sensitive, CDN services that offer robust security measures, including encryption and DDoS protection, have gained significant traction among healthcare providers.Regional Insights

UAE has indisputably cemented its position as the unrivaled leader in the Middle East & Africa content delivery network market, commanding a substantial and influential share of the market's revenue. This preeminence is the result of several compelling factors that have contributed to the UAE's dominance in this pivotal sector of the digital landscape. Firstly, the UAE boasts a thriving and technologically advanced economy that has cultivated an environment conducive to digital innovation and expansion. With its strategic location as a global crossroads and business hub, the UAE has become the epicenter for organizations seeking to establish a digital footprint across the Middle East and Africa. Furthermore, the UAE's relentless commitment to technological advancement and infrastructure development has enabled it to build a robust and extensive network architecture, ensuring the efficient delivery of digital content not only within its borders but also to neighboring regions. This strategic positioning has made the UAE the preferred choice for enterprises seeking reliable CDN services in the broader MEA market. Additionally, the UAE has been at the forefront of cybersecurity and data privacy, offering stringent data protection measures and establishing itself as a regional leader in digital security. This emphasis on safeguarding online assets and user data has instilled trust among businesses seeking secure CDN solutions in an increasingly digitized world.Key Market Players

- Akamai Technologies, Inc.

- Limelight Networks, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Cloudflare, Inc.

- Fastly, Inc.

- StackPath, LLC

- CDNetworks Co., Ltd.

- Cedexis, Inc.

- Alibaba Group Holding Limited.

Report Scope

In this report, the Middle East & Africa content delivery network market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Middle East & Africa Content Delivery Network Market, by Type:

- Video CDN

- Non-Video CDN

Middle East & Africa Content Delivery Network Market, by Service Provider:

- Traditional Content Delivery Network

- Cloud Service Providers

- Telco Content Delivery Network

- Others

Middle East & Africa Content Delivery Network Market, by Solution:

- Media Delivery

- Web Performance Optimization

- Cloud Security

Middle East & Africa Content Delivery Network Market, by Adjacent Service:

- Storage Services

- Website & API Management

- Network Optimization Services

- Support & Maintenance

- Others

Middle East & Africa Content Delivery Network Market, by Content Type:

- Static

- Dynamic

Middle East & Africa Content Delivery Network Market, by End-User:

- Retail & E-Commerce

- Media & Communication

- Gaming

- BFSI

- Healthcare

- Others

Middle East & Africa Content Delivery Network Market, by Country:

- Israel

- Qatar

- UAE

- Saudi Arabia

- South Africa

- Iran

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East & Africa Content Delivery Network market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Akamai Technologies, Inc.

- Limelight Networks, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Cloudflare, Inc.

- Fastly, Inc.

- StackPath, LLC

- CDNetworks Co. Ltd.

- Cedexis, Inc.

- Alibaba Group Holding Limited.

Table Information

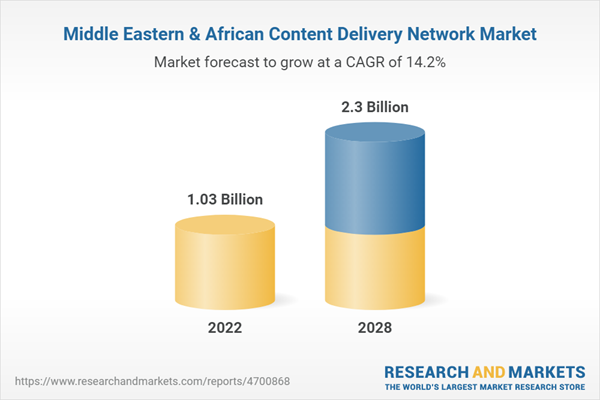

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.03 Billion |

| Forecasted Market Value ( USD | $ 2.3 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |