The COVID-19 pandemic has had a major impact on the residential sector and disrupted the business of developers and manufacturers of construction projects. The COVID-19 pandemic led to negative consequences in the concrete block manufacturing market, where manufacturers are now making strategic decisions to offset losses from 2020. Most cement companies have continued to operate during the outbreak, mainly focusing on complying with safety and health requirements.

Key Highlights

- Over the short term, factors driving the GCC concrete blocks market are increasing demand in the commercial segment and using concrete blocks in infrastructure. Furthermore, businesses are investing money to improve their product portfolio, which, in turn, will help in their market growth.

- However, the fluctuating cost of raw materials to manufacture concrete blocks and the high cost of building homes are likely to slow down the market growth and hinder the expansion of the studied market.

- Nevertheless, the growing consumer awareness for lightweight materials in modern buildings and construction will likely create lucrative opportunities for the concrete block market during the forecast period.

GCC Concrete Blocks Market Trends

The Rise in Commercial Segment

- The rise in the commercial segment due to the large-scale consumption of concrete blocks for remodeling and construction activities shall drive market growth.

- In the construction industry, concrete blocks are mainly used to build walls, foundations, and floors to support the building and other structural surfaces outside and inside the house.

- Structural designers and architects design buildings with concrete blocks because of their high structural capacity, resistance to water and fire, and insulating properties.

- The renovation and refurbishing of old buildings have increased investment in the construction industry, which, in turn, has augmented the demand for concrete blocks.

- UAE, Kuwait, and Qatar are registering strong growth in various remodeling and construction activities.

- Also, government spending will play a vital role in boosting the growth of the construction industry. According to Qatar’s 2021 budget, new projects worth QAR 54 billion (USD 14.81 billion) were proposed, which will help diversify the economy and develop infrastructure.

- These attributes are expected to witness significant growth in the GCC region over the forecast period.

Saudi Arabia Dominates the GCC Concrete Blocks Market

- Construction is a leading economic sector in the GCC region, whereas Saudi Arabia is the leading investor in the construction business, with over USD 82 billion.

- Saudi Arabia dominated the market attributed of construction projects in the country. Giga projects, transport, and mobility schemes such as the Riyadh Metro, social infrastructure developments such as the Ministry of Housing's Sakani program, and energy mega-projects, such as the state-owned Aramco Berri and Marjan oil fields, shall drive the market growth.

- The Saudi Arabian construction market is anticipated to witness significant growth and offer opportunities due to its Vision 2030, NTP 2020, and several ongoing reforms to diversify away from oil. These factors shall drive the Saudi Arabian construction businesses in the next seven years.

- Currently, the country's economy is entering a post-oil era, in which the kingdom's megacities, which are under construction, will provide future growth. According to industry sources, more than 5,200 construction projects worth USD 819 billion are currently underway in Saudi Arabia. These projects represent approximately 35% of the total value of active projects within the GCC.

- An increase in demand for housing boosts residential construction and fuels the demand for concrete blocks as the growing urban population expands and migrates.

GCC Concrete Blocks Market Competitor Analysis

The GCC concrete block market is fragmented in nature. Some of the major manufacturers in the market include Raknor LLC, Consent Group, ESPAC, MJK Group, and MANSOOR CONCRETE BLOCK INDUSTRY LLC (MaCon), among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Increasing Demand in the Commercial Segment

4.1.2 Increasing Use of Concrete Blocks in Infrastructure

4.2 Restraints

4.2.1 Fluctuating Cost of Raw Materials

4.2.2 High Cost of Building Homes with Concrete Blocks

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION

5.1 Type

5.1.1 Solid Concrete Blocks

5.1.2 Hollow Concrete Blocks

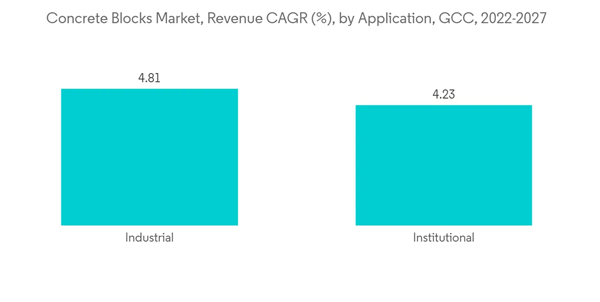

5.2 Application

5.2.1 Residential

5.2.2 Commercial

5.2.3 Infrastructure

5.2.4 Industrial and Institutional

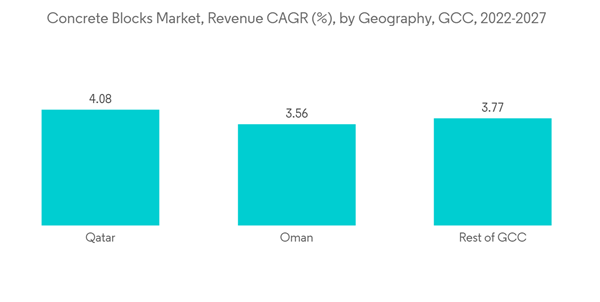

5.3 Geography

5.3.1 Saudi Arabia

5.3.2 UAE

5.3.3 Qatar

5.3.4 Oman

5.3.5 Rest of GCC

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share(%)**/Ranking Analysis**

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Aamal Cement Industries

6.4.2 Al Amaar Block Manufacturing Co. LLC

6.4.3 Al Jazeera Factory For Construction Materials

6.4.4 Al Najah Automatic Tiles & Blocks Factory

6.4.5 AL RAYYAN BLOCK FACTORY WLL

6.4.6 Bucomac Industries

6.4.7 Consent Group

6.4.8 ESPAC

6.4.9 Khonaini International Company

6.4.10 MANSOOR CONCRETE BLOCK INDUSTRY LLC (MaCon)

6.4.11 MJK Group

6.4.12 Raknor LLC

6.4.13 Saudi ReadyMix

6.4.14 Starlines Block Factory

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Growing Awareness Among Consumers for Lightweight Materials

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aamal Cement Industries

- Al Amaar Block Manufacturing Co. LLC

- Al Jazeera Factory For Construction Materials

- Al Najah Automatic Tiles & Blocks Factory

- AL RAYYAN BLOCK FACTORY WLL

- Bucomac Industries

- Consent Group

- ESPAC

- Khonaini International Company

- MANSOOR CONCRETE BLOCK INDUSTRY LLC (MaCon)

- MJK Group

- Raknor LLC

- Saudi ReadyMix

- Starlines Block Factory