Growing Adoption of Sustainable Dry Ice Production Methods Drives Middle East & Africa Dry Ice Market

Traditional dry ice production methods, which involve the direct capture of carbon dioxide from industrial processes, are energy-intensive and contribute to carbon emissions. However, the adoption of more sustainable practices is reshaping the industry landscape. Carbon dioxide from carbon-neutral sources is environmentally friendly, viable, and economically sustainable.Instead of using hydrocarbon by-products to capture carbon dioxide, a few dry ice producers are now using the anaerobic digestion process as an eco-friendly solution, and this trend is expected to gain traction during the forecast period. The biomethane produced by facilities integrating this new process is then captured and transmitted through gas upgraders, and eventually, membrane technology is utilized to separate carbon dioxide from methane.

Anaerobic digestion systems align with the circular economy concept by creating closed-loop systems. Organic waste inputs for anaerobic digestion can be sourced locally, reducing the need for transportation and supporting regional sustainability initiatives. This decentralized approach enhances the overall efficiency of the dry ice production process and minimizes the carbon footprint associated with the raw material acquisition.

Advancements in renewable energy sources are also influencing the sustainability of dry ice production. Incorporating renewable energy, such as solar and wind power, into the production process can significantly reduce the carbon footprints associated with dry ice manufacturing. Manufacturers adopting these sustainable energy practices are likely to gain a competitive edge in the market as environmentally conscious consumers and businesses seek eco-friendly alternatives.

Thus, the increasing demand for anaerobic digestion systems and integration of renewable energy sources in dry ice production is a result of their ability to align with sustainability objectives, minimize environmental impact, and contribute to the circular economy. As industries prioritize greener practices, the integration of sustainable production processes into dry ice production processes is poised to become a key driver of growth in the sector.

Middle East & Africa Dry Ice Market Overview

The Middle East and Africa dry ice market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Strong economic growth in countries across the region is creating a platform for the development and expansion of the market in the region. The healthcare and pharmaceutical industry in the region is significantly growing, with governments in the region focusing more on the well-being of the increasing population.In addition, factors such as strong population growth, greater life expectancy, the predominance of lifestyle-related disorders such as diabetes, and demand for superior healthcare services are driving the pharmaceutical industry's growth in the region. Thus, the rising pharmaceutical industry in the Middle East & Africa is projected to drive the demand for dry ice in the coming years.

The climate in Middle Eastern countries is harsh as deserts surround them. Pharmaceutical shipments in these countries may get exposed to harsh weather conditions, causing severe damage to the products. Therefore, the companies take additional care in such regions to protect their shipments and avoid huge losses. This factor can also favor the dry ice market for pharmaceutical applications in the Middle East & Africa.

Further, the demand for frozen food products in the region is high. The region's frozen food product is witnessing rapid development with the growth of urban markets such as Dubai, Abu Dhabi, and Iran. New investment and better marketing strategies have led to the capture of market share in the Middle East & Africa. Moreover, according to the Food Export Association of the Midwest USA and Food Export USA-Northeast, in 2021, Saudi Arabia exported approx. US$ 1.1 billion of food products to the region, an increase of nearly 2% since 2020. The main products consisted of dairy items, processed foods, snack foods, processed dates, processed fruits & vegetables, sugar and sweeteners, and poultry meat.

Demand for packaged foods is growing due to consumers' changing lifestyles and diets and the expansion of the food retail and food service sectors. The growing populations of the UAE, Bahrain, Saudi Arabia, Kuwait, Qatar, and Oman increased the demand for frozen products. This has been providing huge opportunities for the major players in the dry ice market. The food sector in the Middle East & Africa has experienced a sharp increase due to high economic growth, urbanization, population growth, and a rising middle class.

Consumers highly prefer good quality food products with high nutritional value. The dry ice market offers lucrative opportunities to fulfill the growing consumer demands as it keeps frozen products contamination-free and improves their shelf life. All these factors are expected to create growth opportunities for dry ice market players in the Middle East & Africa.

Middle East & Africa Dry Ice Market Segmentation

- The Middle East & Africa dry ice market is categorized into type, application, and country.

- Based on type, the Middle East & Africa dry ice market is segmented into pellets, blocks, and others. The blocks segment held the largest market share in 2022.

- In terms of application, the Middle East & Africa dry ice market is segmented into food and beverages, storage and transportation, healthcare, industrial applications, and others. The storage and transportation held the largest market share in 2022.

- By country, the Middle East & Africa dry ice market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa dry ice market share in 2022.

- Gulf Cryo LLC, L’Air Liquide SA, Linde Plc, and SOL SpA are some of the leading companies operating in the Middle East & Africa dry ice market.

Market Highlights

- Based on type, the Middle East & Africa dry ice market is segmented into pellets, blocks, and others. The blocks segment held 48.0% market share in 2022, amassing US$ 63.02 million. It is projected to garner US$ 101.80 million by 2030 to register 6.2% CAGR during 2022-2030.

- In terms of application, the Middle East & Africa dry ice market is segmented into food and beverages, storage and transportation, healthcare, industrial applications, and others. The food and beverages segment held 30.9% share of Middle East & Africa dry ice market in 2022, amassing US$ 40.54 million. It is anticipated to garner US$ 64.54 million by 2030 to expand at 6.0% CAGR during 2022-2030.

- This analysis states that the Rest of Middle East & Africa captured 52.3% share of Middle East & Africa dry ice market in 2022. It was assessed at US$ 68.75 million in 2022 and is likely to hit US$ 101.59 million by 2030, registering a CAGR of 5.0% during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa dry ice market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa dry ice market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Middle East & Africa dry ice market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Middle East and Africa Dry Ice market include:- Gulf Cryo LLC

- L’Air Liquide SA

- Linde Plc

- SOL SpA

Table Information

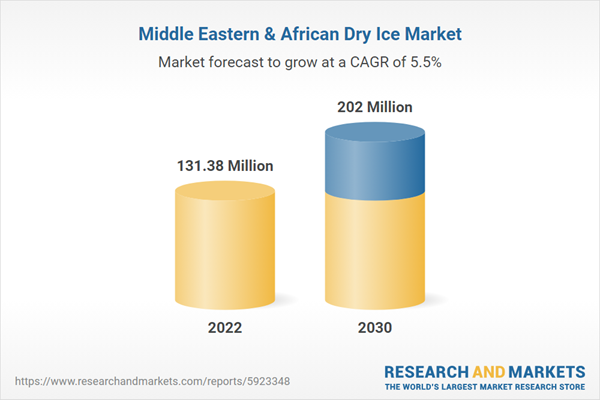

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 131.38 Million |

| Forecasted Market Value ( USD | $ 202 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 5 |