Research Related to Fluoroelastomer Recycling Fuels Middle East & Africa Fluoroelastomers Market

Fluoroelastomers are used in the production of gaskets, seals, and other components, offering a barrier against harsh chemicals and fluids under severe service conditions. However, disposal of fluoroelastomers at the end of their life cycle can be challenging.Recycling initiatives by scientists can help reduce fluoroelastomer waste and limit the need for virgin materials. A few properties of fluoroelastomer such as durability and chemical resistance make recycling a challenging aspect; however, there are several approaches and ongoing research pertaining to fluoroelastomer recycling. Mechanical recycling involves the grinding of fluoroelastomers into small particles; but this method is not suitable for all fluoroelastomers as it hampers material properties, preventing them from being used again. In 2022, researchers at the University of Applied Sciences Kaiserslautern (Germany) studied recycling methods for fluoroelastomers and"green cross-linking strategy." Ongoing research on various fluoroelastomer recycling methods includes chemical recycling, pyrolysis, and solvent-based recycling. Fluoroelastomer seals and gaskets are studied for reclamation and reutilization in cases where it has not undergone significant degradation. Thus, ongoing research for fluoroelastomer recycling offers potential opportunities for the major players operating in the fluoroelastomers market during the forecast period.

Middle East & Africa Fluoroelastomers Market Overview

The fluoroelastomers market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. In the Middle East & Africa, fluoroelastomers are widely used in the oil and gas industry. The region is a global hub for oil production and refining, and fluoroelastomers are crucial in seals, gaskets, and O-rings used in wellheads, pipelines, and processing equipment. Their resistance to aggressive chemicals and high temperatures ensures the reliable operation of these critical components. In the Middle East & Africa, fluoroelastomers are also essential in the mining industry. The report published by the Minerals Council of South Africa in 2022 revealed that the mining production in South Africa was valued at US$ 57 billion in 2021 and reached US$ 61 billion in 2022. Further, in South Africa, mining exports accounted for US$ 46.3 billion, or 24% of the country's international trade, in 2022. The total sales of iron ore in South Africa accounted for US$ 5.4 billion in 2022, representing a rise of 47.3% compared to 2019. In addition, according to the International Trade Administration, Saudi Arabia's untapped mineral reserves accounted for US$ 1.3 trillion in 2021. Further, the World Mining Data 2022 report by the Federal Ministry of the Republic of Austria revealed that Africa accounted for 889.6 million metric tons of mineral production (excluding bauxite). The mining production rate of minerals in Africa increased by 16.2% from 2000 to 2020. This region is rich in mineral resources, and the equipment used in mining operations often operates in abrasive and corrosive environments. Fluoroelastomers contribute to extended service life and reduced mining and mineral processing maintenance.Further, fluoroelastomers are employed in engine seals, fuel system components, and transmission seals. These materials help vehicles endure extreme temperatures and perform in harsh desert climates. The rise in automotive sales in South Africa and Saudi Arabia is creating a significant demand for fluoroelastomers. For instance, in September 2022, Renault Group Morocco announced that its two factories in Tangier and Casablanca, Morocco, produced 350,000 vehicles in 2022, a 15.3% increase over the production numbers in 2021. In the Middle East & Africa, the market is evolving due to the increasing passenger vehicle production. Rising middle-class income, growing population, and increasing passenger vehicle production are driving the fluoroelastomers market.

Middle East & Africa Fluoroelastomers Market Segmentation

The Middle East & Africa fluoroelastomers market is segmented into type, application, end user, and country.Based on type, the Middle East & Africa fluoroelastomers market is segmented into fluorocarbon elastomers, fluorosilicone elastomers, and perfluorocarbon elastomers. The fluorocarbon elastomers segment held the largest share of the Middle East & Africa fluoroelastomers market in 2022.

Based on application, the Middle East & Africa fluoroelastomers market is categorized into O-rings, seals and gaskets, hoses, molded parts, and others. The O-rings segment held the largest share of the Middle East & Africa fluoroelastomers market in 2022.

In terms of end user, the Middle East & Africa fluoroelastomers market is segmented into automotive, aerospace, oil and gas, semiconductors, energy and power, and others. The automotive segment held the largest share of the Middle East & Africa fluoroelastomers market in 2022.

Based on country, the Middle East & Africa fluoroelastomers market is categorized into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa fluoroelastomers market in 2022.

3M Company, AGC Inc, Daikin Industries Ltd, Solvay SA, and The Chemours Co are some of the leading companies operating in the Middle East & Africa fluoroelastomers market.

Table of Contents

Companies Mentioned

- 3M Company

- AGC Inc

- Daikin Industries Ltd

- Solvay SA

- The Chemours Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 89 |

| Published | May 2024 |

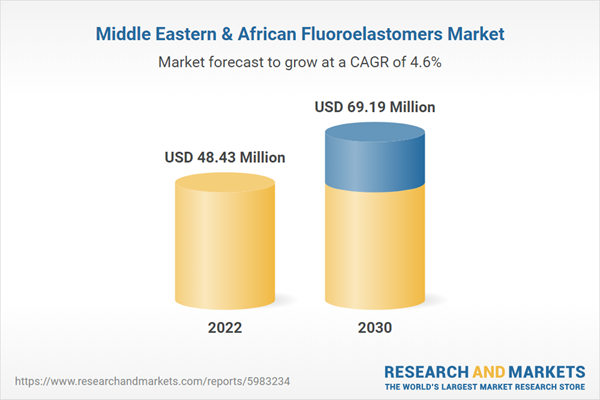

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 48.43 Million |

| Forecasted Market Value ( USD | $ 69.19 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 5 |