Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Component

1.2.2. Indication

1.2.3. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. Internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Volume price analysis (Model 2)

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

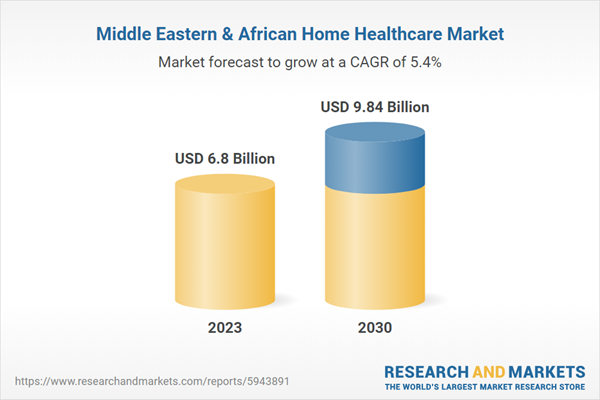

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Component outlook

2.2.2. Indication outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Middle East and Africa Home Healthcare Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising prevalence of chronic diseases

3.2.1.2. Technological advancements in ablation devices

3.2.1.3. Rising geriatric population

3.2.1.4. Government initiatives

3.2.2. Market restraint analysis

3.2.2.1. Stringent regulations

3.2.2.2. Scarcity of skilled home healthcare service professionals

3.3. Middle East and Africa Home Healthcare Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.3.2.4. Social landscape

3.3.2.5. Legal landscape

3.3.2.6. Environmental landscape

Chapter 4. Middle East and Africa Home Healthcare Market: Component Estimates & Trend Analysis

4.1. Component Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Middle East and Africa Home Healthcare Market by Component Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

4.4.1. Equipment

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.1. Therapeutic

4.4.1.1.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.1.2. Home respiratory equipment

4.4.1.1.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.1.3. Insulin delivery market

4.4.1.1.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.1.4. Home IV pumps

4.4.1.1.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.1.5. Home dialysis equipment

4.4.1.1.1.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.1.6. Other therapeutic equipment

4.4.1.1.1.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2. Diagnostics

4.4.1.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.2. Diabetic care unit

4.4.1.1.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.3. BP monitors

4.4.1.1.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.4. Multi para diagnostic monitors

4.4.1.1.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.5. Home pregnancy and fertility kits

4.4.1.1.2.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.6. Apnea and sleep monitors

4.4.1.1.2.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.7. Holter monitors

4.4.1.1.2.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.8. Heart rate meters (include pacemakers)

4.4.1.1.2.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.2.9. Others

4.4.1.1.2.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.3. Mobility assist

4.4.1.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.3.2. Wheel chair

4.4.1.1.3.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.3.3. Home medical furniture

4.4.1.1.3.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.1.3.4. Walking assist devices

4.4.1.1.3.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Services

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1. Skilled nursing services

4.4.2.1.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1.2. Physician primary care

4.4.2.1.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1.3. Nursing care

4.4.2.1.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1.4. Physical/occupational/speech therapy

4.4.2.1.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1.5. Nutritional support

4.4.2.1.1.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1.6. Hospice & palliative

4.4.2.1.1.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.1.7. Other skilled nursing services

4.4.2.1.1.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.1.2. Unskilled nursing services

4.4.2.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Middle East and Africa Home Healthcare Market: Indication Estimates & Trend Analysis

5.1. Indication Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Middle East and Africa Home Healthcare Market by Indication Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

5.4.1. Cardiovascular disorder & hypertension

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Diabetes & kidney disorders

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Neurological & mental disorders

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4. Respiratory disease & COPD

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.5. Maternal disorders

5.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.6. Mobility disorders

5.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.7. Cancer

5.4.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.8. Wound care

5.4.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.9. Others

5.4.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Middle East and Africa Home Healthcare Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Middle East and Africa Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. South Africa

6.5.1. Key country dynamics

6.5.2. Regulatory framework/ reimbursement structure

6.5.3. Competitive scenario

6.5.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

6.6. Saudi Arabia

6.6.1. Key country dynamics

6.6.2. Regulatory framework/ reimbursement structure

6.6.3. Competitive scenario

6.6.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

6.7. Oman

6.7.1. Key country dynamics

6.7.2. Regulatory framework/ reimbursement structure

6.7.3. Competitive scenario

6.7.4. Oman market estimates and forecasts 2018 to 2030 (USD Million)

6.8. Egypt

6.8.1. Key country dynamics

6.8.2. Regulatory framework/ reimbursement structure

6.8.3. Competitive scenario

6.8.4. Egypt market estimates and forecasts 2018 to 2030 (USD Million)

6.9. UAE

6.9.1. Key country dynamics

6.9.2. Regulatory framework/ reimbursement structure

6.9.3. Competitive scenario

6.9.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

6.10. Rest of Middle East and Africa

6.10.1. Key country dynamics

6.10.2. Regulatory framework/ reimbursement structure

6.10.3. Competitive scenario

6.10.4. Rest of Middle East and Africa market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company heat map analysis, 2023

7.4. Company Profiles

7.4.1. Koninklijke Philips N.V.

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Omron Healthcare, Inc.

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. Air Liquide

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. Amana Healthcare

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. B. Braun SE

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. Medtronic

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. Manzil Healthcare Services

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Al Tadawi Medical Centre

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. NMC Healthcare

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives

7.4.10. Abeer Medical

7.4.10.1. Company overview

7.4.10.2. Financial performance

7.4.10.3. Product benchmarking

7.4.10.4. Strategic initiatives

7.4.11. Davita Inc.

7.4.11.1. Company overview

7.4.11.2. Financial performance

7.4.11.3. Product benchmarking

7.4.11.4. Strategic initiatives

7.4.12. CARDINAL HEALTH

7.4.12.1. Company overview

7.4.12.2. Financial performance

7.4.12.3. Product benchmarking

7.4.12.4. Strategic initiatives

7.4.13. Sunrise Medical

7.4.13.1. Company overview

7.4.13.2. Financial performance

7.4.13.3. Product benchmarking

7.4.13.4. Strategic initiatives

7.4.14. GE Healthcare

7.4.14.1. Company overview

7.4.14.2. Financial performance

7.4.14.3. Product benchmarking

7.4.14.4. Strategic initiatives

7.4.15. F. Hoffmann-La Roche Ltd

7.4.15.1. Company overview

7.4.15.2. Financial performance

7.4.15.3. Product benchmarking

7.4.15.4. Strategic initiatives

7.4.16. Linde plc

7.4.16.1. Company overview

7.4.16.2. Financial performance

7.4.16.3. Product benchmarking

7.4.16.4. Strategic initiatives

7.4.17. Mediclinic Middle East

7.4.17.1. Company overview

7.4.17.2. Financial performance

7.4.17.3. Product benchmarking

7.4.17.4. Strategic initiatives

List of Tables

Table 1 List of abbreviations

Table 2 Middle East and Africa home healthcare market, by region, 2018 - 2030 (USD Million)

Table 3 Middle East and Africa home healthcare market, by component, 2018 - 2030 (USD Million)

Table 4 Middle East and Africa home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 5 South Africa home healthcare market, by component, 2018 - 2030 (USD Million)

Table 6 South Africa home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 7 Saudi Arabia home healthcare market, by component, 2018 - 2030 (USD Million)

Table 8 Saudi Arabia home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 9 Oman home healthcare market, by component, 2018 - 2030 (USD Million)

Table 10 Oman home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 11 Egypt home healthcare market, by component, 2018 - 2030 (USD Million)

Table 12 Egypt home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 13 UAE home healthcare market, by component, 2018 - 2030 (USD Million)

Table 14 UAE home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 15 Rest of Middle East and Africa Middle East and Africa home healthcare market, by component, 2018 - 2030 (USD Million)

Table 16 Rest of Middle East and Africa Middle East and Africa home healthcare market, by indication, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in Middle East and Africa

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Middle East and Africa home healthcare market: market outlook

Fig. 10 Middle East and Africa home healthcare competitive insights

Fig. 11 Parent market outlook

Fig. 12 Related/ancillary market outlook

Fig. 13 Penetration and growth prospect mapping

Fig. 14 Industry value chain analysis

Fig. 15 Middle East and Africa home healthcare market driver impact

Fig. 16 Middle East and Africa home healthcare market restraint impact

Fig. 17 Middle East and Africa home healthcare market strategic initiatives analysis

Fig. 18 Middle East and Africa home healthcare market: Component movement analysis

Fig. 19 Middle East and Africa home healthcare market: Component outlook and key takeaways

Fig. 20 Equipment market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 21 Therapeutic market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 22 Home respiratory equipment market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 23 Insulin delivery market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 24 Home iv pumps market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 25 Home dialysis equipment market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 26 Other therapeutic equipment market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 27 Diagnostic market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 28 Diabetic care unit market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 29 BP monitors market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 30 Multi para diagnostic monitors market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 31 Home pregnancy and fertility kits market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 32 Apnea and sleep monitors market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 33 Holter monitors market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 34 Heart rate meters (include pacemakers) market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 35 Other market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 36 Mobility assist market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 37 Wheel chair market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 38 Home medical furniture market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 39 Walking assist devices market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 40 Services market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 41 Skilled nursing services market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 42 Physician primary care market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 43 Nursing care market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 44 Physical/occupational/speech therapy market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 45 Nutritional support market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 46 Hospice & palliative market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 47 Other skilled nursing services market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 48 Unskilled nursing services market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 49 Middle East and Africa home healthcare market: Indication movement Analysis

Fig. 50 Middle East and Africa home healthcare market: Indication outlook and key takeaways

Fig. 51 Cardiovascular disorder & hypertension market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Diabetes & kidney disorders market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Neurological & mental disorders market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 Respiratory disease & COPD market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 Maternal disorders market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 Mobility disorders market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Cancer market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Wound care market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Others market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Middle East and Africa home healthcare: Regional movement analysis

Fig. 61 Middle East and Africa home healthcare: Regional outlook and key takeaways

Fig. 62 Middle East and Africa home healthcare market share and leading players

Fig. 63 Middle East and Africa SWOT

Fig. 64 South Africa

Fig. 65 South Africa market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 66 Saudi Arabia

Fig. 67 Saudi Arabia market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 68 Oman

Fig. 69 Oman market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 70 Egypt

Fig. 71 Egypt market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 72 UAE

Fig. 73 UAE market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 74 Rest of Middle East and Africa

Fig. 75 Rest of Middle East and Africa market estimates and forecasts, 2018 - 2030 (USD Million)