In-vitro diagnostics (IVD) refer to the clinical tests conducted on different bodily samples, such as urine, tissue and blood, to detect diseases and infections. These tests are also employed to monitor the health conditions of patients undergoing different treatments and the effectiveness of therapeutic procedures. Various devices can be used individually or in combination with each other for in-vitro diagnosis, including specimen receptacles, calibrators, reagents and control materials. In the GCC countries, IVD devices have gained traction on account of the aging population, the expanding healthcare sector and the establishment of standalone centers, independent diagnostics chains and academic institutes.

The easy access to better diagnostics and healthcare facilities represents the primary factor impelling the growth of the market in the GCC region. This is facilitated by the increasing insurance penetration rate under the Mandatory Health Insurance (MHI) schemes in the GCC countries. Besides this, a large portion of the deaths in the GCC countries is caused due to chronic diseases that are generally associated with lifestyle factors, including tobacco consumption, unhealthy diets and sedentary schedules. Consequently, the growing health consciousness among consumers has led to a significant rise in the number of people seeking diagnostic services at regular intervals to avoid these conditions.

Additionally, individuals have increased their medical health spending due to inflating disposable incomes, which has further influenced the market growth. Moreover, the governments of several GCC countries have developed various health awareness programs and strategies. They have also shifted their focus toward promoting specialized care and services and are increasing investments in the purchase of devices used in medical examinations. Other factors, such as the rising number of expatriates and growing investments in healthcare infrastructure, are further driving the market growth.

Key Market Segmentation

This report provides an analysis of the key trends in each sub-segment of the GCC in-vitro diagnostic devices market report, along with forecasts at the regional and country level from 2024-2032. The report has categorized the market based on end-user and application.Breakup by End-user:

- Hospital-Based Centers

- Diagnostics Chains

- Standalone Centers

- Others

Breakup by Application:

- Infectious Diseases

- Diabetes

- Blood Test

- Nephrology

- Cardiology

- Oncology

- Autoimmune Diseases

- Others

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Kuwait

- Qatar

- Oman

- Bahrain

Competitive Landscape

The competitive landscape of the market has been examined in the report with the detailed profiles of the key players operating in the industry.Key Questions Answered in This Report

- How has the GCC in-vitro diagnostic devices market performed so far and how will it perform in the coming years?

- What are the key regions in the market?

- What has been the impact of COVID-19 on the GCC in-vitro diagnostic devices market?

- What are the various application segments in the market?

- What are the major end-use sectors in the market?

- What are the various stages in the value chain of the market?

- What are the key driving factors and challenges in the market?

- What is the structure of the GCC in-vitro diagnostic devices market and who are the key players?

- What is the degree of competition in the market?

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | April 2024 |

| Forecast Period | 2023 - 2032 |

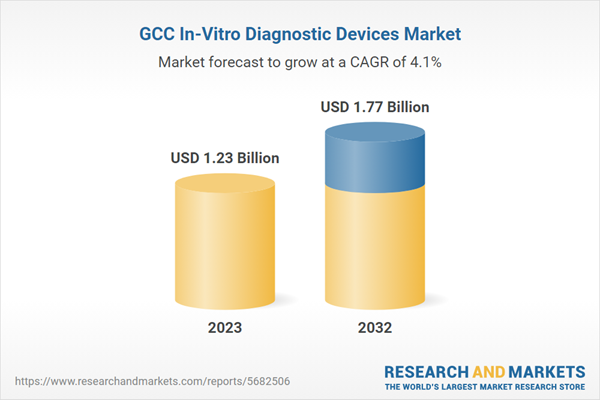

| Estimated Market Value ( USD | $ 1.23 Billion |

| Forecasted Market Value ( USD | $ 1.77 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Middle East |