Integration of Machine Learning and Artificial Intelligence in Screening Fuels the Middle East & Africa Newborn Screening Market

According to a study published in The Lancet Digital Health in April 2023, a new deep-learning artificial intelligence model can help screen newborns for the retinopathy of prematureness. With the increasing availability of genetic and clinical data, machine learning algorithms have the potential to improve the accuracy and efficiency of screening processes. These algorithms can analyze vast datasets, identifying subtle patterns and associations that traditional methods may miss. By integrating machine learning into newborn screening, healthcare providers can improve the early detection of genetic disorders, leading to more timely interventions and better outcomes for infants.As machine learning models evolve and adapt, they can contribute to the ongoing refinement and personalization of newborn screening protocols. This innovation not only benefits the health of newborns but also presents a significant growth opportunity for companies working on solutions that intersect healthcare and artificial intelligence. Additionally, machine learning can further enhance newborn screening programs by decreasing the false positive rate, raising specificity and positive predictive value, and spotting previously unidentified metabolic patterns in data. Thus, artificial intelligence and machine learning-based newborn screening are poised to become a prominent future trend in the newborn screening market.

Middle East & Africa Newborn Screening Market Overview

The newborn screening market in the Middle East & Africa is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of the Middle East & Africa. Countries such as Saudi Arabia, Qatar, and Lebanon have become regional and international pioneers in newborn screening applications, implementing tandem mass spectrometry (the Kingdom of Saudi Arabia), homocystinuria and TREC-KREK screening (Qatar), G6PD screening (Lebanon), and other advanced testing techniques. In Saudi Arabia, the newborn hearing screening (NHS) program was officially initiated in 2016 across some hospitals; in total, the program was adopted by 147 hospitals as of 2021. According to a study titled "Loss to follow-up in a newborn hearing screening program in Saudi Arabia," published in September 2023, included all newborns delivered at a tertiary hospital-based NHS program between June 2020 and February 2022. ~2,312 newborns (indicating 96% of the delivered newborns) were screened. The neonatal screening programs in the country are responsible for screening and diagnosing certain disorders to ensure the long-term management of infants' health. The expanded newborn screening for early treatment and diagnosis of the concerned disease and disorder helps prevent serious health consequences in infants. Newborn screening programs in Saudi Arabia are well-coordinated and comprehensive systems, encompassing screening, diagnosis, treatment, management, and follow-ups.Birth defects are a major concern as they can result in permanent disability and death in infants. According to the study "Prevalence and Pattern of Birth Defects in Saudi Arabia: A Systematic Review of Observational Studies," published in July 2023, birth defects remain the leading cause of death among children in Saudi Arabia, and the prevalence of these defects in the country ranged from 8.6/1,000 to 46.45/1,000. As per data by Cortex Digital Marketing LLC, ~970 children are born every year with congenital heart disease in the UAE, which is the leading cause of infant mortality associated with birth defects.

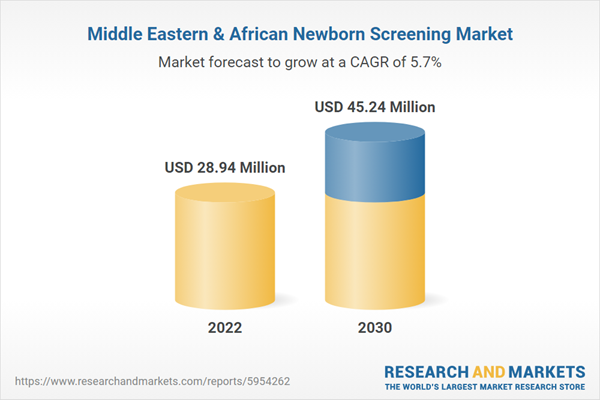

Middl

e East & Africa Newborn Screening Market Revenue and Forecast to 2030 (US$ Million)

Middle East & Africa Newborn Screening Market Segmentation

The Middle East & Africa newborn screening market is segmented based on product type, technology, test type, end user, and country.Based on product type, the Middle East & Africa newborn screening market is bifurcated into reagents and assay kits, and instruments. The reagents and assay kits segment held a larger Middle East & Africa newborn screening market share in 2022. The reagents and assay kits segment is subsegmented into DNA-based assays, and immunoassays and enzymatic assays. Instruments segment is subsegmented into newborn disorder screening instruments, pulse oximeters, newborn hearing screening instruments, and other instruments.

In terms of technology, the Middle East & Africa newborn screening market is categorized into tandem mass spectrometry (TMS), molecular assays, immunoassays and enzymatic assay, pulse oximetry screening technology, and other technologies. The pulse oximetry screening technology segment held the largest Middle East & Africa newborn screening market share in 2022.

Based on test type, the Middle East & Africa newborn screening market is categorized into dry blood spot test, hearing screen test, critical congenital heart diseases (CCHD) test, and other test types. The dry blood spot test segment held the largest Middle East & Africa newborn screening market share in 2022.

By end user, the Middle East & Africa newborn screening market is segmented into hospitals and clinics and diagnostic laboratories. The hospitals and clinics segment held a larger Middle East & Africa newborn screening market share in 2022.

Based on country, the Middle East & Africa newborn screening market is categorized into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa newborn screening market in 2022.

Bio-Rad Laboratories Inc, Masimo Corp, Medtronic Plc, PerkinElmer Inc, and Waters Corp are some of the leading companies operating in the Middle East & Africa newborn screening market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa newborn screening market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa newborn screening market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the newborn screening market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories Inc

- Masimo Corp

- Medtronic Plc

- PerkinElmer Inc

- Waters Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | February 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 28.94 Million |

| Forecasted Market Value ( USD | $ 45.24 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 5 |