Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Reinforcing bars, or rebar as they are more often known, are steel bars that are used in reinforced concrete and reinforced masonry projects as tension devices to support and strengthen the concrete under tension. When it is massed, it is also referred to as reinforcement steel or reinforcing steel. Although, it has a weak tensile strength, concrete has a good compressive strength. Rebar significantly increases the tensile strength of the building. To enhance concrete bonding and reduce the risk of slippage, rebar is covered in a continuous pattern of ribs, lugs, or indentations.

Growing Rapid Urbanization Resulted in Government Initiatives to Develop Infrastructure Likely to Boost Demand for Steel Rebar

The reports claims that the main factors driving the Middle Eastern steel rebar market are the region's growing urbanization, increasing investment in infrastructure development, and the expansion of the manufacturing sector, particularly in nations such as Saudi Arabia and the United Arab Emirates. Saudi Arabia, for instance, has allocated more than USD 40.0 billion for construction activity.

Value Added Steel Rebar Products are Trending in Middle East Marketplace

The study of the Middle East Steel Rebar Market indicates that value-added steel rebar products are the latest market trends. Steel rebar grades and product utilization saw a significant transformation in recent years. For instance, the region's building sector has begun to accept newer grades including Fe500, Fe550, and Fe500D. The use of sophisticated value-added rebar goods such as corrosion-resistant steel rebar, epoxy coated rebar, and earthquake-resistant steel rebar has also increased.Infrastructure Development

Middle East has started a trillion-dollar pipeline of infrastructure projects to diversify its economy away from oil. The Middle East aspires to become a significant global hub for investment and logistics, and Saudi Arabia is the largest country by infrastructure, as stated in its Vision 2030. With strategically located giant projects all around the country, the development program has opened doors in a number of brand-new industries, such as clean energy, tourism, and smart cities. The Economic Cities Authority, on the other hand, was set up to rekindle investor interest in earlier economic city efforts in the Kingdom that sought to address specific socioeconomic issues such as the shortage of affordable housing and efficient transportation, among others. This transformation presents a wide range of opportunities. Massive public and private sector projects funded by the Public Investment Fund, the royal commissions in charge of the major urban areas, the appropriate ministries, and the private sector are driving a substantial number of initiatives and opportunities and the KSA market has made a remarkable comeback after the COVID-19 pandemic, and there are currently projects worth more than USD 1.70 trillion in the planning stages.Rising Urbanization in the Country Driving Market Growth

The World Bank invests an average of USD 5 billion year in planning and carrying out financing programs on sustainable cities and communities in order to assist cities in meeting the essential needs of urbanization. The active portfolio now consists of 231 projects with a combined value of USD 33.9 billion that are financed through a number of different methods, including investment project financing, loans for policy development, and program-for-results funding. In the Middle East, 84.51% of the population, or about the same as the year before, resided in urban areas in 2021. The share's peak value over the time period under consideration was in 2021. The urbanization rate of a country is the proportion of the total population that lives in an urban region. International comparisons of urbanization rates may be inaccurate due to variations in the definitions of what makes an urban center (based on population size, area, or space between dwellings, among others).Market Segmentation

The Middle East Rebar Steel Market is divided on the basis of type, end use, process, finishing type, and country. Based on type, the market is further bifurcated into deformed and mild. Based on end use, the market is segmented into residential, commercial, industrial, and Public. On the basis of process, the market is divided into basic oxygen steelmaking and electric arc furnace. Based on finishing type, the market is further divided into carbon steel rebar, epoxy-coated rebar and others.Market Players

Major market players in the Middle East Rebar Steel Market are Star Steel International LLC, Emirates Rebar Limited, Union Iron and Steel, Conares, Hamriyah Steel, Emirates Steel, Rajhi Steel Industries Co. Ltd., Watania Steel Factory Corp., Al-Rashed Steel, and United Steel Industrial Co.Report Scope

In this report, the Middle East Rebar Steel Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Middle East Rebar Steel Market, by Type:

- Deformed

- Mild

Middle East Rebar Steel Market, by End Use:

- Residential

- Commercial

- Industrial

- Public

Middle East Rebar Steel Market, by Process:

- Basic Oxygen Steelmaking

- Electric Arc Furnace

Middle East Rebar Steel Market, by Finishing Type:

- Carbon Steel Rebar

- Epoxy-Coated Rebar

- Others

Middle East Rebar Steel Market, by Country:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Bahrain

- Rest of Middle East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East Rebar Steel Market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Star Steel International LLC

- Emirates Rebar Limited

- Union Iron and Steel

- Conares

- Hamriyah Steel

- Emirates Steel

- Rajhi Steel Industries Company Ltd.

- Watania Steel Factory Corp.

- Al-Rashed Steel

- United Steel Industrial Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | September 2023 |

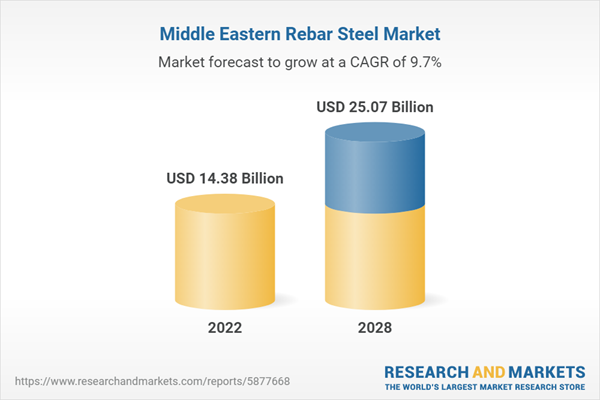

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 14.38 Billion |

| Forecasted Market Value ( USD | $ 25.07 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 10 |