Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Seismic surveys can be conducted both onshore and offshore and are categorized as 2D, 3D, or 4D based on the complexity and depth of data captured. They are essential in the early stages of oil and gas exploration and also play a critical role in earthquake risk assessment, infrastructure planning, and geoscientific research. This non-invasive method offers a safer and more efficient alternative to extensive drilling.

Key Market Drivers

Technological Advancements in Seismic Surveying

Technological innovation is a key growth driver in the Middle East seismic survey market. Over the past decade, the industry has seen substantial advancements in data acquisition, processing, and interpretation. High-resolution 3D and 4D seismic imaging, along with technologies such as Full Waveform Inversion (FWI) and AI-driven analytics, have significantly enhanced the ability to visualize complex subsurface structures.Given the maturity of many oil and gas fields in the Middle East, there is a growing need for improved reservoir imaging to support enhanced recovery methods. Advanced seismic technologies are instrumental in identifying bypassed reserves, monitoring fluid movements, and optimizing well placement, all of which contribute to increased operational efficiency and reduced costs.

The adoption of cloud computing, machine learning, and advanced algorithms has expedited data analysis, enabling faster and more informed decision-making. These innovations are particularly appealing to national and international oil companies aiming to reduce exploration risk and maximize returns.

Furthermore, the development of ocean-bottom node (OBN) systems and wireless seismic acquisition technologies has enabled data collection in challenging environments, including urban areas and complex offshore terrains. As these solutions become more cost-effective and accessible, demand for technologically sophisticated seismic surveys in the region is expected to rise significantly.

Key Market Challenges

Environmental and Geopolitical Constraints

The seismic survey market in the Middle East faces significant challenges due to harsh environmental conditions and ongoing geopolitical tensions. The region's extreme climate - including high temperatures, arid deserts, and rugged landscapes - complicates onshore operations, particularly in remote areas. Equipment performance can be adversely affected, while safety regulations may limit working hours due to heat-related risks.Marine surveys in areas such as the Arabian Gulf and the Red Sea encounter additional difficulties, including high salinity, variable seabed topography, and rough sea conditions. These factors can impair sensor accuracy, lower data quality, and drive up operational costs.

Moreover, geopolitical instability in certain parts of the Middle East adds another layer of complexity. Political unrest, border disputes, and security risks in countries like Iraq, Syria, and Yemen can lead to delays or suspension of projects. Companies may need to allocate resources for private security or risk mitigation strategies, increasing overall expenditures. Sanctions and trade restrictions in nations such as Iran can also limit access to advanced seismic technologies and hinder partnerships with international service providers. These issues not only impede market growth but also reduce foreign investment in exploration efforts.

Key Market Trends

Adoption of High-Resolution 3D and 4D Seismic Technologies

A notable trend in the Middle East seismic survey market is the increasing adoption of high-resolution 3D and 4D seismic technologies. While 2D surveys have historically been sufficient for initial exploration, evolving geological complexities and the demand for higher imaging accuracy have prompted a shift toward more detailed approaches.3D seismic surveys provide a three-dimensional view of the subsurface, enabling more accurate identification of hydrocarbon reserves and minimizing the risk of non-productive wells. These capabilities are particularly valuable in mature oil fields, where advanced imaging is crucial for locating residual reserves and planning secondary recovery strategies. 4D seismic surveys - also referred to as time-lapse seismic - offer insights into reservoir dynamics over time, such as tracking fluid movements during production.

Major national oil companies, including Saudi Aramco and ADNOC, are investing in these technologies to optimize resource extraction and enhance operational efficiency. Complementing these advances are improvements in data processing, including the integration of AI and machine learning tools. These technologies enable rapid, accurate interpretation of large datasets and support real-time decision-making across exploration and production activities.

Key Market Players

- Schlumberger Limited

- Halliburton Company

- Fugro Group

- SAExploration

- Seabird Exploration

- TechnipFMC

- Dolphin Geophysical

- ION Geophysical Corporation

Report Scope:

In this report, the Middle East Seismic Survey Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Middle East Seismic Survey Market, By Technology:

- 2D imaging

- 3D imaging

- 4D imaging

Middle East Seismic Survey Market, By Service:

- Data Acquisition

- Data Processing

- Data Interpretation

Middle East Seismic Survey Market, By Type:

- Reflection

- Refraction

- Surface-Wave

Middle East Seismic Survey Market, By Deployment:

- Offshore

- Onshore

Middle East Seismic Survey Market, By Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

- Israel

- Rest of Middle East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East Seismic Survey Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited

- Halliburton Company

- Fugro Group

- SAExploration

- Seabird Exploration

- TechnipFMC

- Dolphin Geophysical

- ION Geophysical Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | April 2025 |

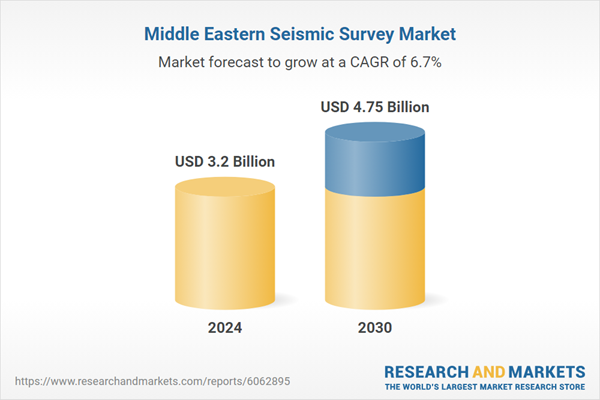

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 4.75 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 8 |