Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The youth demographic in the MEA region, consisting largely of millennials and Generation Z, has been a major catalyst for the growth of video streaming services. These generations are digitally native, accustomed to the convenience of accessing content on their terms, and often prioritize online streaming over traditional television. To cater to this demand, streaming platforms have curated extensive libraries of content, spanning from Hollywood blockbusters and international TV series to localized content that reflects the region's rich cultural diversity. Furthermore, the COVID-19 pandemic accelerated the adoption of video streaming in the MEA region. Lockdowns and social distancing measures led to a surge in demand for entertainment within the confines of people's homes. This resulted in a considerable uptick in subscribers for streaming platforms, leading to unprecedented growth and market expansion. Streaming providers also responded by diversifying their content portfolios and investing in original productions to keep viewers engaged.

The MEA video streaming market is characterized by a blend of global giants and regional players. While international heavyweights like Netflix, Amazon Prime Video, and Disney+ have a significant presence in the region, local platforms such as Shahid, Icflix, and StarzPlay have carved out niches by offering content tailored to regional tastes and preferences. To stay competitive, many streaming platforms are investing not only in content acquisition but also in technology and user experience improvements. This includes the development of adaptive streaming algorithms, advanced recommendation systems, and user-friendly interfaces that enhance viewer engagement and satisfaction. Despite the remarkable growth and opportunities in the MEA video streaming software market, several challenges persist. Piracy remains a major concern, with illegal streaming websites and platforms siphoning off viewers and revenue from legitimate providers. This issue calls for concerted efforts from industry stakeholders, governments, and law enforcement agencies to combat piracy effectively. Additionally, payment options in some parts of the region remain limited, hindering the monetization potential of streaming services. Providers are addressing this by diversifying payment methods, including mobile payment solutions, prepaid cards, and partnerships with local financial institutions.

Moreover, the infrastructure for internet connectivity varies significantly across MEA countries. While some urban areas enjoy high-speed broadband connections, rural and remote regions often face challenges in accessing reliable internet services. Bridging this digital divide is crucial for ensuring equitable access to streaming content across the region. Streaming platforms are working with telecommunications companies and governments to expand broadband infrastructure and improve internet accessibility, even in underserved areas.

In conclusion, the Middle East and Africa video streaming software market represent a dynamic and rapidly expanding sector within the global digital entertainment landscape. Fueled by a youthful population, increasing digitalization efforts, and improved internet access, the MEA region is ripe with opportunities for both global and regional streaming providers. Despite challenges such as piracy and varying internet infrastructure, the market's potential for growth remains immense. As streaming platforms continue to innovate and adapt to local preferences, the MEA video streaming market is poised for continued expansion in the coming years, providing diverse and engaging content to audiences across the region.

Key Market Drivers

Rapid Expansion of Internet Infrastructure

The Middle East and Africa (MEA) region has witnessed a significant expansion in internet infrastructure in recent years, serving as a key driver for the video streaming software market's growth. The proliferation of high-speed broadband networks and the deployment of 4G and 5G mobile networks have played a pivotal role in enabling seamless video streaming experiences for consumers across the region. This increased connectivity has empowered individuals to access video content on a variety of devices, from smartphones and tablets to smart TVs and desktop computers, driving up demand for video streaming services. Governments and telecommunications companies have recognized the importance of robust internet infrastructure for economic development and are actively investing in network expansion and upgrades. Initiatives to connect underserved rural areas with broadband internet have been launched, reducing the digital divide and expanding the potential customer base for video streaming providers. As internet access continues to grow across the MEA region, it is expected to catalyze further market expansion, presenting opportunities for both local and global video streaming companies to tap into this burgeoning user base.Youthful Demographic Profile and Digital Natives

The MEA region boasts a youthful demographic profile, with a significant proportion of its population falling within the millennial and Generation Z age groups. This digitally native population is accustomed to consuming content online and has a strong preference for on-demand video streaming services over traditional television. Their familiarity with digital platforms and devices, such as smartphones and smart TVs, has driven the adoption of video streaming services at an accelerated pace. This younger demographic is also more open to experimenting with different content genres, languages, and cultures. Streaming platforms have responded by curating diverse content libraries that cater to the varied tastes and preferences of this audience. From Hollywood blockbusters to regional dramas and international TV series, video streaming services are capitalizing on the demand for content diversity, resulting in increased subscriptions and viewership.Furthermore, the pandemic has reinforced the importance of digital entertainment in the lives of MEA's youth. Lockdowns and social distancing measures led to a surge in demand for online entertainment, with streaming platforms offering a convenient escape from the challenges posed by the global health crisis. This trend has further solidified the role of video streaming services in the region's entertainment landscape.

Content Localization and Regionalization

Content localization and regionalization have become integral strategies for video streaming providers looking to succeed in the diverse MEA market. Recognizing the importance of tailoring content to local tastes, languages, and cultural nuances, streaming platforms have invested heavily in acquiring and producing region-specific content. This approach not only enhances the appeal of their services but also strengthens their competitive position in the market. Local content production has gained momentum, with platforms partnering with regional talent, filmmakers, and production houses to create original content that resonates with MEA audiences. This has led to the emergence of a vibrant ecosystem of regional content creators and storytellers who are producing content that reflects the region's unique culture and experiences. Additionally, streaming platforms are actively securing licensing agreements for popular Arabic, African, and Turkish content, further enriching their content libraries. By offering a mix of international blockbusters and locally relevant content, video streaming services are attracting a wider audience base, driving up subscriptions and viewer engagement.Digital Transformation and Government Initiatives

Digital transformation efforts across the MEA region, both in the public and private sectors, have created an enabling environment for the video streaming software market. Governments in various MEA countries have recognized the economic potential of the digital economy and are implementing policies and initiatives to facilitate its growth. This includes reforms in telecommunications regulations, efforts to improve the ease of doing business, and investments in digital infrastructure. Additionally, governments are promoting the development of local content creation and technology innovation, providing incentives and support to startups and entrepreneurs in the digital entertainment space. This encourages the growth of local video streaming platforms and services, fostering healthy competition in the market. As businesses and consumers increasingly embrace digital technologies, the demand for video streaming services as a form of entertainment, education, and communication is expected to continue growing. The convergence of digital transformation and government initiatives positions the MEA video streaming software market for sustained expansion, with opportunities for innovation, investment, and partnerships across the region.Key Market Challenges

Piracy and Content Protection

One of the most significant challenges facing the Middle East and Africa (MEA) video streaming software market is the rampant issue of piracy and content protection. The MEA region has long struggled with copyright infringement and illegal distribution of copyrighted content, posing a substantial threat to the revenue streams and sustainability of legitimate streaming platforms. Piracy takes various forms in the MEA region, including illegal streaming websites, torrenting, and unauthorized sharing of content on social media and messaging apps. These platforms offer free access to a wide range of copyrighted material, from movies and TV shows to sports events and music albums. As a result, many consumers are tempted by the allure of free content, which undercuts the business models of legitimate streaming providers.The challenges posed by piracy are multifaceted. First, it results in significant revenue losses for streaming platforms and content creators, limiting their ability to invest in high-quality, original content and technology improvements. Second, piracy undermines the viability of legal streaming services, making it difficult for them to compete on a level playing field. This situation can stifle innovation and discourage new entrants from investing in the MEA market. Addressing piracy in the MEA region requires a concerted effort from governments, law enforcement agencies, and the industry itself. Streamlining copyright enforcement, implementing stricter anti-piracy measures, and collaborating with internet service providers to block illegal streaming websites are some potential solutions. Additionally, educating consumers about the consequences of piracy and promoting the benefits of legal streaming can play a crucial role in changing behaviors. However, overcoming the deeply entrenched culture of piracy in some MEA countries remains a substantial challenge.

Diverse Payment Ecosystem and Limited Financial Inclusion

Another significant challenge facing the Middle East and Africa video streaming software market is the diverse payment ecosystem and limited financial inclusion in certain parts of the region. While consumers in more developed MEA countries have access to various payment options, including credit cards, debit cards, and digital wallets, a significant portion of the population relies on cash-based transactions or lacks access to formal banking services. This diversity in payment methods creates hurdles for streaming platforms seeking to monetize their services effectively. Subscriptions to streaming services often require electronic payments, which can be a barrier for potential subscribers who do not have access to traditional banking or digital payment solutions. Even when such services are available, they may not be widely adopted or trusted, particularly in rural and underserved areas.To address this challenge, streaming platforms are diversifying their payment options to cater to the unique needs of different MEA markets. This includes partnerships with mobile network operators to enable carrier billing, offering prepaid cards that can be purchased with cash, and exploring alternative payment solutions such as mobile money and blockchain-based payments. However, navigating the complex payment landscape in the MEA region requires a deep understanding of local preferences and behaviors. It also demands significant investment in building partnerships with financial institutions, mobile network operators, and local payment providers. Streamlining the payment process for users who may not have access to traditional banking services or credit cards is crucial for expanding the reach of video streaming services in the MEA region.

Key Market Trends

Growth of Local Content Production and Regionalization

One prominent trend shaping the Middle East and Africa (MEA) video streaming software market is the rapid growth of local content production and regionalization efforts by streaming platforms. As the competition intensifies in this dynamic market, providers are increasingly recognizing the importance of tailoring their content libraries to cater to the diverse tastes and cultural preferences of MEA audiences. To achieve this, streaming platforms are not only investing in acquiring licensing rights for popular international content but are also heavily focusing on creating original, region-specific content. By collaborating with local filmmakers, production houses, and talent, these platforms are producing a wide range of content, including movies, TV series, and documentaries that reflect the region's unique cultural, linguistic, and social landscapes.This trend has multiple benefits. Firstly, it allows streaming platforms to differentiate themselves from their competitors by offering exclusive, locally relevant content that resonates with viewers. Secondly, it helps in building stronger connections with the local audience, enhancing brand loyalty and subscriber retention. Thirdly, it contributes to the growth of the local media and entertainment industries, creating job opportunities and fostering creative talent in the region. Furthermore, the regionalization trend extends to language support and user interfaces. Streaming platforms are increasingly providing content in multiple languages, including Arabic, Turkish, and various African languages, to cater to a broader audience. Additionally, user interfaces are being localized to ensure a seamless and culturally sensitive experience for viewers. As this trend continues to gain momentum, it is expected to drive further subscriber growth and engagement in the MEA video streaming software market.

Sports Streaming and Exclusive Rights

Sports streaming is emerging as a significant trend in the Middle East and Africa video streaming software market, driven by the region's passion for sports and the growing demand for live sports content. Sports events, such as football (soccer), cricket, and basketball, enjoy immense popularity in MEA countries, and streaming platforms are capitalizing on this enthusiasm by securing exclusive broadcasting rights and offering dedicated sports packages. One of the key drivers of this trend is the changing media consumption habits of sports fans. Increasingly, viewers are opting for streaming services to watch live sports events on their preferred devices, allowing them to follow their favorite teams and athletes in real-time, regardless of their location. This shift from traditional television to digital sports streaming is transforming how sports content is delivered and consumed across the MEA region.Streaming platforms are actively pursuing partnerships with sports leagues, clubs, and organizations to secure exclusive rights to broadcast matches, tournaments, and other sports-related content. This not only enhances the value proposition of their services but also drives subscriptions, particularly among sports enthusiasts. Moreover, sports streaming platforms are investing in features that enhance the viewing experience, such as interactive and immersive options like multi-angle views, real-time statistics, and personalized highlights. These innovations aim to provide viewers with a more engaging and interactive sports-watching experience.

Hybrid Models and Bundling

Hybrid business models and content bundling have emerged as notable trends in the Middle East and Africa video streaming software market. Providers are exploring innovative ways to monetize their services and attract a broader customer base by offering a combination of subscription-based and ad-supported content. Many streaming platforms in the MEA region have adopted a freemium model, where users can access a limited selection of content for free with advertisements while offering premium, ad-free subscriptions for access to the full content library. This approach not only caters to cost-conscious viewers but also generates advertising revenue, diversifying income streams for streaming platforms.Furthermore, content bundling has gained popularity as a strategy to attract and retain subscribers. Streaming providers are forming partnerships and alliances with telecommunications companies, internet service providers, and pay-TV operators to bundle their services with other offerings. For example, a telecom company might offer a package that includes high-speed internet access, mobile data, and a subscription to a streaming platform as part of a single package, providing added value to customers. These hybrid models and bundling strategies offer several advantages. They can help streaming platforms acquire a large user base quickly, enhance customer retention, and generate additional revenue streams. Moreover, they create win-win scenarios for both streaming providers and their partners, such as telecom companies, by cross-promoting services and increasing customer loyalty.

Segmental Insights

Solutions Insights

Based on solutions, the video analytics segment asserted its dominance in the Middle East & Africa video streaming software market, and this dominance is anticipated to endure throughout the forecast period. The ascendancy of video analytics within the market can be attributed to its pivotal role in enhancing the overall streaming experience for both providers and viewers. Video analytics solutions empower streaming platforms to gain valuable insights into user behavior, content engagement, and quality of service, enabling them to optimize their offerings and content recommendations. Moreover, these solutions play a critical role in content moderation, ensuring that inappropriate or copyrighted material is promptly identified and removed, thus safeguarding the platform's reputation and legality. As streaming platforms in the MEA region continue to grow and diversify their content libraries, the demand for robust video analytics solutions will remain high, further solidifying their dominance in the market and contributing to the continued evolution of the video streaming landscape in the region.End User Insights

Based on end user, the healthcare emerged as the dominant segment in the Middle East & Africa video streaming software market, and this dominance is projected to persist throughout the forecast period. The healthcare industry in the MEA region has witnessed a significant transformation, driven by the growing need for remote healthcare services, telemedicine, and medical education. Video streaming software has played a pivotal role in enabling healthcare providers to connect with patients, conduct virtual consultations, and deliver medical training and educational content. Particularly, the COVID-19 pandemic accelerated the adoption of telehealth solutions, making video streaming an indispensable tool for healthcare professionals. Moreover, healthcare providers recognize the potential of video streaming for enhancing patient engagement and health awareness. Live streaming of medical events, surgeries, and health-related webinars has become increasingly popular, fostering better communication between healthcare institutions and their communities. As the healthcare sector in the MEA region continues to embrace digital transformation, the demand for secure, reliable, and high-quality video streaming software remains robust. This enduring dominance of healthcare as an end-user segment underscores the vital role that video streaming technology plays in advancing healthcare services and patient care in the Middle East and Africa.Country Insights

United Arab Emirates asserted its dominance in the Middle East & Africa video streaming software market, and this dominance is anticipated to persist throughout the forecast period. The UAE's position at the forefront of the market can be attributed to several key factors. Firstly, the country boasts a highly developed digital infrastructure, including advanced internet connectivity and mobile networks, which facilitates seamless streaming experiences. Secondly, the UAE has positioned itself as a regional hub for media and entertainment, attracting international streaming giants and fostering the growth of local streaming platforms. This convergence of global and local players has created a thriving ecosystem of streaming services, leading to increased competition and innovation. Lastly, the UAE's affluent population, with a strong appetite for premium content and cutting-edge technology, has driven the demand for video streaming services. As the UAE continues to invest in its digital infrastructure and cultivate its status as a regional media hub, its dominance in the video streaming software market is poised to remain unchallenged in the Middle East & Africa region.Report Scope:

In this report, the Middle East & Africa Video Streaming Software Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Middle East & Africa Video Streaming Software Market, By Component:

- Solutions

- Transcoding & Processing

- Video Delivery & Distribution

- Video Analytics

- Video Management

- Video Security

- Other

- Services

- Professional

- Managed

Middle East & Africa Video Streaming Software Market, By Streaming Type:

- Video On-demand Streaming

- Live Streaming

Middle East & Africa Video Streaming Software Market, By Deployment Type:

- On-Premise

- Cloud

Middle East & Africa Video Streaming Software Market, By End User:

- Broadcaster, Operators & Media

- Enterprises

- Education

- Healthcare

- Others

Middle East & Africa Video Streaming Software Market, By Country:

- United Arab Emirates

- Saudi Arabia

- South Africa

- Turkey

- Israel

- Qatar

- Nigeria

- Morocco

- Egypt

- Kenya

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East & Africa Video Streaming Software Market.Available Customizations:

Middle East & Africa Video Streaming Software Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Brightcove Inc.

- IBM Middle East and Africa FZ LLC

- Kaltura EMEA Limited

- Vbrick Inc.

- Wowza Media Systems, LLC

- Kollective Technology, Inc.

- Cloudinary Technologies Inc.

- Dacast MENA FZ-LLC.

- OBS Studio

- Microsoft Corporation EMEA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | November 2023 |

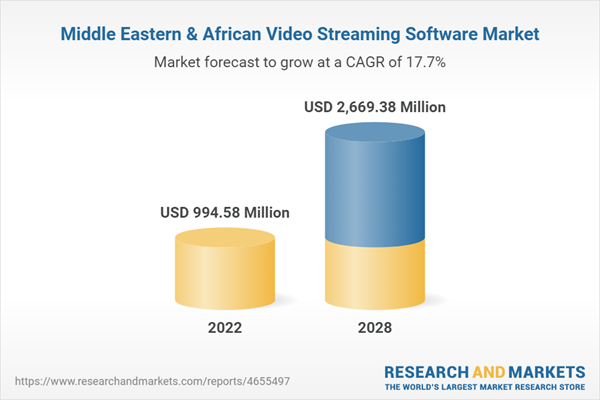

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 994.58 Million |

| Forecasted Market Value ( USD | $ 2669.38 Million |

| Compound Annual Growth Rate | 17.7% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |