Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Smartphone sensors include but are not limited to accelerometers, gyroscopes, magnetometers, proximity sensors, ambient light sensors, fingerprint sensors, GPS modules, barometers, and a variety of environmental sensors. These components are critical for features like orientation detection, motion sensing, augmented reality applications, location-based services, biometric security, and more.

The Smartphone Sensors market is characterized by continuous innovation, driven by consumer demand for more advanced and sophisticated features in their mobile devices. Manufacturers, both of sensors and smartphones, are engaged in fierce competition to develop cutting-edge sensor technologies that enhance user experiences. These sensors also play a crucial role in emerging technologies such as augmented reality, virtual reality, and the Internet of Things. As the market continues to evolve, it presents challenges and opportunities for industry stakeholders, impacting product design, pricing, and overall competitiveness in the global smartphone ecosystem.

Key Market Drivers

Increasing Consumer Demand for Advanced Features

The global Smartphone Sensors market is being driven by the ever-increasing consumer demand for smartphones with advanced features and capabilities. As consumers become more tech-savvy and reliant on their mobile devices for various aspects of their daily lives, they seek smartphones that can provide an enhanced user experience. To meet these demands, smartphone manufacturers are integrating a wide array of sensors into their devices.Consumers now expect features such as facial recognition, fingerprint scanning, augmented reality, and sophisticated photography capabilities. These features rely heavily on various sensors like cameras, fingerprint sensors, accelerometers, and gyroscopes. Consequently, the demand for smartphones with advanced sensor technology is growing, and this trend is propelling the global Smartphone Sensors market forward.

Technological Advancements

Continuous technological advancements play a pivotal role in driving the global Smartphone Sensors market. Smartphone sensors are becoming increasingly sophisticated, allowing for improved performance and enabling new applications. Innovations in sensor technology include the development of smaller, more power-efficient sensors, as well as sensors with higher resolution and accuracy.Advancements in image sensors have led to the proliferation of high-quality smartphone cameras, which, in turn, have driven consumer demand. Additionally, the integration of new types of sensors, such as LiDAR for improved depth sensing and environmental awareness, is expanding the capabilities of smartphones. These innovations drive smartphone manufacturers to upgrade their devices, ensuring that they remain competitive in the market.

Internet of Things (IoT) Integration

The global rise of the Internet of Things (IoT) is another significant driver of the Smartphone Sensors market. IoT involves the interconnection of devices and objects via the internet, and smartphones often serve as the central hub for managing and controlling these connected devices. As IoT applications expand, smartphones are increasingly equipped with a range of sensors, such as proximity sensors and environmental sensors, to facilitate communication with other smart devices like thermostats, security systems, and wearables.Consumers want the convenience of controlling their smart homes, cars, and other IoT devices from their smartphones. This, in turn, drives the demand for smartphones with a diverse set of sensors that can seamlessly connect and interact with the IoT ecosystem.

Augmented and Virtual Reality (AR/VR)

The growing interest in augmented and virtual reality experiences is fueling the demand for advanced sensors in smartphones. AR and VR applications rely heavily on sensors like accelerometers, gyroscopes, and magnetometers to provide immersive experiences. Whether it's for gaming, educational purposes, or virtual tours, users expect their smartphones to deliver high-quality AR and VR experiences.In response to this demand, smartphone manufacturers are enhancing their sensor capabilities to support these technologies effectively. The integration of more precise motion sensors and the development of specialized sensors, like depth sensors and eye-tracking sensors, are contributing to the growth of the AR/VR segment in the global Smartphone Sensors market.

Wearable Device Integration

The integration of smartphone sensors with wearable devices is driving the global Smartphone Sensors market. Wearables like smartwatches, fitness trackers, and smart glasses often rely on smartphone connectivity to provide users with a seamless and holistic experience. These devices require sensors that can monitor physical activity, track health metrics, and communicate with smartphones to display data or notifications.As the popularity of wearables continues to grow, smartphone manufacturers are aligning their devices with the capabilities and requirements of these accessories. This integration drives the demand for smartphones with a diverse set of sensors that can enhance the functionality of wearables and create a more comprehensive user experience.

Environmental and Safety Concerns

Environmental and safety concerns are increasingly influencing the Smartphone Sensors market. Governments and consumers alike are placing greater importance on environmental factors and safety features. As a result, smartphone manufacturers are integrating sensors that contribute to these concerns.Environmental sensors such as air quality sensors and UV sensors can provide real-time data on air pollution levels and sun exposure. These sensors are vital for addressing health and environmental concerns. Additionally, sensors like NFC (Near Field Communication) and GPS contribute to features that enhance user safety and security, such as contactless payments and location-based emergency services.

The global Smartphone Sensors market is being driven by a combination of factors, including consumer demand for advanced features, technological advancements, IoT integration, AR/VR applications, wearable device compatibility, and environmental and safety concerns. As technology continues to evolve, smartphone manufacturers will need to stay at the forefront of innovation in sensor technology to meet the ever-growing demands of consumers and address the changing landscape of environmental and safety regulations. These drivers are expected to shape the future of the global Smartphone Sensors market, making it a dynamic and competitive industry.

Government Policies are Likely to Propel the Market

Manufacturing Incentives for Sensor Components

To promote the growth of the global Smartphone Sensors market, governments can implement policies aimed at encouraging the domestic manufacturing of sensor components. This policy can include tax incentives, grants, and subsidies for companies engaged in the research, development, and production of sensor components like accelerometers, gyroscopes, and image sensors. By incentivizing local production, governments aim to reduce reliance on imports, create jobs, and boost the overall competitiveness of the smartphone sensor industry.Governments can provide support for research and development activities, fostering innovation in sensor technology. Such incentives can lead to the creation of cutting-edge sensor components that can be integrated into smartphones, making them more advanced and appealing to consumers.

Standardization and Regulation of Sensor Data Privacy

Data privacy is a growing concern in the Smartphone Sensors market, with sensors collecting sensitive information about users. Governments can formulate policies to standardize and regulate how sensor data is collected, stored, and used by smartphone manufacturers. These regulations may include requirements for obtaining explicit user consent, data encryption standards, and guidelines for secure data transmission.Furthermore, governments can establish penalties for non-compliance and empower regulatory bodies to audit smartphone manufacturers' data handling practices. By setting clear and enforceable regulations, governments aim to protect consumers' privacy and build trust in the smartphone sensor industry, ultimately benefiting the market by ensuring responsible data handling practices.

Environmental Sustainability Regulations

Governments worldwide are increasingly focused on environmental sustainability. To address this concern, governments can implement policies that require smartphone manufacturers to adhere to specific environmental standards when designing and producing smartphones with integrated sensors. These policies may include mandates for the responsible disposal and recycling of electronic waste and restrictions on the use of hazardous materials in sensor components.Governments can incentivize smartphone manufacturers to develop energy-efficient sensors and promote eco-friendly manufacturing processes. These measures contribute to reducing the environmental footprint of smartphones and can drive demand for devices that align with eco-conscious consumers' preferences.

Trade Tariffs and Import Restrictions

Government policies concerning trade tariffs and import restrictions can significantly impact the global Smartphone Sensors market. Governments may impose tariffs or restrictions on the import of smartphone sensors to protect domestic industries, encourage local manufacturing, or address national security concerns.Tariffs can be applied to sensors manufactured in specific countries or regions, which may lead to changes in the supply chain and influence the competitiveness of smartphone manufacturers. Policymakers must carefully consider the potential consequences on both domestic and international markets when formulating such policies to ensure they strike the right balance between economic interests and global trade.

Research and Development Funding

To foster innovation and keep the Smartphone Sensors market competitive, governments can allocate funding for research and development initiatives related to sensor technology. These funds can support academic institutions, research organizations, and private companies working on sensor advancements.By investing in R&D, governments can help push the boundaries of sensor technology, leading to breakthroughs in sensor performance, miniaturization, and power efficiency. These innovations can give smartphone manufacturers a competitive edge and attract consumers seeking the latest in sensor capabilities.

Export Promotion and International Cooperation

International cooperation and export promotion policies can benefit the global Smartphone Sensors market. Governments can facilitate partnerships and agreements with other countries to promote the export of domestically manufactured sensor components and smartphones.These policies can include trade agreements, export subsidies, and the establishment of international standards for sensor technology. By fostering global collaboration and easing international trade barriers, governments aim to expand the market reach of smartphone sensors, supporting the growth of the industry on a global scale.

Government policies play a significant role in shaping the global Smartphone Sensors market. By implementing a mix of incentives, regulations, and funding initiatives, governments can influence the development, manufacturing, and distribution of smartphone sensors. These policies can help ensure that the industry remains competitive, responsible, and aligned with the evolving needs and expectations of consumers and the global economy.

Key Market Trends

Increasing Adoption of Advanced Sensing Technologies

The global smartphone sensors market is witnessing a notable trend toward the adoption of advanced sensing technologies. With the continuous evolution of smartphones into powerful computing devices, the demand for sensors capable of providing enhanced functionalities has surged. Manufacturers are incorporating a diverse range of sensors such as accelerometers, gyroscopes, magnetometers, proximity sensors, and ambient light sensors to enable various features like motion sensing, augmented reality (AR), virtual reality (VR), and environmental sensing.One prominent example of this trend is the integration of 3D depth-sensing cameras in high-end smartphones. These cameras utilize advanced technologies like time-of-flight (ToF) or structured light to accurately measure depth, enabling applications such as facial recognition, gesture control, and immersive gaming experiences. As consumer expectations for smartphone capabilities continue to rise, manufacturers are likely to invest further in advanced sensing technologies to differentiate their products in the highly competitive market landscape.

The emergence of Internet of Things (IoT) and smart home applications is driving the demand for smartphones equipped with a diverse array of sensors capable of seamlessly interacting with other connected devices. This trend is expected to fuel the integration of additional sensors such as temperature sensors, humidity sensors, and air quality sensors into smartphones, enabling users to monitor and control their surrounding environment conveniently.

The increasing adoption of advanced sensing technologies in smartphones is a significant market trend that is reshaping the landscape of smartphone functionality. Manufacturers are focusing on incorporating a diverse range of sensors to enable innovative features and enhance user experiences, driving growth in the global smartphone sensors market.

Key Market Challenges

Price Competition and Margin Pressures

One of the most significant challenges in the global Smartphone Sensors market is the intense price competition and margin pressures faced by both sensor manufacturers and smartphone OEMs (Original Equipment Manufacturers). As smartphones have become ubiquitous and integral to modern life, consumers have come to expect increasingly advanced features and capabilities in their devices. This has led to a growing demand for high-quality sensors in smartphones, which in turn, has driven up the cost of production.The competition among sensor manufacturers to supply these advanced sensors to smartphone manufacturers is fierce. They continuously strive to innovate and produce sensors with better performance, higher resolution, and increased reliability. While technological advancements are crucial for market growth, they also add to production costs. Manufacturers invest heavily in research and development to stay ahead of the competition, driving up expenses.

On the other side, smartphone OEMs are under constant pressure to keep the retail prices of their devices competitive in a crowded marketplace. Consumers are sensitive to pricing, and price-consciousness often drives purchasing decisions. As a result, smartphone manufacturers must balance the desire for high-quality sensors with the need to keep production costs in check.

This pricing dilemma is a challenge for both sensor manufacturers and smartphone OEMs. To maintain profit margins, sensor manufacturers must find cost-effective ways to produce advanced sensors, while smartphone manufacturers must decide how to allocate resources without sacrificing the quality of sensors in their devices. Striking this balance is challenging and has implications for product competitiveness and profitability.

In some regions, consumers are demanding more affordable smartphones with basic sensor functionalities, adding further pressure to the pricing challenge. Manufacturers must find ways to offer sensors that meet these budget-friendly requirements without compromising quality.

To address this challenge, sensor manufacturers need to focus on improving the efficiency of their manufacturing processes and exploring cost-effective materials and technologies. Smartphone OEMs, on the other hand, must carefully consider which sensor features are essential for their target audience and make smart choices in sensor integration.

Rapid Technological Obsolescence

The global Smartphone Sensors market faces another significant challenge in the form of rapid technological obsolescence. Sensor technologies evolve at a breakneck pace, and what was considered cutting-edge just a few years ago can quickly become outdated. This rapid rate of change can lead to several complications for both consumers and industry stakeholders.For consumers, the challenge lies in keeping up with the constant stream of new sensor innovations. Purchasing a smartphone with the latest sensors is no guarantee of long-term relevance, as newer, more advanced sensors can be introduced shortly thereafter. This situation can lead to consumer dissatisfaction and reluctance to upgrade their devices, as they fear their purchases will quickly become obsolete.

For sensor manufacturers, rapid technological obsolescence poses a challenge in terms of product development and lifecycle management. They must continually invest in research and development to keep pace with evolving sensor technologies. This process involves significant time and financial resources, which can strain their operations. Furthermore, the fast pace of obsolescence can result in reduced demand for older sensor models, potentially leading to inventory management challenges and financial losses.

Smartphone OEMs also face the challenge of integrating the latest sensors into their devices while managing product lifecycles. This can be particularly challenging for manufacturers with long lead times between product design and release, as they may struggle to keep up with the pace of technological change.

Addressing the challenge of technological obsolescence in the Smartphone Sensors market requires a multifaceted approach. Sensor manufacturers need to focus on sustainable product development strategies that incorporate upgradeable or modular components, which can extend the lifespan of sensors in smartphones. Smartphone OEMs must work on agile product development processes that allow for quick integration of the latest sensor technologies and, when necessary, faster product updates.

In summary, the global Smartphone Sensors market faces the challenges of price competition and margin pressures, driven by consumers' demand for advanced features, and the issue of rapid technological obsolescence, where the fast pace of sensor advancements can pose challenges for manufacturers and consumers alike. Navigating these challenges requires strategic planning, innovation, and a focus on cost-effective, sustainable solutions.

Segmental Insights

Mobile Type Insights

The Standard Smart Phones segment held the largest Market share in 2023. Standard smartphones are the most widely adopted category of mobile devices. They cater to the general consumer market, and a broad range of people, from various demographics and backgrounds, use standard smartphones in their daily lives. This extensive user base drives the demand for smartphones with advanced sensor capabilities. Standard smartphones are designed to be versatile, offering a wide range of features and applications. They serve as multipurpose devices for communication, entertainment, productivity, and more. To meet the diverse needs of consumers, these devices integrate a variety of sensors, such as touchscreens, accelerometers, gyroscopes, ambient light sensors, and proximity sensors, among others. Consumers have increasingly high expectations for the capabilities of their smartphones. They want devices that can handle a multitude of tasks, from taking high-quality photos and videos to tracking fitness data and providing location-based services. These features often rely on various sensors, driving smartphone manufacturers to continually enhance sensor technology in standard smartphones. Standard smartphones face intense competition, with numerous manufacturers vying for market share. To differentiate their products and attract consumers, manufacturers invest in integrating advanced sensor technologies, which help them stand out in a crowded market. The large-scale production of standard smartphones benefits from economies of scale. The high volume of production helps reduce the cost of components, including sensors. This allows manufacturers to offer advanced sensor features in standard smartphones at a relatively affordable price point. Market research and consumer trends play a significant role in shaping the smartphone industry. Manufacturers closely monitor consumer preferences and market demands. As a result, they continually evolve standard smartphones, incorporating the latest sensor technologies to meet current trends and consumer expectations. The app ecosystem, which plays a crucial role in driving smartphone adoption, relies on the sensor capabilities of standard smartphones. Developers create applications that leverage sensors to offer innovative solutions for users. The availability of a wide range of sensor types in standard smartphones provides developers with the tools to create diverse and engaging apps, further fueling demand for these devices.Regional Insights

Asia Pacific

Asia Pacific was the largest market for smartphone sensors in 2023. This is due to the region's large population base and rapidly growing smartphone market. China is the largest market for smartphone sensors in Asia Pacific, followed by India and South Korea.One of the primary reasons for the Asia Pacific region's dominance in the global smartphone sensors market is the rapid expansion of the smartphone manufacturing industry across countries like China, South Korea, Taiwan, and India. These countries have emerged as key manufacturing hubs for smartphones, driven by factors such as favorable government policies, abundant skilled labor, and established supply chains.

China, in particular, has solidified its position as the world's largest smartphone producer, with numerous domestic and international brands setting up manufacturing facilities in the country. The sheer scale of smartphone production in China, coupled with the presence of leading semiconductor manufacturers, has created a robust ecosystem for smartphone sensor suppliers. As a result, Asia Pacific accounts for a significant share of the global smartphone sensors market, owing to the high demand generated by the region's burgeoning smartphone manufacturing sector.

Countries like South Korea and Taiwan are home to some of the world's leading semiconductor companies, which specialize in manufacturing components essential for smartphones, including sensors. This concentration of semiconductor expertise further strengthens Asia Pacific's position in the global smartphone sensors market, as these companies supply sensors not only to domestic smartphone manufacturers but also to major players worldwide.

Another factor contributing to Asia Pacific's leadership in the global smartphone sensors market is the region's focus on technological innovation and research & development (R&D). Countries like Japan and South Korea have long been at the forefront of sensor technology innovation, investing heavily in R&D to develop cutting-edge sensor solutions for smartphones and other electronic devices.

Japanese companies, in particular, have a strong track record of innovation in sensor technology, with a significant presence in sectors such as imaging sensors, gyroscopes, and accelerometers. These sensors are integral to the functionality of smartphones, enabling features such as image stabilization, motion sensing, and augmented reality experiences.

Key Market Players

- Sony Corporation

- Samsung Electronics Co. Ltd

- STMicroelectronics International N.V.

- Qualcomm Technologies Inc.

- Bosch Sensortec GmbH

- Honeywell International Inc.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Microchip Technology Inc.

Report Scope:

In this report, the Global Smartphone Sensors Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Smartphone Sensors Market, By Mobile Type:

- Standard Smart Phones

- Rugged Smartphones

- Others

Smartphone Sensors Market, By Sensor Type:

- Biometric Sensors

- Image Sensors

- Accelerometer

- Gyroscope

- Magnetometer

- GPS

- Ambient Light Sensor

Smartphone Sensors Market, By Application:

- High End

- Mid-Range

- Low End

Smartphone Sensors Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smartphone Sensors Market.Available Customizations:

Global Smartphone Sensors Market report with the given Market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.3. Key Market Segmentations

2. Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Formulation of the Scope

2.4. Assumptions and Limitations

2.5. Sources of Research

2.5.1. Secondary Research

2.5.2. Primary Research

2.6. Approach for the Market Study

2.6.1. The Bottom-Up Approach

2.6.2. The Top-Down Approach

2.7. Methodology Followed for Calculation of Market Size & Market Shares

2.8. Forecasting Methodology

2.8.1. Data Triangulation & Validation

3. Executive Summary

4. Voice of Customer

5. Global Smartphone Sensors Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Mobile Type (Standard Smart Phones, Rugged Smartphones, and Others),

5.2.2. By Sensor Type (Biometric Sensors, Image Sensors, Accelerometer, Gyroscope, Magnetometer, GPS and Ambient Light Sensor),

5.2.3. By Application (High End, Mid-Range and Low End)

5.2.4. By Region

5.2.5. By Company (2023)

5.3. Market Map

6. North America Smartphone Sensors Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Mobile Type

6.2.2. By Sensor Type

6.2.3. By Application

6.2.4. By Country

6.3. North America: Country Analysis

6.3.1. United States Smartphone Sensors Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Mobile Type

6.3.1.2.2. By Sensor Type

6.3.1.2.3. By Application

6.3.2. Canada Smartphone Sensors Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Mobile Type

6.3.2.2.2. By Sensor Type

6.3.2.2.3. By Application

6.3.3. Mexico Smartphone Sensors Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Mobile Type

6.3.3.2.2. By Sensor Type

6.3.3.2.3. By Application

7. Europe Smartphone Sensors Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Mobile Type

7.2.2. By Sensor Type

7.2.3. By Application

7.2.4. By Country

7.3. Europe: Country Analysis

7.3.1. Germany Smartphone Sensors Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Mobile Type

7.3.1.2.2. By Sensor Type

7.3.1.2.3. By Application

7.3.2. United Kingdom Smartphone Sensors Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Mobile Type

7.3.2.2.2. By Sensor Type

7.3.2.2.3. By Application

7.3.3. Italy Smartphone Sensors Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Mobile Type

7.3.3.2.2. By Sensor Type

7.3.3.2.3. By Application

7.3.4. France Smartphone Sensors Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Mobile Type

7.3.4.2.2. By Sensor Type

7.3.4.2.3. By Application

7.3.5. Spain Smartphone Sensors Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Mobile Type

7.3.5.2.2. By Sensor Type

7.3.5.2.3. By Application

8. Asia-Pacific Smartphone Sensors Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Mobile Type

8.2.2. By Sensor Type

8.2.3. By Application

8.2.4. By Country

8.3. Asia-Pacific: Country Analysis

8.3.1. China Smartphone Sensors Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Mobile Type

8.3.1.2.2. By Sensor Type

8.3.1.2.3. By Application

8.3.2. India Smartphone Sensors Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Mobile Type

8.3.2.2.2. By Sensor Type

8.3.2.2.3. By Application

8.3.3. Japan Smartphone Sensors Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Mobile Type

8.3.3.2.2. By Sensor Type

8.3.3.2.3. By Application

8.3.4. South Korea Smartphone Sensors Market Outlook

8.3.4.1. Market Size & Forecast

8.3.4.1.1. By Value

8.3.4.2. Market Share & Forecast

8.3.4.2.1. By Mobile Type

8.3.4.2.2. By Sensor Type

8.3.4.2.3. By Application

8.3.5. Australia Smartphone Sensors Market Outlook

8.3.5.1. Market Size & Forecast

8.3.5.1.1. By Value

8.3.5.2. Market Share & Forecast

8.3.5.2.1. By Mobile Type

8.3.5.2.2. By Sensor Type

8.3.5.2.3. By Application

9. South America Smartphone Sensors Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Mobile Type

9.2.2. By Sensor Type

9.2.3. By Application

9.2.4. By Country

9.3. South America: Country Analysis

9.3.1. Brazil Smartphone Sensors Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Mobile Type

9.3.1.2.2. By Sensor Type

9.3.1.2.3. By Application

9.3.2. Argentina Smartphone Sensors Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Mobile Type

9.3.2.2.2. By Sensor Type

9.3.2.2.3. By Application

9.3.3. Colombia Smartphone Sensors Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Mobile Type

9.3.3.2.2. By Sensor Type

9.3.3.2.3. By Application

10. Middle East and Africa Smartphone Sensors Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Mobile Type

10.2.2. By Sensor Type

10.2.3. By Application

10.2.4. By Country

10.3. Middle East and Africa: Country Analysis

10.3.1. South Africa Smartphone Sensors Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Mobile Type

10.3.1.2.2. By Sensor Type

10.3.1.2.3. By Application

10.3.2. Saudi Arabia Smartphone Sensors Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Mobile Type

10.3.2.2.2. By Sensor Type

10.3.2.2.3. By Application

10.3.3. UAE Smartphone Sensors Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Mobile Type

10.3.3.2.2. By Sensor Type

10.3.3.2.3. By Application

10.3.4. Kuwait Smartphone Sensors Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Mobile Type

10.3.4.2.2. By Sensor Type

10.3.4.2.3. By Application

10.3.5. Turkey Smartphone Sensors Market Outlook

10.3.5.1. Market Size & Forecast

10.3.5.1.1. By Value

10.3.5.2. Market Share & Forecast

10.3.5.2.1. By Mobile Type

10.3.5.2.2. By Sensor Type

10.3.5.2.3. By Application

11. Market Dynamics

11.1. Drivers

11.2. Challenges

12. Market Trends & Developments

13. Company Profiles

13.1. Sony Corporation

13.1.1. Business Overview

13.1.2. Key Revenue and Financials

13.1.3. Recent Developments

13.1.4. Key Personnel/Key Contact Person

13.1.5. Key Product/Services Offered

13.2. Samsung Electronics Co. Ltd

13.2.1. Business Overview

13.2.2. Key Revenue and Financials

13.2.3. Recent Developments

13.2.4. Key Personnel/Key Contact Person

13.2.5. Key Product/Services Offered

13.3. STMicroelectronics International N.V.

13.3.1. Business Overview

13.3.2. Key Revenue and Financials

13.3.3. Recent Developments

13.3.4. Key Personnel/Key Contact Person

13.3.5. Key Product/Services Offered

13.4. Qualcomm Technologies Inc.

13.4.1. Business Overview

13.4.2. Key Revenue and Financials

13.4.3. Recent Developments

13.4.4. Key Personnel/Key Contact Person

13.4.5. Key Product/Services Offered

13.5. Bosch Sensortec GmbH

13.5.1. Business Overview

13.5.2. Key Revenue and Financials

13.5.3. Recent Developments

13.5.4. Key Personnel/Key Contact Person

13.5.5. Key Product/Services Offered

13.6. Honeywell International Inc.

13.6.1. Business Overview

13.6.2. Key Revenue and Financials

13.6.3. Recent Developments

13.6.4. Key Personnel/Key Contact Person

13.6.5. Key Product/Services Offered

13.7. TDK Corporation

13.7.1. Business Overview

13.7.2. Key Revenue and Financials

13.7.3. Recent Developments

13.7.4. Key Personnel/Key Contact Person

13.7.5. Key Product/Services Offered

13.8. Murata Manufacturing Co., Ltd.

13.8.1. Business Overview

13.8.2. Key Revenue and Financials

13.8.3. Recent Developments

13.8.4. Key Personnel/Key Contact Person

13.8.5. Key Product/Services Offered

13.9. NXP Semiconductors N.V.

13.9.1. Business Overview

13.9.2. Key Revenue and Financials

13.9.3. Recent Developments

13.9.4. Key Personnel/Key Contact Person

13.9.5. Key Product/Services Offered

13.10. Microchip Technology Inc.

13.10.1. Business Overview

13.10.2. Key Revenue and Financials

13.10.3. Recent Developments

13.10.4. Key Personnel/Key Contact Person

13.10.5. Key Product/Services Offered

14. Strategic Recommendations

15. About the Publisher & Disclaimer

Companies Mentioned

- Sony Corporation

- Samsung Electronics Co. Ltd

- STMicroelectronics International N.V.

- Qualcomm Technologies Inc.

- Bosch Sensortec GmbH

- Honeywell International Inc.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Microchip Technology Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2024 |

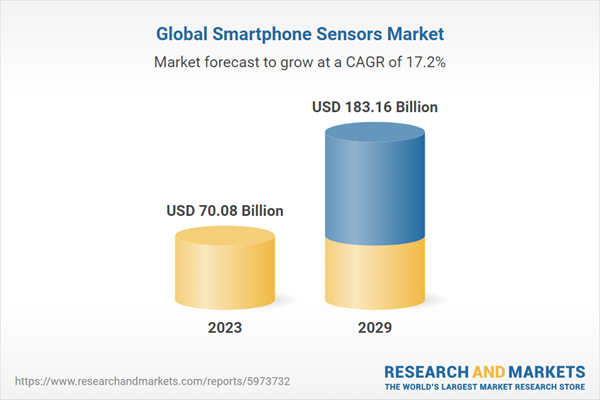

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 70.08 Billion |

| Forecasted Market Value ( USD | $ 183.16 Billion |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |