Global Mooring Inspection Market - Key Trends and Drivers Summarized

How Is Mooring Inspection Ensuring Offshore Safety?

Mooring inspection is a critical maintenance activity in offshore and maritime industries, aimed at ensuring the safety, reliability, and longevity of mooring systems used to anchor ships, floating production units, and offshore platforms. Mooring systems, which consist of chains, wires, and anchors, are essential for securing vessels and structures in position, especially in harsh marine environments. Regular inspection and maintenance of these systems help detect potential issues such as corrosion, fatigue, and mechanical wear, which could compromise the integrity of the mooring equipment and lead to safety risks or operational downtime. Mooring inspections involve a range of techniques, including visual inspections, nondestructive testing (NDT), and digital monitoring, to assess the condition of mooring lines, anchors, and connectors. The adoption of advanced inspection methods, such as remotely operated vehicles (ROVs) and underwater drones, has improved the accuracy and efficiency of inspections in deep-water environments. These advancements are crucial in ensuring the compliance of mooring systems with industry standards and regulatory requirements, ultimately minimizing the risk of accidents and failures in offshore operations.What Trends Are Shaping the Mooring Inspection Market?

Several key trends are influencing the mooring inspection market, including the increasing complexity of offshore projects, technological advancements in inspection methods, and stricter regulatory requirements for safety. As offshore energy production extends into deeper waters, the need for reliable and effective mooring inspection solutions is growing. Complex projects, such as floating wind farms and deep-water oil drilling, demand robust mooring systems capable of withstanding harsh marine conditions. This trend has led to increased demand for advanced inspection techniques and technologies to ensure the structural integrity of mooring components. The integration of digital technologies, such as machine learning and data analytics, is transforming the mooring inspection landscape. These technologies enable predictive maintenance by analyzing inspection data to identify potential risks and schedule repairs before issues escalate. Additionally, the use of ROVs and autonomous underwater vehicles (AUVs) is gaining traction, offering safer and more cost-effective inspection solutions in challenging environments. Regulatory bodies are also playing a significant role in shaping the market by mandating regular mooring inspections and setting stringent standards for offshore safety.How Do Market Segments Impact the Mooring Inspection Industry?

Inspection types include visual inspection, NDT, and digital monitoring, with NDT being widely used due to its ability to detect internal defects without damaging the equipment. Technologies used in mooring inspections encompass ROVs, AUVs, ultrasonic testing, and electromagnetic inspection, among others. The adoption of ROVs and AUVs is growing rapidly due to their ability to conduct inspections in deep waters and hazardous conditions. Applications of mooring inspection span the oil and gas industry, offshore wind energy, shipping, and marine infrastructure. The oil and gas sector is the largest application segment, as offshore drilling and production operations require robust mooring systems for stability and safety. Offshore wind energy is an emerging segment experiencing rapid growth, driven by the increasing number of floating wind farms that require reliable mooring solutions. Geographically, regions such as North America, Europe, and Asia-Pacific are key markets, driven by the presence of major offshore projects and stringent safety regulations.What Factors Are Driving the Growth in the Mooring Inspection Market?

The growth in the mooring inspection market is driven by several factors, including the increasing scale of offshore energy projects, advancements in inspection technologies, and stringent regulatory requirements for safety. As offshore exploration and production extend into deeper waters, the demand for reliable mooring inspection solutions is rising to ensure operational safety. Technological innovations, such as the use of ROVs, AUVs, and data analytics, are enhancing inspection accuracy and efficiency, making them more attractive for the industry. Additionally, regulatory mandates for regular mooring inspections and adherence to safety standards are further propelling market growth, as companies prioritize risk mitigation and compliance.Report Scope

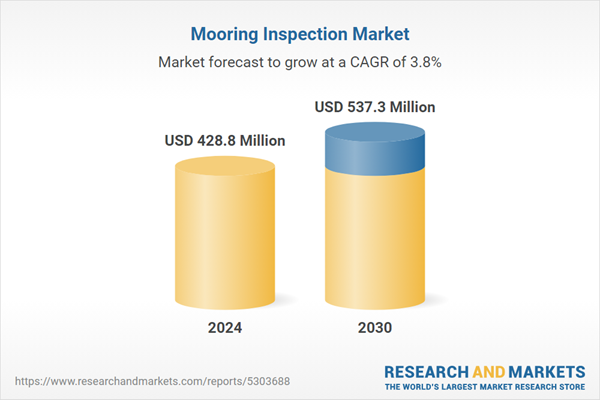

The report analyzes the Mooring Inspection market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Below Water Inspection (BWI), Above Water Inspection (AWI)); Technology (Close Visual Inspection (CVI), Magnetic Particle Inspection (MPI), Ultrasonic Testing (UT), Electromagnetic Detection, Mooring Line Dimension Measurement, Other Technologies).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below Water Inspection (BWI) segment, which is expected to reach US$386.1 Million by 2030 with a CAGR of a 4.1%. The Above Water Inspection (AWI) segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $113.1 Million in 2024, and China, forecasted to grow at an impressive 6% CAGR to reach $113.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Mooring Inspection Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Mooring Inspection Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Mooring Inspection Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aceton Group Ltd., Deep Sea Mooring, Deepocean Group Holding Bv, Delmar Systems, Inc., DOF Subsea and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Mooring Inspection market report include:

- Aceton Group Ltd.

- Deep Sea Mooring

- Deepocean Group Holding Bv

- Delmar Systems, Inc.

- DOF Subsea

- Franklin Offshore Australia Pty Ltd.

- InterMoor

- JIFMAR Offshore Services

- Moffatt & Nichol

- Oceaneering International, Inc.

- Viking Seatech Ltd.

- Welaptega Marine Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aceton Group Ltd.

- Deep Sea Mooring

- Deepocean Group Holding Bv

- Delmar Systems, Inc.

- DOF Subsea

- Franklin Offshore Australia Pty Ltd.

- InterMoor

- JIFMAR Offshore Services

- Moffatt & Nichol

- Oceaneering International, Inc.

- Viking Seatech Ltd.

- Welaptega Marine Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 428.8 Million |

| Forecasted Market Value ( USD | $ 537.3 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |