Speak directly to the analyst to clarify any post sales queries you may have.

Introduction to the transformative technological shift in motorcycle braking systems and the imperative for integrated electronic control architectures

The evolution of motorcycle braking technology is entering an inflection point as mechanical linkages give way to electronically controlled systems that redefine how riders experience safety, control, and vehicle dynamics. Brake by wire systems remove the purely hydraulic or mechanical dependency and replace it with an integrated electronic control layer that interprets rider input, optimizes force distribution, and interfaces with other electronic subsystems. Consequently, stakeholders across OEM engineering, component supply, and aftermarket services must reconcile hardware precision, software integrity, and user perception when considering adoption.As electrification and advanced rider assistance systems become more pervasive, brake by wire architectures are positioned to deliver both incremental and transformational benefits. The rapid integration of sensors, actuators, and control algorithms introduces new validation and reliability imperatives, while also enabling capabilities such as torque vectoring, regenerative braking coordination on hybrid platforms, and refined ABS and traction management strategies. In this dynamic landscape, the industry must balance regulatory compliance, functional safety, and real-world user acceptance to convert technical promise into practical deployment.

How technological convergence, regulatory rigor, and electrification dynamics are catalyzing rapid structural change across the motorcycle braking ecosystem

Recent years have witnessed a convergence of multiple forces that are reshaping the competitive and technical landscape for motorcycle brake by wire systems. Advances in sensor miniaturization and actuator efficiency have reduced latency and energy consumption, enabling designs that are both compact and responsive. Simultaneously, the maturation of real-time control software and fail‑safe architectures has increased confidence among OEMs to move from concept demonstrators to production intent. These trends are further amplified by the broader electrification of two‑wheel platforms, where the removal of traditional engine packaging constraints creates fresh opportunities for reimagined braking integration.Market entrants are responding with modular platforms that can be adapted across vehicle types, allowing tier suppliers and startups to collaborate with OEMs on scalable solutions. Meanwhile, regulatory bodies are converging on functional safety frameworks that demand rigorous verification and validation protocols, thereby raising the bar for suppliers but also creating defensible differentiation for those who demonstrate compliance and robust testing. Taken together, these shifts are accelerating partnerships across software, semiconductor, and mechanical domains and reframing the value chain from discrete components to system-level performance.

Assessing how cumulative tariff adjustments are reshaping sourcing strategies, production footprints, and supply chain resilience for braking module suppliers

The recent imposition of tariffs and trade measures has introduced new complexity to supplier networks and sourcing strategies within the motorcycle braking domain. Tariff adjustments have altered relative cost positions for imported components and finished assemblies, prompting procurement teams to reassess production footprints and to model the impact of duties on landed cost and supplier selection. As a result, many manufacturers have accelerated localization initiatives or sought alternative regional suppliers to mitigate exposure to duty variability and logistic disruption.In response to cumulative tariff pressures, companies are increasing emphasis on supply chain resilience and inventory planning, shifting toward multi-sourcing strategies and nearshoring where feasible. At the same time, engineering teams are prioritizing design flexibility so that modules can be adapted to multiple regional suppliers without extensive requalification. While tariffs introduce near-term cost volatility, they also incentivize deeper engagement with local supply ecosystems and promote investments in domestic test and assembly capabilities, which can shorten lead times and reduce exposure to cross-border transport bottlenecks.

Comprehensive segmentation analysis revealing how technology choices, vehicle classes, distribution pathways, and component placement determine development priorities and commercialization strategies

A robust segmentation framework reveals distinct technical, vehicle, distribution, and placement dynamics that inform product strategy and commercialization choices. Based on technology type, the market is studied across Electro Hydraulic and Electro Mechanical, highlighting divergent engineering trade-offs: electro hydraulic solutions often leverage familiar fluidic architectures supplemented by electronic modulation, whereas electro mechanical solutions rely on direct motorized actuation with potential benefits for packaging and energy recovery. This distinction influences supplier specialization, testing regimes, and integration pathways with vehicle control systems.Based on vehicle type, the market is studied across Commuter, Cruiser, Off Road, Sport, and Touring, each presenting unique ride profiles, duty cycles, and rider expectations that drive calibration and durability priorities. Urban commuter platforms prioritize predictable, low-effort modulation in stop‑and‑go traffic; sport and touring platforms demand high thermal stability and precise feedback under sustained loads; off road variants require robust sealing and impact resistance to withstand environmental extremes. Based on distribution channel, the market is studied across Aftermarket and Original Equipment Manufacturer, which frames how products are specified, certified, and supported. OEM channels impose stringent integration and warranty requirements, whereas aftermarket channels emphasize retrofit simplicity, compatibility, and user-installable form factors. Finally, based on component placement, the market is studied across Combined Brake, Front Brake, and Rear Brake, reflecting packaging constraints and control strategies where combined systems enable coordinated electronic modulation while dedicated front or rear modules require targeted performance tuning and redundancy planning. These segmentation lenses together provide a multidimensional view that informs product roadmaps, validation priorities, and go-to-market positioning.

Regional market dynamics and strategic considerations across the Americas, Europe Middle East & Africa, and Asia-Pacific that drive differentiated adoption and localization strategies

Regional dynamics exert a profound influence on adoption timelines, regulatory alignment, and supply chain design for motorcycle brake by wire systems. In the Americas, regulatory discourse and consumer demand emphasize safety certification and integration with advanced rider aids, while logistical considerations and growing local engineering capabilities favor production localization and supplier partnerships that reduce lead times. This region also hosts mature aftermarket ecosystems that can accelerate retrofit adoption for certain vehicle segments.Europe, Middle East & Africa presents a heterogeneous landscape where stringent safety standards and an established OEM base drive early adoption among premium segments, while emerging markets within the region require cost‑effective designs that tolerate variable road and climatic conditions. Asia-Pacific remains a focal point for volume production, technological experimentation, and rapid electrification of two‑wheel mobility, with major manufacturing clusters and a diverse range of vehicle types from commuter scooters to high‑performance motorcycles. Differences in regulatory frameworks, rider preferences, and infrastructure maturity across these regions necessitate tailored product strategies, regional partnerships, and adaptable compliance roadmaps to achieve commercial traction.

Key competitive dynamics and differentiators among component innovators, integration specialists, and aftermarket solution providers shaping the future of brake by wire systems

The competitive landscape is characterized by a mix of established tier suppliers, specialist actuator and sensor vendors, and nimble technology providers focusing on software and system integration. Leading players increasingly prioritize cross-domain capabilities that combine mechanical actuation expertise with embedded control software and cybersecurity provisions. Partnerships between component manufacturers and software firms are becoming more common, enabling rapid iterations of control logic while leveraging proven hardware baselines.Strategic differentiation is emerging around system-level validation, functional safety certification, and modular architectures that reduce integration friction for OEMs. Companies that invest early in rigorous testing protocols, redundancy strategies, and clear upgrade paths for fielded systems tend to gain credibility with vehicle manufacturers and fleet operators. Additionally, aftermarket-focused firms are capitalizing on retrofit demand by developing user-centric installation processes and compatibility matrices that minimize rework. Overall, competitive advantage increasingly hinges on the ability to deliver validated, interoperable solutions that align with OEM roadmaps and regional regulatory predicates.

Actionable strategic playbook for suppliers and OEMs to accelerate safe deployment, diversify sourcing, and build software-integrated capabilities for competitive advantage

Industry leaders should pursue a coordinated set of strategic initiatives to capture value and mitigate implementation risk. First, prioritize investment in functional safety and cybersecurity certification pathways to establish trust with OEMs and regulators, while also creating repeatable validation artifacts that accelerate project timelines. Second, diversify sourcing strategies to incorporate regional suppliers and modular subassemblies, which reduces exposure to trade disruptions and supports near-term localization objectives. Third, accelerate software and calibration expertise by building cross‑functional teams that merge control engineers with vehicle dynamics specialists, ensuring that electronic modulation enhances perceived rider feedback rather than diminishing it.Fourth, cultivate partnerships with semiconductor and actuator vendors to secure prioritized access to critical components and to co-develop optimized control stacks. Fifth, design aftermarket-friendly variants and serviceable modules that expand addressable customer segments and support long-term aftermarket revenue streams. Finally, adopt an open, transparent engagement model with regulators and industry consortia to influence standards development and to align product roadmaps with evolving compliance requirements. Taken together, these actions will help companies convert technical capability into repeatable commercial success.

Transparent, interview-driven methodology combining expert engagement and technical documentation synthesis to evaluate integration, validation, and supply chain scenarios

The research approach combined a synthesis of primary stakeholder interviews, technical whitepaper review, and structured analysis of publicly available regulatory documents and product specifications. Primary inputs included conversations with engineering leads, procurement managers, and aftermarket operators to capture firsthand perspectives on integration challenges, warranty considerations, and rider acceptance factors. These qualitative insights were triangulated with technical documentation such as safety standards, actuator performance data, and system architecture references to ensure alignment between reported priorities and engineering feasibility.Analytical methods emphasized scenario-based assessment rather than predictive modeling, focusing on stress testing supply chain alternatives, validation roadmaps, and integration pathways. Where applicable, comparative benchmarking of architectural choices-electro hydraulic versus electro mechanical-was performed against criteria including packaging constraints, energy efficiency, and maintainability. Throughout, the methodology prioritized transparency about assumptions and sought corroboration across multiple independent sources to strengthen confidence in the findings and to highlight areas where further empirical testing or field validation would be beneficial.

Concluding synthesis on how integrated engineering, validation, and regional strategies will determine who captures long-term value in the evolving brake by wire landscape

The transition to brake by wire systems for motorcycles represents a strategic inflection that intersects engineering innovation, regulatory evolution, and shifting supply chain paradigms. While technical maturity has advanced to a level that enables production intent for select architectures, widespread adoption will depend on clear demonstrations of reliability, rider-perceived performance parity, and fit with regional compliance regimes. The interplay between software sophistication and mechanical robustness will determine which suppliers succeed in delivering systems that are both safe and commercially viable.Decision-makers should view this period as an opportunity to establish leadership by investing in certification pathways, modular designs, and regional partnerships that lower the barriers to integration. By aligning engineering efforts with pragmatic sourcing strategies and customer-centered calibration, companies can move beyond pilot implementations to create scalable product families that meet diverse rider needs. Ultimately, the firms that balance rigorous testing, adaptable architectures, and proactive regulatory engagement will be best positioned to transform emerging technical capabilities into enduring market advantage.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Motorcycle Brake by Wire System Market

Companies Mentioned

The key companies profiled in this Motorcycle Brake by Wire System market report include:- Akebono Brake Industry Co., Ltd.

- Brembo S.p.A.

- Continental AG

- Denso Corporation

- Hitachi Astemo, Ltd.

- Magura GmbH & Co. KG

- Mando Corporation

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH

- SILCO CABLES

- The Hagerty Group, LLC

- TVS Motor Company

- Yamaha Motor Co., Ltd.

- ZF Friedrichshafen AG

- Zovik Cable Automotive Solutions LLP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

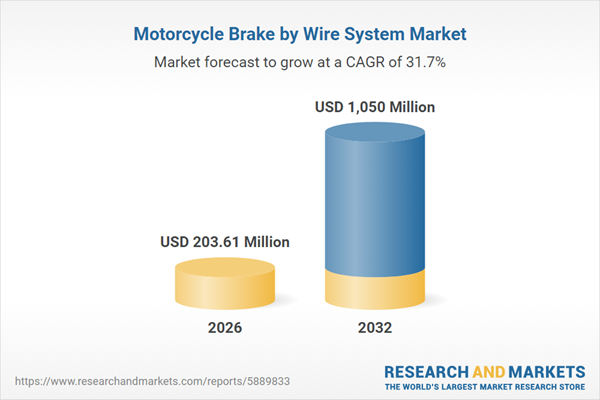

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 203.61 Million |

| Forecasted Market Value ( USD | $ 1050 Million |

| Compound Annual Growth Rate | 31.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |