Asia Pacific is one of the major contributors of the market as China, Japan, and India have aged population, thus capturing approximately 2/5thshare of the market by 2029. For instance, over 60% of Japan's population is aged 30 and above. By 2050, most of the global population aged 60 and above is projected to be in low- and middle-income nations. The rise in life expectancy has led to a growing aging population. This emerging trend is advantageous for the market as it leads to a rise in the incidence of musculoskeletal diseases due to the illness's high prevalence in old adults and boosts the demand for its treatments, resulting in market expansion.

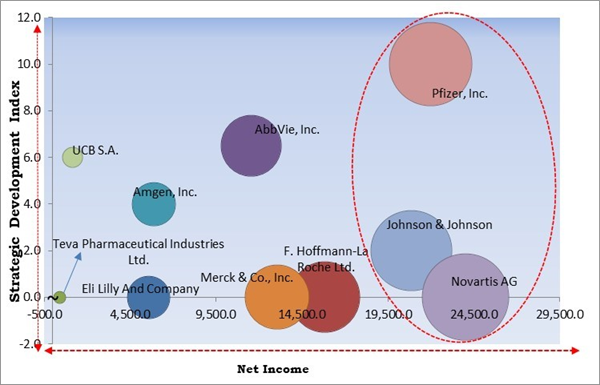

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2022, The Johnson & Johnson Medical Devices Companies collaborated with Microsoft for expanding its digital surgery ecosystem. In addition, Pfizer came into collaboration with Sirana Pharma focusing on investigating treatment for a rare bone disease, through leveraging Sirana’s microRNA targeting approach.

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson, Novartis AG, and Pfizer, Inc. are the forerunners in the Market. In March, 2022, Pfizer completed the acquisition of Arena Pharmaceuticals, an American biopharmaceutical company. Through this acquisition, the company aimed to adjoin the amazing pipeline and experience of Arena Pharmaceuticals to Pfizer’s Immunology and swelling healing area, assisting further motive of advancement boost to change the lives of patients with the immuno-inflammatory illness. Companies such as AbbVie, Inc., Amgen, Inc., and UCB S.A. are some of the key innovators in Market.COVID-19 Impact Analysis

The COVID-19 pandemic caused supply chain disruptions in several end-user industries, including food and beverage, healthcare, and industrial. In addition, the COVID-19-led economic slowdown resulted in a drop in the market for musculoskeletal disorders drugs. Since the COVID-19 pandemic disrupted supply chains and slowed down clinical studies and drug development, it had a considerable effect on the market for medications for musculoskeletal problems. Due to a drop in sales of medications for musculoskeletal disorders, including analgesics, the market for musculoskeletal disorders drugs shrank during the period. However, a rebound in the market is forecasted, and the musculoskeletal disease medications market is expected to continue growing steadily in the years to come.Market Growth Factors

Musculoskeletal diseases are extremely common

There are more than 150 diseases and conditions that are categorized as musculoskeletal impairments. These impairments are characterized by muscle, bone, joint, and adjacent connective tissue dysfunction. These dysfunctions can result in temporary or permanent restrictions on functioning and involvement. According to WHO, 1.71 billion individuals globally suffer from musculoskeletal diseases, such as rheumatoid arthritis, osteoarthritis, low back pain, neck discomfort, fractures, and other injuries. Musculoskeletal problems afflict people of all ages; however, the prevalence differs by age and diagnosis. As more people suffer from musculoskeletal problems, there will likely be a greater need for pharmaceuticals to treat them, accelerating market expansion.Higher alcohol consumption

At both the individual and societal levels, numerous variables that influence alcohol consumption levels, patterns, and the scope of alcohol-related issues in populations have been found. Poorer cultures experience more negative health effects and social implications from drinking at a given level and pattern of drinking than wealthier ones. Men account for 7.7% of all fatalities globally from alcohol-related causes, compared to women, who account for 2.6% of all deaths. In addition, male drinkers used 19.4 liters of pure alcohol on average per person in 2016, whereas female drinkers consumed 7.0 liters on average. As there is a link between higher rates of joint diseases and greater alcohol use, the market is anticipated to develop as a result of rising alcohol consumption throughout the projected period.Market Restraining Factors

Insufficient availability of healthcare professionals

Projected for 2035, a shortage of 12.9 million healthcare professionals is anticipated, representing an increase from the current 7.2 million deficit. As per the recent research published by WHO, it has been observed that the dearth of healthcare professionals can significantly impact the health of billions of individuals globally if prompt action is not taken. Factors contributing to this phenomenon include an aging workforce, resulting in retirements or departures for higher-paying positions without corresponding replacements. Also, there is a shortage of new entrants and inadequate training in the industry. Insufficient healthcare personnel in different regions of the world will negatively impact the identification and management of ailments such as musculoskeletal disorders, reducing the need for associated medications and hindering market expansion.Drug Type Outlook

Based on drug type, the market is segmented into analgesics, DMARDs, corticosteroids and others. The analgesics segment dominated the market with maximum revenue share in 2022. This is due to the affordability of analgesics, which is increasing their demand in the market as medications for musculoskeletal disorders. Additionally, they come in a variety of strengths, from moderate to powerful, and many of these are available over the counter at the local drugstore or grocery store. Thus, their affordability and availability as OTC is expected to boost the segment's expansion.Distribution Channel Outlook

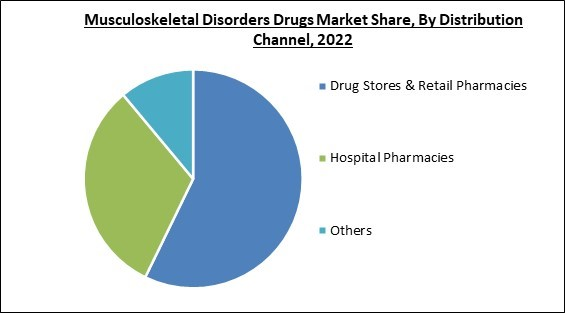

By distribution channel, the market is classified into hospital pharmacies, online providers and drug stores & retail pharmacies. The drug stores & retail pharmacies segment witnessed the largest revenue share in the market in 2022. This is due to a growth in the number of patients suffering from musculoskeletal ailments such as rheumatoid arthritis, which raises the demand for pharmaceuticals in drug stores and retail pharmacies. Also, these stores are able to provide a much more personalized solution to the customer's complication, and the patient can have their medication instantly. The easy availability of drugs, combined with other factors, is expected to increase the segment's growth.Route of Administration Outlook

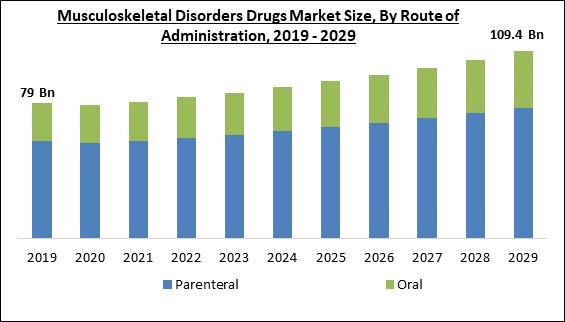

On the basis of route of administration, the market is divided into oral and parenteral. The oral segment procured a substantial revenue share in the market in 2022. This is owing to the fact many patients choose oral drugs over other kinds of treatment because they are easier to administer and less expensive. Due to its many benefits, the oral administration route is favored above the many alternative medication delivery methods. These benefits include dependability to accommodate different drug types, safety, excellent patient compliance, simplicity of intake, pain avoidance, and versatility. The benefits associated with the oral route will drive the market segment's expansion.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the market in 2022. The market is expanding due to the presence of numerous key companies and improvements in the region's medicine production for musculoskeletal disorders. Additionally, the market is anticipated to develop due to a solid healthcare infrastructure, significant purchasing power, and an increased adoption rate of analgesics and other medications for musculoskeletal disorders. Additionally, there has been an increase in the prevalence of musculoskeletal illnesses due to several causes, such as obesity, sedentary lifestyles, and workplace injuries, which has led to a rise in the demand for medications to treat these conditions, propelling the market growth in the region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AbbVie, Inc., Amgen, Inc., Eli Lilly And Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Merck & Co., Inc., Novartis AG, Pfizer, Inc., Teva Pharmaceutical Industries Ltd., and UCB S.A.

Recent Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Jun-2022: Pfizer came into collaboration with Sirana Pharma, a Germany-based developer of a biotechnology company. The collaboration involves investigating treatment for a rare bone disease, through leveraging Sirana’s microRNA targeting approach.

- Jan-2022: The Johnson & Johnson Medical Devices Companies collaborated with Microsoft, a US-based technology company. The collaboration involves expanding the medical devices company's digital surgery ecosystem.

- Feb-2021: UCB extended its collaboration agreement with Microsoft, a US-based technology company. The agreement involves advancing drug discovery and development. The collaboration integrates Microsoft's cloud, AI, computational services, and UCS's drug discovery abilities, and aims at identifying more effective molecules.

Geographical Expansions:

- Sep-2022: AbbVie expanded its already existing facility located in Cork. The expansion includes building a new manufacturing facility and bringing in new technologies.

Acquisitions and Mergers:

- Mar-2022: Pfizer completed the acquisition of Arena Pharmaceuticals, an American biopharmaceutical company. Through this acquisition, the company aimed to adjoin the amazing pipeline and experience of Arena Pharmaceuticals to Pfizer’s Immunology and swelling healing area, assisting further motive of advancement boost to change the lives of patients with the immuno-inflammatory illness.

- Mar-2022: UCB took over Zogenix, a US-based developer of therapeutic solutions. The addition of Zogenix expands and reinforces the acquiring company's market presence and reinforces its sustainable patient value strategy.

- Oct-2021: Amgen took over Teneobio, a clinical-stage biotechnology company. With this acquisition, the company aimed to leverage Teneobio's antibody platform to complement its prevailing capabilities. Moreover, the company also aimed to gain a diverse range of building blocks that can be created into new multispecific therapeutics.

Approvals and Trials:

- Apr-2022: AbbVie received FDA clearance for its RINVOQ. RINVOQ is intended for the treatment of ankylosing spondylitis (AS) in adults. The recently approved drug delivers quick disease control. Further, the approval demonstrates the company's continued advancement towards achieving its mission to accelerate the standards of care in rheumatic diseases.

Scope of the Study

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Providers

By Route of Administration

- Parenteral

- Oral

By Drug Type

- Analgesics

- DMARDs

- Corticosteroids

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- AbbVie, Inc.

- Amgen, Inc.

- Eli Lilly And Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- AbbVie, Inc.

- Amgen, Inc.

- Eli Lilly And Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.