Global Natural Gas Market - Key Trends & Drivers Summarized

Natural gas is a crucial component of the global energy mix, serving as a versatile and cleaner-burning alternative to other fossil fuels such as coal and oil. Composed primarily of methane, natural gas is extracted from underground reservoirs through drilling and hydraulic fracturing techniques. Natural gas is used extensively for electricity generation, industrial processes, residential heating, and as a fuel for vehicles. The combustion of natural gas releases fewer pollutants and greenhouse gases compared to coal and oil, making it a preferred choice for power generation in many regions seeking to reduce their carbon footprint. Additionally, natural gas is a key feedstock for the production of chemicals, fertilizers, and hydrogen, further underscoring its importance in various industrial applications. Natural gas is the fastest growing fossil fuel in the market, and is an important source of energy in North America, Western Europe and Eastern Europe as well as in industrialized markets of Asia. Widespread availability and environmental friendliness make natural gas the primary energy resource and a major raw material in the chemical and petrochemical industries, especially in industrialized parts of the world.Natural gas continues to grow in demand as a reliable, abundant and reasonably cleaner energy source. Compared to renewable energy sources such as wind and solar energy, which show fluctuating production patterns, natural gas, although a non-renewable energy resource, is more dependable in terms of availability, with abundant reserves and no major disruptions seen in production. Natural gas also scores over coal, another fossil fuel resource and currently the largest energy source globally, as it burns more thoroughly, hence resulting in less air pollution. Technological innovations in natural gas extraction methods and quality of equipment used will only make its production more easy, efficient and dependable over the next few years. Recent spike in natural gas production in the US, thanks to unconventional natural gas resources and innovative horizontal drilling and hydraulic fracturing methods, has only increased its supply and driving down prices for consumers globally and in the process driving steady demand for pipeline transportation services and solutions. The development of liquefied natural gas (LNG) technology has revolutionized the natural gas market by enabling the efficient transport of gas over long distances. Furthermore, improvements in pipeline infrastructure and storage facilities have enhanced the reliability and flexibility of natural gas supply chains. The integration of natural gas with renewable energy sources, through technologies like combined cycle gas turbines and power-to-gas systems, is also gaining traction as a means to balance intermittent renewable power generation and ensure grid stability.

The growth in the natural gas market is driven by several factors. The increasing global demand for cleaner energy sources to mitigate climate change and reduce air pollution is a major driver, as natural gas serves as a bridge fuel in the transition from coal and oil to renewable energy. Economic growth and industrialization, particularly in emerging economies, are fueling the demand for natural gas in power generation, industrial applications, and residential heating. Technological advancements in extraction and transportation are making natural gas more accessible and cost-competitive, encouraging its adoption. Additionally, geopolitical factors and energy security concerns are leading countries to diversify their energy sources and invest in natural gas infrastructure. Government policies and incentives aimed at reducing carbon emissions and promoting energy efficiency are also supporting the expansion of the natural gas market. These factors, combined with ongoing innovations in natural gas technologies, are driving the robust growth of the natural gas market, ensuring its pivotal role in the global energy landscape.

Report Scope

The report analyzes the Natural Gas market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Industrial, Electric Power, Residential, Commercial, Transportation, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

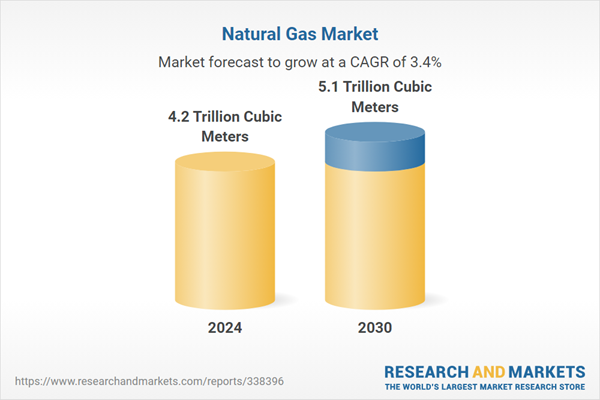

- Market Growth: Understand the significant growth trajectory of the Industrial End-Use segment, which is expected to reach 1.9 Trillion Cubic Meters by 2030 with a CAGR of 3.4%. The Electric Power End-Use segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 947 Billion Cubic Meters in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach 501 Billion Cubic Meters by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Natural Gas Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Natural Gas Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Natural Gas Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BP Plc, Chesapeake Energy Corp., Chevron Corp., China National Petroleum Corporation, Conoco Philips, Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 145 companies featured in this Natural Gas market report include:

- BP Plc

- Chesapeake Energy Corp.

- Chevron Corp.

- China National Petroleum Corporation

- Conoco Philips, Co.

- EQT Corp.

- Equinor ASA

- Exxon Mobil Corp.

- Hess Corp.

- Saudi Arabian Oil Company (Saudi Aramco)

- Shell Plc

- The PJSC Lukoil Oil Company

- TotalEnergies SE

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BP Plc

- Chesapeake Energy Corp.

- Chevron Corp.

- China National Petroleum Corporation

- Conoco Philips, Co.

- EQT Corp.

- Equinor ASA

- Exxon Mobil Corp.

- Hess Corp.

- Saudi Arabian Oil Company (Saudi Aramco)

- Shell Plc

- The PJSC Lukoil Oil Company

- TotalEnergies SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 493 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 4.2 Trillion Cubic Meters |

| Forecasted Market Value by 2030 | 5.1 Trillion Cubic Meters |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |