Global Natural Gas Storage Market - Key Trends & Drivers Summarized

What Is Natural Gas Storage, and Why Is It Essential for Energy Security?

Natural gas storage refers to the process of storing surplus natural gas in large underground or above-ground facilities for later use during periods of high demand or supply disruptions. This storage is a crucial part of the natural gas supply chain, ensuring a reliable and consistent supply of gas to consumers, particularly during peak usage times such as the winter heating season. Storage facilities, typically located in depleted oil and gas reservoirs, salt caverns, or aquifers, allow natural gas producers and suppliers to balance seasonal fluctuations in consumption. Natural gas storage is essential for energy security, grid stability, and price regulation, helping to manage unexpected surges in demand or temporary supply constraints due to geopolitical events or natural disasters.How Does Natural Gas Storage Support Global Energy Systems?

Natural gas storage plays a critical role in supporting global energy systems by ensuring that gas is available when demand spikes or when production levels are lower than expected. The ability to store natural gas enables utility companies and grid operators to mitigate risks related to supply shortages and price volatility. For instance, during extreme weather events or geopolitical tensions that impact natural gas supplies, stored gas can be released to maintain consistent energy flow to consumers. Additionally, natural gas storage facilities provide flexibility in energy markets, allowing suppliers to store gas when prices are low and sell it when demand pushes prices higher. This capability is increasingly vital as natural gas becomes a central component of the global energy transition, serving as a bridge fuel while renewable energy infrastructure scales up.What Are the Key Trends Shaping the Natural Gas Storage Industry?

Several key trends are currently shaping the natural gas storage industry. Technological advancements in storage facility design and management are enhancing the efficiency and safety of storage operations, with smart sensors and automation systems playing a critical role in monitoring gas levels and detecting leaks in real time. The rising demand for liquefied natural gas (LNG) is also impacting storage trends, as more LNG storage facilities are being developed to support the growing international trade of natural gas. Another emerging trend is the development of hydrogen-ready storage facilities, as many regions look to blend hydrogen with natural gas to meet future decarbonization goals. Additionally, the increasing focus on energy security, particularly in Europe and Asia, has led to expanded investment in strategic gas storage reserves to guard against supply disruptions. Lastly, environmental regulations and the push for greener energy solutions are influencing how storage facilities are built and maintained, with operators seeking to reduce methane emissions and improve the environmental footprint of their operations.What Factors Are Driving the Growth of the Natural Gas Storage Market?

The growth in the natural gas storage market is driven by several factors, including rising global demand for natural gas, the increasing need for energy security, and advancements in storage technologies. Natural gas consumption continues to grow across industrial, residential, and power generation sectors, requiring additional storage capacity to manage seasonal and demand-driven fluctuations. The rise of liquefied natural gas (LNG) as a key export commodity has further driven the development of storage infrastructure to handle the increased international trade of natural gas. In regions such as Europe, concerns over energy independence and the geopolitical risks associated with gas imports have led to significant investments in strategic storage reserves. Technological advancements, particularly in automation and leak detection, are also contributing to the expansion of storage capacity by improving the safety and efficiency of operations. Furthermore, as the global energy mix shifts toward lower-carbon solutions, natural gas remains a critical transition fuel, underscoring the importance of storage facilities to support its role in the energy ecosystem.Report Scope

The report analyzes the Natural Gas Storage market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Underground, Above Ground).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe (France; Germany; Italy; UK; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Underground Storage segment, which is expected to reach 390.2 Million TOE by 2030 with a CAGR of 2.8%. The Above Ground Storage segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 147.5 Million TOE in 2024, and China, forecasted to grow at an impressive 3% CAGR to reach 104.6 Million TOE by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Natural Gas Storage Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Natural Gas Storage Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Natural Gas Storage Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cardinal Gas Storage Partners LLC, Centrica Storage Limited, Chiyoda Corporation, Enbridge, Inc., ENGIE SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this Natural Gas Storage market report include:

- Cardinal Gas Storage Partners LLC

- Centrica Storage Limited

- Chiyoda Corporation

- Enbridge, Inc.

- ENGIE SA

- John Wood Group PLC

- Mitsubishi Heavy Industries Ltd.

- NAFTA a.s. (Slovakia)

- Rockpoint Gas Storage

- SNC-Lavalin Group, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cardinal Gas Storage Partners LLC

- Centrica Storage Limited

- Chiyoda Corporation

- Enbridge, Inc.

- ENGIE SA

- John Wood Group PLC

- Mitsubishi Heavy Industries Ltd.

- NAFTA a.s. (Slovakia)

- Rockpoint Gas Storage

- SNC-Lavalin Group, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

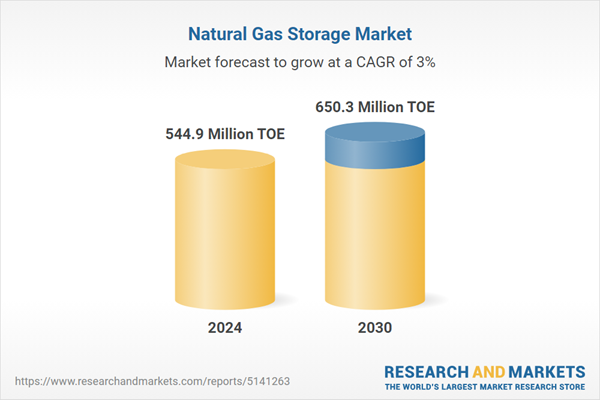

| Estimated Market Value in 2024 | 544.9 Million TOE |

| Forecasted Market Value by 2030 | 650.3 Million TOE |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |