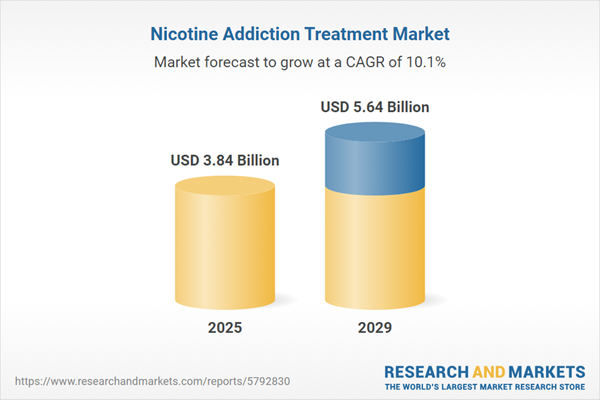

The nicotine addiction treatment market size is expected to see rapid growth in the next few years. It will grow to $5.64 billion in 2029 at a compound annual growth rate (CAGR) of 10.1%. The growth in the forecast period can be attributed to government regulations and policies, clinical research and development, consumer behavior and trends, market competition and industry strategies, healthcare system integration. Major trends in the forecast period include personalized treatment approaches, technology-based interventions, alternative therapies and products, telemedicine and remote support, integration of behavioral support.

The forecast of 10.1% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. smoking cessation programs by increasing the cost of prescription nicotine antagonists and partial agonists sourced from Canada and France, potentially reducing quit-smoking success rates and elevating public health intervention costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing prevalence of tobacco addiction among teenagers is anticipated to drive the growth of the nicotine addiction treatment market in the future. Tobacco addiction, also referred to as nicotine dependency, is characterized by the strong urge to use tobacco products, particularly cigarettes, which contain the highly addictive substance nicotine. Many teenagers begin smoking at a young age due to its anxiety-relieving and mood-enhancing effects, often linked to feelings of depression. This rise in tobacco addiction creates a substantial demand for treatments targeting nicotine dependency. For example, in October 2024, the Centers for Disease Control and Prevention (CDC), a US-based public health agency, reported that in 2024, 1 out of every 29 middle school students (3.5%) indicated they had used electronic cigarettes within the past 30 days. Consequently, the growing prevalence of tobacco addiction among teenagers is a key factor driving the expansion of the nicotine addiction treatment market.

The growth of the nicotine addiction treatment market is expected to be boosted by rising government initiatives aimed at promoting smoking cessation. These initiatives encompass policies, programs, and financial support that encourage individuals to discontinue smoking habits. Efforts include awareness campaigns, policy adjustments, and funding for smoking cessation programs, contributing to a larger population seeking support and treatment for nicotine addiction. In October 2023, the UK's Department of Health and Social Care unveiled the strategic document Stopping the Start, A New Plan to Create a Smoke-Free Generation, outlining measures to curb youth vaping, restrict disposable vape sales, and allocate funds for smoking cessation initiatives. With a commitment to establishing a smoke-free generation, the government's financial support includes £70 million ($95.2 million) annually for local authority-led stop smoking services and £45 million ($61.2 million) over two years for the nationwide 'Swap to Stop' program, providing free vape kits and behavioral support for smoking cessation. Therefore, the increasing government initiatives to encourage smoking cessation are expected to drive the growth of the nicotine addiction treatment market.

Innovative solutions have emerged as a prominent trend in the nicotine addiction treatment market, with major companies focusing on launching inventive products to maintain their market position. For example, in February 2022, the World Health Organization introduced the 'Quit Tobacco App,' the first app targeting all tobacco products to assist users in quitting by identifying triggers, setting goals, controlling cravings, and maintaining focus. Innovative approaches, such as this app, play a crucial role in helping individuals overcome tobacco addiction, acknowledging the difficulty of quitting for various reasons.

Leading companies in the nicotine addiction treatment market are focusing on the implementation of combination therapy to enhance treatment effectiveness, mitigate withdrawal symptoms, and improve the likelihood of achieving long-term smoking cessation. This approach integrates pharmacological interventions with behavioral therapies, acknowledging that a multi-faceted strategy is more effective than relying solely on one method. Research shows that pairing medications with behavioral support significantly boosts the chances of successful cessation compared to treatments used in isolation. For example, in June 2024, the Royal Australian College of General Practitioners (RACGP), an Australian institution, launched an advanced treatment option known as Combination Therapy. This therapy emphasizes cognitive behavioral therapy (CBT) and other psychological techniques to help individuals recognize triggers and build coping strategies. This element is vital as it provides patients with practical skills to manage cravings and prevent relapse. The treatment may include FDA-approved medications such as nicotine replacement therapies (NRT), varenicline (Chantix), and bupropion (Zyban). These medications help alleviate withdrawal symptoms and cravings, enabling individuals to concentrate on making behavioral changes.

In June 2024, Dr. Reddy's Laboratories, an India-based company specializing in nicotine addiction treatment, acquired the Nicotinell portfolio from Haleon plc for $544.4 million. This acquisition allows Dr. Reddy's to enhance its portfolio by leveraging Haleon's expertise in providing nicotine addiction treatment solutions. Haleon plc is a UK-based firm known for its offerings in the nicotine addiction treatment market.

Major companies operating in the nicotine addiction treatment market include Cipla Limited, Pfizer Inc., Glenmark Pharmaceuticals Limited, Johnson & Johnson Private Limited, Japan Tobacco Inc., British American Tobacco PLC, Imperial Brands PLC, GlaxoSmithKline plc, Perrigo Company PLC, NJOY LLC, Takeda Pharmaceutical Company Limited, Dr. Reddy's Laboratories Limited, Cerecor Inc., Embera NeuroTherapeutics Inc., Hager Biosciences LLC, RTI International, Novartis International AG, Sanofi S.A., Sandoz International GmbH, Boehringer Ingelheim International GmbH, Alkermes plc, Teva Pharmaceutical Industries Ltd.

North America was the largest region in the nicotine addiction treatment market in 2024. The regions covered in the nicotine addiction treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the nicotine addiction treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The nicotine addiction treatment market research report is one of a series of new reports that provides nicotine addiction treatment market statistics, including nicotine addiction treatment industry global market size, regional shares, competitors with a nicotine addiction treatment market share, detailed nicotine addiction treatment market segments, market trends and opportunities, and any further data you may need to thrive in the nicotine addiction treatment industry. This nicotine addiction treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Nicotine addiction treatment, also referred to as nicotine dependence treatment, is a process designed to aid individuals in quitting smoking by alleviating nicotine cravings and managing withdrawal symptoms.

The primary types of nicotine addiction treatment include pharmacological interventions, various therapeutic approaches, and other types of interventions. Pharmacology is a branch of medicine that studies the effects of drugs, including their characteristics, uses, and impact on the systems and functions of living organisms. Nicotine addiction treatment medications are typically distributed through various channels, including hospital pharmacies, retail pharmacies, and online pharmacies. These treatments are utilized by individuals across different age groups, such as Generation Z, millennials, Generation X, and the silent generation.

The nicotine addiction treatment market consists of revenues earned by entities by providing counselling, support groups, behavioral therapy and medication. Establishments such as hospitals, health care clinics and health care providers that provide nicotine replacement medications and residential treatment programs are included in this market. The nicotine addiction treatment market also includes sales of gums, and drugs that are used in providing nicotine addiction treatment. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Nicotine Addiction Treatment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on nicotine addiction treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for nicotine addiction treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The nicotine addiction treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Pharmacological; Therapies; Other Types2) By Distribution Channel: Hospital Pharmacy; Retail Pharmacy; Online Pharmacy

3) By End-User: Generation Z; Millennials; Generation X; Silent Generation

Subsegments:

1) By Pharmacological: Nicotine Replacement Therapies (NRTs); Prescription Medications2) By Therapies: Behavioral Therapy; Cognitive Behavioral Therapy (CBT); Group Therapy; Hypnotherapy

3) By Other Types: Mobile Applications; Support Groups; Online Counseling Services

Companies Mentioned: Cipla Limited; Pfizer Inc.; Glenmark Pharmaceuticals Limited; Johnson & Johnson Private Limited; Japan Tobacco Inc.; British American Tobacco PLC; Imperial Brands PLC; GlaxoSmithKline plc; Perrigo Company PLC; NJOY LLC; Takeda Pharmaceutical Company Limited; Dr. Reddy's Laboratories Limited; Cerecor Inc.; Embera NeuroTherapeutics Inc.; Hager Biosciences LLC; RTI International; Novartis International AG; Sanofi S.A.; Sandoz International GmbH; Boehringer Ingelheim International GmbH; Alkermes plc; Teva Pharmaceutical Industries Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Nicotine Addiction Treatment market report include:- Cipla Limited

- Pfizer Inc.

- Glenmark Pharmaceuticals Limited

- Johnson & Johnson Private Limited

- Japan Tobacco Inc.

- British American Tobacco PLC

- Imperial Brands PLC

- GlaxoSmithKline plc

- Perrigo Company PLC

- NJOY LLC

- Takeda Pharmaceutical Company Limited

- Dr. Reddy's Laboratories Limited

- Cerecor Inc.

- Embera NeuroTherapeutics Inc.

- Hager Biosciences LLC

- RTI International

- Novartis International AG

- Sanofi S.A.

- Sandoz International GmbH

- Boehringer Ingelheim International GmbH

- Alkermes plc

- Teva Pharmaceutical Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.84 Billion |

| Forecasted Market Value ( USD | $ 5.64 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |