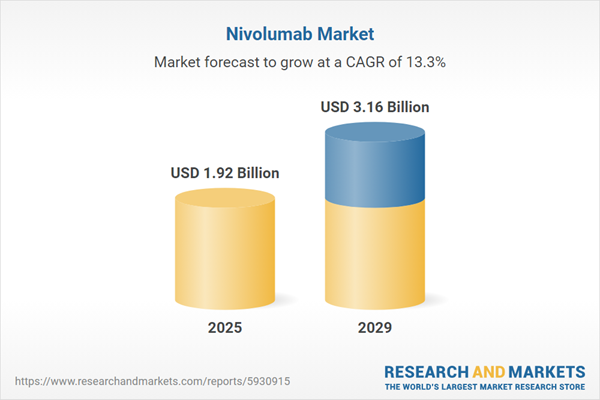

The nivolumab market size is expected to see rapid growth in the next few years. It will grow to $3.16 billion in 2029 at a compound annual growth rate (CAGR) of 13.3%. The growth in the forecast period can be attributed to personalized medicine, emerging indications, global access to cancer care, advancements in combination therapies. Major trends in the forecast period include biomarker-driven treatment, neoantigen vaccines, enhanced immunotherapy regimens, long-term follow-up studies.

The forecast of 13.3% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions are likely to impact U.S. immunotherapy programs by inflating prices of programmed cell death protein 1 checkpoint inhibitors manufactured in Japan and Switzerland, resulting in delayed cancer treatment initiations and higher immuno-oncology care costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing prevalence of cancer is expected to drive the growth of the nivolumab market in the future. Cancer is a group of diseases that can occur in nearly any organ or tissue in the body when abnormal cells grow uncontrollably, break through normal boundaries, and either spread to other organs or invade surrounding tissues. Nivolumab is used to treat various types of cancer by preventing cancer cells from suppressing the immune system, allowing the immune system to attack and destroy the cancer cells. For example, in July 2024, the Australian Institute of Health and Welfare, an Australian government agency focused on providing health and welfare data and analysis, reported that the number of cancer cases diagnosed in Australia increased from 156,781 in 2021 to 160,570 in 2022, marking an increase of 3,789 cases over the one-year period. As a result, the rising prevalence of cancer is fueling the growth of the nivolumab market.

The increasing incidence of non-small cell lung cancer (NSCLC) is poised to be a prominent driver for the Nivolumab market's growth in the foreseeable future. NSCLC, a prevalent form of lung cancer originating in the epithelial cells of the lungs, is a major area of focus for Nivolumab. The drug has garnered approval for the treatment of advanced non-small cell lung cancer (NSCLC) owing to its proven efficacy in addressing this specific condition. Notably, data from the American Society of Clinical Oncology reveals that an estimated 238,340 individuals (comprising 117,550 men and 120,790 women) are anticipated to receive a lung cancer diagnosis in the United States in March 2023. Among these cases, NSCLC is the predominant subtype, representing approximately 81% of all lung cancer diagnoses. Consequently, the increased incidence of non-small cell lung cancer (NSCLC) stands as a formidable growth driver for the Nivolumab market.

Prominent companies operating within the Nivolumab market are placing a significant emphasis on the development of innovative drugs aimed at enhancing patient care and sustaining their market positions. The creation of novel drugs holds the potential to improve treatment outcomes for patients grappling with various medical conditions. As an illustration, in May 2022, Bristol-Myers Squibb Co., a US-based pharmaceutical company primarily dedicated to therapeutic endeavors encompassing cancer, cardiovascular health, immunology, and fibrotic conditions, disclosed the FDA's approval of two Nivolumab-based regimens. These regimens included Nivolumab in combination with fluoropyrimidine and platinum-containing chemotherapy and Nivolumab paired with Yervoy (ipilimumab), for the first-line treatment of adult patients dealing with unresectable advanced or metastatic esophageal squamous cell carcinoma (ESCC), regardless of PD-L1 status.

In November 2022, Lyvgen Biopharma Co. Ltd., a China-based biotechnology firm specializing in cancer treatment, entered into a collaborative partnership with Bristol-Myers Squibb Co. The collaboration's focal point is the assessment of LVGN7409 in conjunction with Nivolumab, targeting patients with non-small cell lung cancer. This combination therapy concurrently addresses the co-stimulatory checkpoint CD40 and the co-inhibitory checkpoint PD-1. This multifaceted approach is envisioned to enhance the effectiveness of immunotherapy for patients confronting diseases that exhibit resistance or refractoriness. Bristol-Myers Squibb Co. is a US-based pharmaceutical company with a primary focus on therapeutic domains spanning cancer, cardiovascular health, immunology, and fibrotic disorders, inclusive of pioneering developments in Nivolumab.

Major companies operating in the nivolumab market are Pfizer Inc., Johnson & Johnson Services Inc., F. Hoffmann-La Roche Ltd., Merck & Co. Inc., AbbVie Inc., Novartis AG, Sanofi S.A., Bristol-Myers Squibb Company, AstraZeneca PLC, GlaxoSmithKline PLC, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Amgen Inc., Regeneron Pharmaceuticals Inc., Astellas Pharma Inc., Chugai Pharmaceutical Co. Ltd., Daiichi Sankyo Company Limited, Eisai Co. Ltd., Ono Pharmaceutical Co. Ltd., Kyowa Kirin Co. Ltd., Nippon Kayaku Co. Ltd., Luye Pharma AG, Genentech Inc., Taiho Pharmaceutical Co. Ltd., SymBio Pharmaceuticals Ltd., Xbrane Biopharma AB, NeuClone Therapeutics Inc.

North America was the largest region in the nivolumab market in 2024. The regions covered in nivolumab report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the nivolumab market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The nivolumab market research report is one of a series of new reports that provides nivolumab market statistics, including nivolumab industry global market size, regional shares, competitors with a nivolumab market share, detailed nivolumab market segments, market trends and opportunities and any further data you may need to thrive in the nivolumab industry. This nivolumab market research report delivers a complete perspective on everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Nivolumab is an immunoglobulin G4 (IgG4) fully human antibody that targets programmed cell death protein 1 (PD1). It is approved at a dosage of 3 mg/kg for the treatment of metastatic or unresectable melanoma, metastatic non-small cell lung cancer following platinum-based chemotherapy, and metastatic renal cell carcinoma in the second-line setting. Nivolumab is a targeted therapy medication employed in the management and treatment of various types of cancer, and it operates by enhancing the immune system's response to cancer cells.

Nivolumab is available in two main formulations such as an injection of 4 mL and an injection of 10 mL. The 40 mg/4 mL (10 mg/mL) solution of nivolumab is provided in single-use vials. This formulation is utilized in the treatment of melanoma, non-small cell lung cancer (NSCLC), and Hodgkin lymphoma. It is administered via intravenous and other routes for the treatment of conditions such as melanoma, NSCLC, malignant pleural mesothelioma, classical Hodgkin lymphoma (CHL), squamous cell carcinoma of the head and neck (SCCHN), renal cell carcinoma (RCC), and other cancer types. Nivolumab is used in clinical settings, hospitals, and other healthcare facilities for cancer treatment.

The nivolumab market consists of sales of opdivo, nivolumab injection, generic Nivolumab. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Nivolumab Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on nivolumab market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for nivolumab? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The nivolumab market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Injection 4mL; Injection 10mL2) By Route of Administration: Intravenous; Other Routes of Administration

3) By Application: Melanoma; Non-small Cell Lung Cancer (NSCLC); Malignant Pleural Mesothelioma; Classical Hodgkin Lymphoma (CHL); Squamous Cell Carcinoma of The Head and Neck (SCCHN); Renal Cell Carcinoma (RCC); Other Applications

4) By End-User: Clinic; Hospital; Other End-Users

Subsegments:

1) By Injection 4mL: Single-Dose Vial; Multi-Dose Vial2) By Injection 10mL: Single-Dose Vial; Multi-Dose Vial

Companies Mentioned: Pfizer Inc.; Johnson & Johnson Services Inc.; F. Hoffmann-La Roche Ltd.; Merck & Co. Inc.; AbbVie Inc.; Novartis AG; Sanofi S.A.; Bristol-Myers Squibb Company; AstraZeneca plc; GlaxoSmithKline plc; Takeda Pharmaceutical Company Limited; Eli Lilly and Company; Amgen Inc.; Regeneron Pharmaceuticals Inc.; Astellas Pharma Inc.; Chugai Pharmaceutical Co. Ltd.; Daiichi Sankyo Company Limited; Eisai Co. Ltd.; Ono Pharmaceutical Co. Ltd.; Kyowa Kirin Co. Ltd.; Nippon Kayaku Co. Ltd.; Luye Pharma AG; Genentech Inc.; Taiho Pharmaceutical Co. Ltd.; SymBio Pharmaceuticals Ltd.; Xbrane Biopharma AB; NeuClone Therapeutics Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Nivolumab market report include:- Pfizer Inc.

- Johnson & Johnson Services Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co. Inc.

- AbbVie Inc.

- Novartis AG

- Sanofi S.A.

- Bristol-Myers Squibb Company

- AstraZeneca plc

- GlaxoSmithKline plc

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Amgen Inc.

- Regeneron Pharmaceuticals Inc.

- Astellas Pharma Inc.

- Chugai Pharmaceutical Co. Ltd.

- Daiichi Sankyo Company Limited

- Eisai Co. Ltd.

- Ono Pharmaceutical Co. Ltd.

- Kyowa Kirin Co. Ltd.

- Nippon Kayaku Co. Ltd.

- Luye Pharma AG

- Genentech Inc.

- Taiho Pharmaceutical Co. Ltd.

- SymBio Pharmaceuticals Ltd.

- Xbrane Biopharma AB

- NeuClone Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.92 Billion |

| Forecasted Market Value ( USD | $ 3.16 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |