In addition, the prevailing trend of remodeling houses in the region since the spread of the COVID-19 pandemic is further expected to drive demand for non-structural stainless steel fasteners in the coming years. This, in turn, is anticipated to lead to the growth of the market in North America during the forecast period.

The use of stainless steel is prevalent in most fasteners due to its durable mechanical characteristics. Stainless steel fasteners are specifically employed in situations where the key criteria include superior tensile strength, resistance to high temperatures, and protection against corrosion. These factors are expected to drive the expansion of the non-structural stainless-steel fastener industry in North America.

The North America non-structural stainless steel industry is characterized by the presence of several large and small players, with established players leading in market developments. The market exhibits high competition owing to vast distribution networks and diverse product portfolios. To retain their positions in the market, major manufacturers in North America are concentrating on geographical expansion, new developments, and mergers & acquisitions to gain a competitive advantage.

Manufacturers of non-structural stainless steel fasteners in North America use online and offline sales channels to sell their products. Online sales channels enable users to purchase directly from manufacturers or third-party online distributors, while offline sales channels sell the fasteners through physical stores, which involves a middleman that directly impacts the prices of the fasteners.

North America Non-structural Stainless Steel Fasteners Market Report Highlights

- The decking segment is estimated to grow at the fastest CAGR of 5.3% over the forecast period, due to the prevailing trend of expanding and renovating living spaces in the U.S. and Canada since the COVID-19 pandemic. The high-income population is using garden areas or backyards to extend building structures into trendy dining areas, cooking spaces, and entertainment and relaxation areas, leading to a demand for non-structural stainless steel fasteners for connecting wood-to-wood products

- The construction industry in North American countries, including the U.S. and Canada, is likely to register high growth in the coming years. In North America, a significant portion of demand for non-structural construction is anticipated to be driven by the residential construction segment. The rising GDP, coupled with the growing trend of single-family houses, in the above-mentioned countries, is expected to propel construction activities in the region, thus positively influencing the demand for non-structural stainless steel fasteners

- The U.S. non-structural stainless steel fasteners market dominated with USD 224.5 million in 2022. Wood-framed construction dominates the frame construction segment in the U.S. The surged demand for wood-framed construction can be attributed to the easy availability of wood at prices lower than cement, along with the ease of construction offered by wooden houses and the low taxes associated with them. With the rise in the construction of wooden houses, the demand for non-structural stainless steel fasteners is expected to surge significantly in the U.S. This is anticipated to positively impact the growth of the non-structural stainless steel fasteners market in the country in the coming years

- Manufacturers of non-structural stainless steel fasteners such as bolts, screws, nuts, studs, and rivets require significant capital investments owing to their high production volumes and stringent specifications concerning their testing and labeling. These fasteners are manufactured and distributed by different players. Companies invest significantly in research and development activities for manufacturing stainless steel fasteners used in different applications, thereby resulting in dynamic market conditions.

- The North America non-structural stainless steel fasteners industry is moderately competitive due to the presence of small and medium-scale manufacturers. Major players are adopting strategies such as new product launches and mergers & acquisitions to gain a competitive advantage and maintain their positions. Additionally, prominent players are involved in strategic tie-ups with distributors and retailers to increase their geographical reach

Table of Contents

Companies Mentioned

- Associated Fastening Products, Inc.

- Simpson Strong-Tie Company, Inc

- Maze Nails

- FastenMaster

- Starborn Industries, Inc.

- KD FASTENERS, INC.

- KUIKEN BROTHERS

- Camo Fasteners

- Eagle Claw Fasteners

- The Hillman Group, Inc.

- Star Stainless Steel

- STANLEY BLACK & DECKER, INC.(Bostitch)

- Ford Fasteners

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 54 |

| Published | June 2023 |

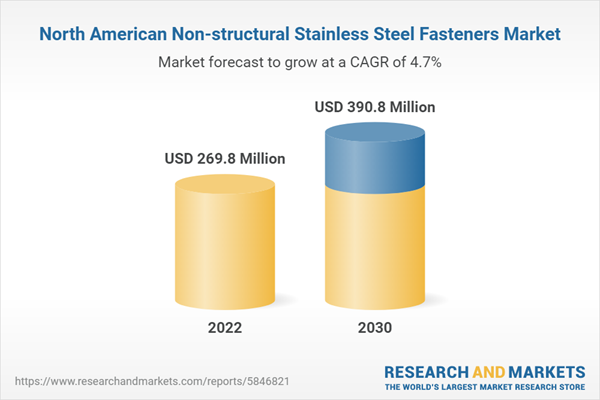

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 269.8 Million |

| Forecasted Market Value ( USD | $ 390.8 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | North America |

| No. of Companies Mentioned | 13 |