Increasing Air Travel Fuels North America Aircraft MRO Market

Airlines are maximizing the utilization of their aircraft to meet the growing passenger demand. This means that aircraft spend more time in the air and require more frequent maintenance checks to ensure their airworthiness. As more people choose air travel, airlines are operating more flights with shorter turnaround times between departures. This increased flight frequency places greater demands on aircraft maintenance to ensure safe and reliable operations.According to the Airports Council International (ACI) World's Industry Outlook for 2023-2024, as global passenger traffic recovers, 2024 is predicted to represent a turning point, with 9.4 billion passengers traveling worldwide, up from 9.2 billion in 2019 (102.5% of 2019 levels). With 2.0 billion passengers or 99.8% of the 2019 level, the North American region is predicted to approach the 2019 level by the end of 2023. Despite a robust rebound in 2021 and 2022, primarily due to domestic travel, the region's growth is anticipated to surge in the upcoming years. It is projected that passenger traffic in the region will reach 2.1 billion in 2024, which is 103.7% of the level in 2019. As air travel continues to rise, MRO providers play a crucial role in meeting the maintenance demands of airlines, contributing to the growth of the Aircraft MRO market.

North America Aircraft MRO Market Overview

The air passenger traffic is increasing at a constant pace, which has forced the airlines to increase their flight movements and introduce new aircraft. Aircraft MRO activities are essential in keeping up component availability, consistency, and quality. Airline operators depend on MRO services to ensure the safety of the aircraft and enhance fuel efficiency. The MRO market has become a viable business in the aviation industry since original equipment manufacturers (OEMs) mainly focus on the development of aircraft.Maintenance, repair, and overhaul (MRO) is a complex process in the aviation industry that has stringent and specific criteria specified by airworthiness authorities to decide whether an aircraft is airworthy. Airlines in the area spend billions of dollars per year to meet such specifications, which account for a significant portion of their overall operating costs. The aircraft MRO market in North America is expected to be driven by a rise in air passenger traffic; the need to improve operability and performance; and the need for disassembling, replacing, testing, and repairing many sections of aircraft. The region had primed its contribution to the global aviation industry.

Nonetheless, the North America aviation industry would continue to generate relatively higher profits from the US owing to the continuity of air travel. Because of the existence of many aircraft OEMs in the US, the country is the world's largest aircraft manufacturer. With the launch and purchase of new aircraft, several contracts and agreements are routinely signed between aircraft MRO service providers and airlines, defense agencies, and others. Thus, the aforementioned factors are propelling a significant demand in North America.

According to the publisher analysis, in 2023, North America had a fleet of more than 8,000 operational commercial aircraft, which is expected to reach ~10,000 by the end of 2033. Such a huge number of operating commercial aircraft will further generate the demand for MRO services in the region.

Moreover, the increase in the number of aircraft fleets across North America is expected to bolster the requirement of MRO for major aircraft components such as engines and airframes.

Besides this, one of the factors catalyzing the aircraft MRO market is the continued emphasis on rising spending on maintenance and repair activities of various components. Furthermore, MRO service providers in the region continually focus on creative integrated technologies, such as digital MRO technology, which enables service providers to carry out MRO activities more effectively and efficiently. As a result, digital MRO technology is expected to create lucrative opportunities for aircraft MRO service providers.

Various North American behemoths are engaged in offering MRO services to gain momentum in the industry. GE Aviation, Barnes Group Inc., Rolls Royce PLC, Delta TechOps, and Collins Aerospace are among the leading players in this industry. Several international MRO service providers are also present in the region. Southwest Airlines and United Airlines are preparing to open new aircraft hangars for their MRO operations in Houston and Los Angeles, respectively. Furthermore, airlines in the region are engaging in MRO outsourcing activities to cut costs associated with MRO activities.

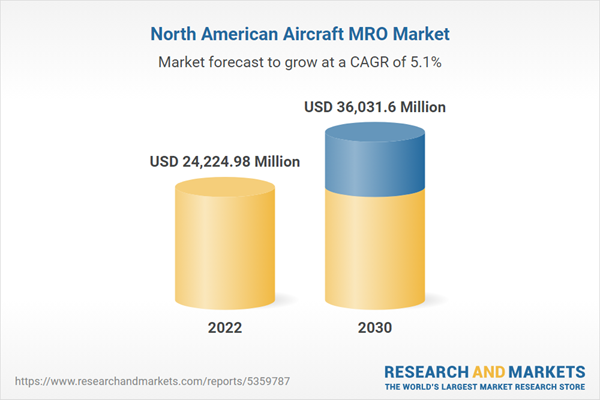

North America Aircraft MRO Market Revenue and Forecast to 2030 (US$ Million)

North America Aircraft MRO Market Segmentation

The North America aircraft MRO market is categorized into components, aircraft type, end users, and country.Based on components, the North America aircraft MRO market is segmented into engine MRO, avionics MRO, airframe MRO, cabin MRO, landing gear MRO, and others. The engine MRO segment held the largest market share in 2022.

In terms of aircraft type, the North America aircraft MRO market is bifurcated into fixed wing aircraft and rotary wing aircraft. The fixed wing aircraft segment held a larger market share in 2022.

By end users, the North America aircraft MRO market is bifurcated into commercial and military. The commercial segment held a larger market share in 2022.

By country, the North America aircraft MRO market is segmented into the US, Canada, and Mexico. The US dominated the North America aircraft MRO market share in 2022.

AAR CORP; Barnes Group Inc; Collins Aerospace; Delta TechOps; FLTechnics, UAB; GE Aviation; Lufthansa Technik; Rolls-Royce plc; Singapore Technologies Engineering Ltd; and Turkish Technic Inc are among the leading companies operating in the North America aircraft MRO market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America aircraft MRO market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America aircraft MRO market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America aircraft MRO market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- AAR CORP

- Barnes Group Inc

- Collins Aerospace

- Delta TechOps

- FLTechnics, UAB.

- GE Aviation

- Lufthansa Technik

- Rolls-Royce Holdings Plc

- Singapore Technologies Engineering Ltd

- Turkish Technic Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 24224.98 Million |

| Forecasted Market Value ( USD | $ 36031.6 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |