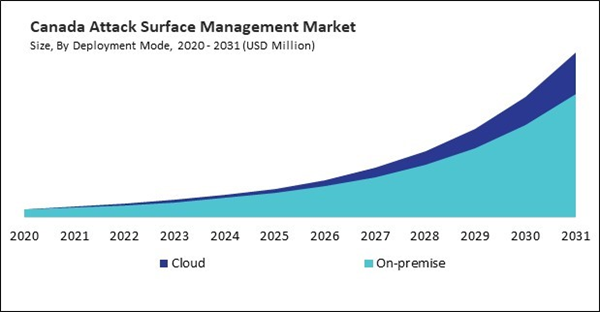

The US market dominated the North America Attack Surface Management Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,526.1 million by 2031. The Canada market is exhibiting a CAGR of 31.9% during (2024 - 2031). Additionally, The Mexico market would experience a CAGR of 30.7% during (2024 - 2031).

The applications of attack surface management span a wide range of use cases and industries, reflecting the diverse challenges and requirements of organizations seeking to manage and secure their digital infrastructure effectively. Solutions for managing the attack surface allow businesses to locate, rank, and fix vulnerabilities throughout their whole attack surface. Organizations can proactively address security weaknesses and reduce their exposure to cyber threats by conducting continuous asset discovery, vulnerability scanning, and risk assessment.

Attack surface management solutions provide organizations with real-time threat intelligence and monitoring capabilities to detect and respond to emerging threats and security incidents. By integrating with threat intelligence feeds, security information and event management (SIEM) systems, and other security tools, organizations can identify malicious activity, abnormal behavior, and potential indicators of compromise across their attack surface.

Moreover, effective attack surface management in the Mexican banking sector involves comprehensive strategies such as vulnerability assessments, penetration testing, and continuous monitoring of network infrastructure. It also requires collaboration between banks, regulators, and cybersecurity experts to avoid emerging threats and ensure the security of financial systems and customer data. As per the data from the International Trade Administration, the International Trade Administration, with over 650 fintechs, Mexico is currently the largest fintech industry in Latin America after Brazil and Colombia. Electronic money services, virtual assets, application programming interfaces (APIs), crowdfunding and peer-to-peer (P2P) lending, open banking, and electronic money services are all governed by the Fintech legislation in Mexico. Thus, the rising banking sector in North America will assist in the expansion of the regional market.

Based on Deployment Mode, the market is segmented into Cloud, and On-premise. Based on Component, the market is segmented into Solution, and Services. Based on Enterprise Size, the market is segmented into Large Enterprise, and mall & Medium Enterprise. Based on Vertical, the market is segmented into BFSI, Healthcare, Government & Defense, IT & ITeS, Energy & Utilities, Retail & E-Commerce, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Palo Alto Networks, Inc.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Google LLC (Alphabet Inc.)

- Trend Micro, Inc.

- Qualys, Inc.

- Tenable Holdings, Inc.

- Crowdstrike Holdings, Inc.

- BitSight Technologies, Inc.

Market Report Segmentation

By Deployment Mode- Cloud

- On-premise

- Solution

- Services

- Large Enterprise

- Small & Medium Enterprise

- BFSI

- Healthcare

- Government & Defense

- IT & ITeS

- Energy & Utilities

- Retail & E-Commerce

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Palo Alto Networks, Inc.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Google LLC (Alphabet Inc.)

- Trend Micro, Inc.

- Qualys, Inc.

- Tenable Holdings, Inc.

- Crowdstrike Holdings, Inc.

- BitSight Technologies, Inc.