Increasing Automation in Manufacturing Sector Fuels North America Automated Test Equipment Market

The evolution of electronic and semiconductor technologies is paving the way for automation in the manufacturing sector. In recent years, automation has been highly adopted in the manufacturing sector for transforming manufacturing employment, factory floor operations, and the overall dynamics of the manufacturing sector. The growing adoption of several advanced technologies, such as artificial intelligence, robotics, and machine learning, allows machines to match or outpace humans in manufacturing activities, such as the cognitive activities that are required at various levels of manufacturing.Automation in the manufacturing processes increases productivity by up to more than 40% and removes 45% of repetitive work while integrated on the lean assembly line. Further, the evolution of Industry 4.0 is another trend driving the manufacturing sector. According to the GSM Association, the industry 4.0 trend is expected to grow at 46% during 2023-2025, associated with the rapid deployment of advanced technologies, which is driving the market. The evolution of Industry 4.0 or the Industrial Internet of Things (IIoT) that would utilize automated guided vehicles and the powers of collaborative robots is further boosting productivity in the manufacturing sector.

Semiconductor fabrications are increasing the adoption of automation in the manufacturing sector worldwide. The growing use of the Internet among customers is transforming and automating the entire value chain, from software to service to semiconductor devices. The emergence of IoT across the globe increases its adoption in the semiconductor industry. The industry is expected to play a crucial role in driving the North America automated test equipment market.

IoT-connected products, devices, and applications need ultra-small chips, wireless connectivity options, and low power consumption. The growing adoption of numerous IoT sensor-based products such as smart glasses, smartphones, and smartwatches is creating demand for MEMS/NEMS sensor platforms that have power advantages with lower technology nodes. These platforms increase functionality on a single small form-factor die.

The manufacturing sector is witnessing error-free and streamlined procedures using Robotic Process Automation (RPA). Manufacturing companies are replacing the production units from human sources with industry robots for the products to assemble, quality checks, and packaging to be done. The integration of RPA into the manufacturing sector for automatic activities such as preparing bills of materials, data migration, administration and reporting, ERP automation, logistics data automation, customer support, and service desk, and Web-integrated RPA is fueling the automated test equipment market growth.

Manufacturing facilities have been incorporating greater levels of automation, owing to which the demand for new technologies is growing rapidly. Consumer electronics, automobiles, healthcare, and defense industries are the most prominent industry verticals that have become productive by integrating automation into the manufacturing assembly lines to streamline operations. These industries are anticipated to drive the demand for automatic test equipment as it results in lesser and quicker inspection of the semiconductor devices used for automation.

North America Automated Test Equipment Market Overview

The manufacturing industry plays a vital role in the growth of the North American economy. The US, Canada, and Mexico are the prime countries in the region. The availability of efficient infrastructure in developed countries (the US and Canada) enables manufacturing companies to explore the limits of science, technology, and commerce. According to the National Association of Manufacturers (NAM), the US has the second-largest manufacturing industry in the world, which accounted for ~US$ 2.9 trillion as of September 2023.As per a survey by Spex Precision Machine Technologies Inc., the manufacturing industry accounts for 11% of the US economy as of 2023. Moreover, this industry is expected to grow rapidly in the coming years owing to increased productivity due to the availability of modern technologies and decreasing gas prices. Rising labor costs in emerging markets and better protection available for intellectual properties are other important factors benefiting the manufacturing businesses in the US. The manufacturing industry dynamics in North America, specifically in the US, have been the most influential trends globally over the past few years. A few of the major manufacturing industries in North America include aerospace, automotive, telecommunications, and electronics. Thus, the well-established manufacturing industry generates a high demand for automated test equipment in the region.

The manufacturing industry in Canada is becoming more profitable with the rising demand for coal, metal, and oil products among consumers. The country is experiencing a declining dollar value and availability of cheaper power, which benefits manufacturing businesses. In Mexico, the manufacturing industry is noticing significant growth due to efforts made by governments to attract foreign direct investments (FDIs). Furthermore, the country's proximity to the US and ability to achieve cost-competitiveness due to NAFTA benefit this industry.

The automotive industry in Mexico is experiencing a paradigm shift, with many huge automobile companies constructing their plants in the country. A few of the companies that recently opened their plants in the country include Kia Motors, Mercedes-Benz, Nissan, Audi, General Motors, and others. Axium Packaging Inc. and Ford are also planning to construct their new plants in the country and start operations by 2026.

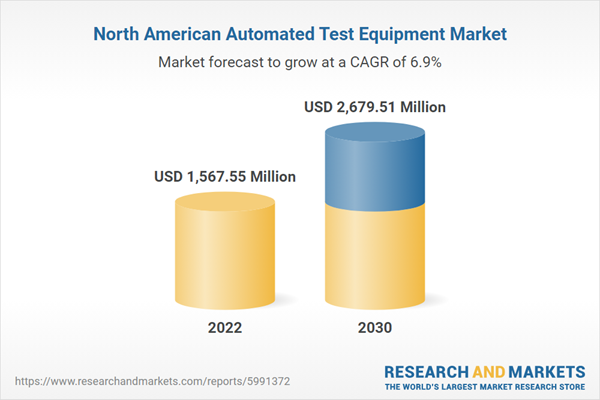

North America Automated Test Equipment Market Revenue and Forecast to 2030 (US$ Million)

North America Automated Test Equipment Market Segmentation

The North America automated test equipment market is categorized into type, component, end user, and country.Based on type, the North America automated test equipment market is categorized into integrated circuits (ICs) testing, printed circuit boards (PCBs) testing, hard disk drives (HDDs) testing, and others. The integrated circuits (ICs) testing segment held the largest market share in 2022.

In terms of component, the North America automated test equipment market is segmented into industrial PCs, mass interconnect, and handler/prober. The industrial PCs segment held the largest market share in 2022.

By end user, the North America automated test equipment market is categorized into consumer electronics, automotive, medical, aerospace & defense, IT & telecommunication, and other industries. The consumer electronics segment held the largest market share in 2022.

By country, the North America automated test equipment market is segmented into the US, Canada, and Mexico. The US dominated the North America automated test equipment market share in 2022.

Advantest Corp; Anritsu Corp; Astronics Corporation; Averna Technologies Inc; Chroma ATE Inc.; National Instruments Corp; SPEA S.p.A; Teradyne Inc; and Test Research, Inc. are among the leading companies operating in the North America automated test equipment market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America automated test equipment market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America automated test equipment market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America automated test equipment market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Advantest Corp

- Anritsu Corp

- Astronics Corporation

- Averna Technologies Inc

- Chroma ATE Inc.

- National Instruments Corp

- SPEA S.p.A.

- Teradyne Inc

- Test Research, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 97 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1567.55 Million |

| Forecasted Market Value ( USD | $ 2679.51 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |