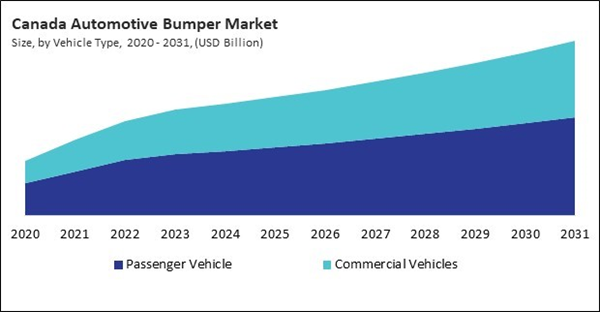

The US market dominated the North America Automotive Bumper Market by Country in 2023, and is forecast to continue being a dominant market till 2031; thereby, achieving a market value of $3.73 billion by 2031. The Canada market is exhibiting a CAGR of 6.6% during (2024 - 2031). Additionally, The Mexico market is projected to experience a CAGR of 5.7% during (2024 - 2031).

The market is a critical segment of the broader automotive industry, encompassing the design, manufacture, distribution, and sale of bumpers that serve aesthetic and functional purposes in vehicles. Bumpers are essential components that protect in the event of collisions, absorbing impact and minimizing damage to the vehicle's body and, more importantly, safeguarding passengers. Over the years, the market for automotive bumpers has evolved significantly, driven by advancements in materials, manufacturing technologies, design innovations, and changes in regulatory standards and consumer preferences. Understanding the automotive bumper market dynamics requires an in-depth look at its history, current trends, challenges, and prospects.

In the contemporary automotive sector, bumpers are far more than protective components. They are integral to a vehicle's design, contributing to its aerodynamic performance, aesthetic appeal, and brand identity. Modern bumpers are typically composed of a combination of materials, including high-strength plastics, composites, and metals, which provide an optimal balance of strength, durability, and weight. The use of advanced polymers and composites, in particular, has revolutionized bumper manufacturing, enabling the production of lighter yet stronger bumpers that improve fuel efficiency and vehicle performance.

The Mexican Automotive Industry Association (AMIA) highlights that Mexico is one of the world's top auto parts producers and exporters, with the U.S. being a major market for these exports. According to the International Trade Administration (ITA), Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually. 88% of vehicles produced in Mexico are exported. The production of EVs and hybrids totaled 51,065 units in 2022, representing a growth of 8.5 percent compared to 2021. The production involves not just complete vehicles but also parts like bumpers.

Furthermore, the vast network of free trade agreements that permit the export of automobile components, such as bumpers, to a number of nations is a factor that makes a contribution to the demand in Mexico. This export capacity is supported by competitive manufacturing costs and strategic geographic proximity to the U.S., driving the need for increased bumper production to meet both domestic and international demand. Therefore, the region will present lucrative growth opportunities for the market throughout the forecast period.

List of Key Companies Profiled

- Forvia SE

- TOYOTA BOSHOKU CORPORATION

- Magna International, Inc.

- Hyundai Motor Company

- Flex-N-Gate Corporation

- OPmobility (Burelle SA)

- MONTAPLAST GmbH

- Warn Industries, Inc. (LKQ Corporation)

- Tong Yang Group

- Valeo SA

Market Report Segmentation

By Vehicle Type- Passenger Vehicle

- Commercial Vehicles

- Standard Bumper

- Step Bumper

- Deep Drop Bumper

- Roll Pan Bumper

- Tube Bumper

- Plastic

- Steel

- Aluminum

- Fiber

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Forvia SE

- TOYOTA BOSHOKU CORPORATION

- Magna International, Inc.

- Hyundai Motor Company

- Flex-N-Gate Corporation

- OPmobility (Burelle SA)

- MONTAPLAST GmbH

- Warn Industries, Inc. (LKQ Corporation)

- Tong Yang Group

- Valeo SA