North America Biobanking Market Analysis

Biobank is a type of biorepository containing large collections of biological materials (usually human). The large-scale biomedical database acts as a research resource to facilitate new scientific discoveries. Biological samples in biobanks can act as a vital tool for medical research and accelerate the development of new and innovative treatments.North America biobanking market growth is driven by the rising prevalence of chronic diseases, such as cancer, cardiovascular diseases, and diabetes, in the region. According to the Centers for Disease Control and Prevention, 6 out of 10 Americans are affected by at least one chronic disease. Moreover, chronic diseases not only rank as the leading causes of death and disability in America but are also a major driver of healthcare costs. Biobanks help in studying the genetic and environmental factors resulting in chronic diseases. Thus, with the growing prevalence of chronic diseases, the demand for biological samples in biomedical research is expected to rise, which will boost the market growth.

Technological advancements such as the development of computational tools to analyze huge volumes of complex data in biobanks are expected to boost the North America biobanking market demand in the forecast period. In December 2023, a study primarily funded by the National Institute of Aging (a division of the United States National Institutes of Health) revealed the development of a suite of free computational tools that can analyze brain dissection photographs from brain biobanks and reconstruct a three-dimensional picture of the brain, which can help to understand neurodegenerative diseases and find their potential treatments. Thus, data from biobanks is increasingly used to advance the understanding of various brain disorders, which are anticipated to propel the market demand.

North America biobanking market share is likely to be positively impacted by increased fundings from government organizations to improve biobanking infrastructure and support research initiatives. In December 2023, New York-based Wilmot Cancer Institute (leader in cancer care and research) received a grant worth USD 339k from Empire State Development (New York State funds). The funding will help in renovations and the establishment of new technology for the institute's Biobank Shared Resource. Such investments will support biobank upgrades and are likely to augment market size in the region.

North America Biobanking Market Segmentation

North America Biobanking Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Breakup by Equipment

- Cryogenic Storage Systems

- Alarm Monitoring Systems

- Others

Breakup by Media

- Optimized Media

- Non-Optimized Media

- Others

Breakup by Services

- Human Tissue Biobanking

- Stem Cell Biobanking

- Cord Banking

- DNA/RNA Biobanking

- Others

Breakup by Biospecimen Type

- Human Tissues

- Human Organs

- Stem Cells

- Others

Breakup by Application

- Drug Discovery

- Disease Research

- Others

Breakup by End User

- Hospitals

- Cosmetology Clinics

- Ambulatory Surgical Centers

- Others

Breakup by Region

- United States of America

- Canada

North America Biobanking Market: Competitor Landscape

The key features of the market report include patent analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Atlanta Biologicals Inc. (Bio-Techne Corporation)

- Becton, Dickinson and Company

- BioLifeSolution Inc.

- Chart Industries Inc.

- Hamilton Company

- Qiagen NV

- Sigma-Aldrich Inc. (Merck KGaA)

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- VWR International LLC

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Atlanta Biologicals Inc. (Bio-Techne Corporation)

- Becton, Dickinson and Company

- BioLifeSolution Inc.

- Chart Industries Inc.

- Hamilton Company

- Qiagen NV

- Sigma-Aldrich Inc. (Merck KGaA)

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

- VWR International LLC

Table Information

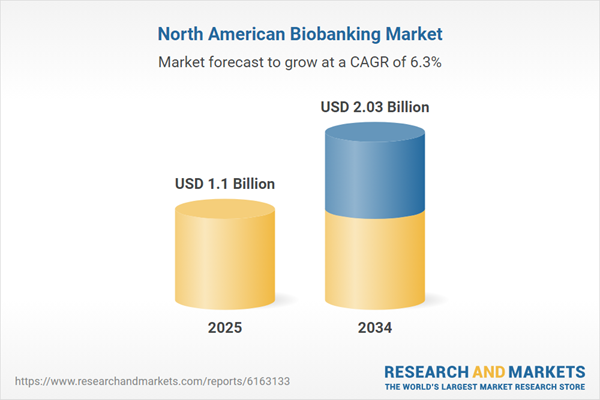

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 2.03 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |