Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key drivers of this market include the growing prevalence of infectious diseases, the emergence of drug-resistant pathogens, and the increasing awareness of the importance of early and precise microbial identification. Rapid advancements in microbiology techniques, such as molecular diagnostics, automation, and point-of-care testing, have revolutionized the way clinical laboratories operate. These technologies allow for quicker and more accurate identification of pathogens, which is crucial for guiding appropriate treatment decisions. The market is characterized by a diverse array of products and services, including instruments, reagents, consumables, and software solutions. Clinical microbiology laboratories and hospitals are the primary end-users, but there is also increasing demand from academic research institutions and pharmaceutical companies engaged in drug development.

Key Market Drivers

Increasing Prevalence of Infectious Diseases

The increasing prevalence of infectious diseases is a significant driving force behind the growth of the North America clinical microbiology market. Infectious diseases have remained a persistent North America health challenge, affecting populations across the world. Diseases such as tuberculosis, malaria, HIV, respiratory infections, and emerging threats like the COVID-19 pandemic have underscored the need for robust diagnostic tools and microbiological solutions.As populations continue to grow and become more interconnected due to globalization and international travel, the spread of infectious diseases becomes more rapid and widespread. This heightened risk amplifies the importance of early and accurate diagnosis, creating a strong demand for clinical microbiology products and services.

The emergence of new and evolving pathogens further complicates the healthcare landscape. New infectious diseases continually emerge, demanding rapid and effective diagnostic solutions to identify and contain these threats. Clinical microbiology laboratories are at the forefront of this battle, as they play a crucial role in identifying and characterizing these pathogens.

The rise of antimicrobial resistance (AMR) presents a dual challenge. AMR renders many traditional treatments less effective, necessitating precise diagnostic tools to guide treatment decisions and reduce the misuse of antibiotics. Clinical microbiology, with its ability to identify drug-resistant pathogens, is indispensable in the fight against AMR. The COVID-19 pandemic, a stark example of the North America impact of infectious diseases, has accelerated the demand for clinical microbiology solutions. The rapid development and deployment of diagnostic tests, including molecular techniques like PCR and serological assays, have been instrumental in managing and mitigating the pandemic. This experience has further underscored the importance of clinical microbiology in public health and pandemic preparedness.

Rising Antimicrobial Resistance

Rising antimicrobial resistance (AMR) is a compelling driver propelling the growth of the North America clinical microbiology market. AMR poses a formidable North America healthcare crisis as it undermines the efficacy of antibiotics and other antimicrobial treatments. This phenomenon necessitates the development and implementation of precise diagnostic tools to guide treatment decisions, reduce the overuse of antibiotics, and combat drug-resistant pathogens effectively.Clinical microbiology, with its ability to identify and characterize resistant microorganisms, is at the forefront of the battle against AMR. Traditional microbiological methods, such as culture-based techniques, susceptibility testing, and molecular diagnostics, play a pivotal role in identifying resistant strains and determining the most appropriate treatment options. The increasing prevalence of AMR strains, particularly in healthcare settings, underscores the critical need for accurate and rapid diagnosis to curtail the spread of these pathogens.

AMR has a profound impact on patient outcomes and healthcare costs. Ineffective treatments due to drug resistance can lead to prolonged hospital stays, increased mortality rates, and higher healthcare expenditures. This highlights the urgency of investing in clinical microbiology solutions that can provide timely and reliable results, enabling healthcare professionals to make informed decisions about the use of antibiotics.

The clinical microbiology market has responded to the AMR crisis with ongoing innovation, resulting in more advanced and efficient diagnostic tools. These innovations include the development of rapid susceptibility testing methods, the integration of automation into microbiology laboratories, and the incorporation of genotypic and phenotypic approaches for AMR detection. The market is witnessing a surge in demand for these advanced diagnostic technologies as healthcare providers and institutions strive to combat AMR effectively.

As AMR continues to escalate, with resistant pathogens emerging and spreading in various healthcare and community settings, the North America clinical microbiology market is poised to expand. Healthcare stakeholders recognize the critical role that clinical microbiology plays in addressing the AMR challenge and are willing to invest in cutting-edge diagnostic solutions.

Aging Population

The aging population is a significant driver behind the growth of the North America clinical microbiology market. As the world's demographic landscape shifts, with a growing proportion of older individuals, healthcare systems are faced with unique challenges related to the susceptibility of this group to infectious diseases. With age, the immune system tends to weaken, making older individuals more vulnerable to infections and their complications. This demographic shift has led to an increased demand for clinical microbiology products and services, as accurate and timely diagnosis becomes paramount in the healthcare of the elderly.Infections among the elderly can be particularly severe, leading to extended hospital stays, higher healthcare costs, and, in some cases, increased mortality rates. Hence, clinical microbiology plays a vital role in identifying pathogens and guiding appropriate treatments, thereby improving patient outcomes and reducing the economic burden on healthcare systems.

The aging population is prone to chronic diseases and often requires complex medical interventions, including surgeries and immunosuppressive therapies. These interventions can make them more susceptible to healthcare-associated infections. The clinical microbiology market provides the tools and expertise needed to detect and manage these infections effectively, contributing to the overall well-being of older patients.

The healthcare industry is responding to this demographic shift by investing in advanced clinical microbiology technologies and services to cater to the unique healthcare needs of the elderly. This includes the development of diagnostic tools and solutions tailored to detect pathogens prevalent in this age group, such as respiratory infections, urinary tract infections, and healthcare-associated infections like methicillin-resistant Staphylococcus aureus (MRSA).

The aging population trend is not limited to developed countries; it is a North America phenomenon. As emerging economies also experience a rise in their elderly populations, the demand for clinical microbiology solutions is expected to grow worldwide. This expansion in the North America clinical microbiology market driven by the aging population underscores the importance of accurately diagnosing and managing infections in older individuals.

Key Market Challenges

Antimicrobial Resistance (AMR)

Antimicrobial resistance (AMR) has emerged as a formidable challenge that not only poses a serious threat to public health but also hinders the growth and efficiency of the North America clinical microbiology market. AMR is the ability of microorganisms, such as bacteria, viruses, and fungi, to develop resistance to the drugs designed to kill or inhibit their growth. The evolving landscape of AMR makes it more challenging to diagnose and treat infectious diseases accurately. Traditional diagnostic methods may not effectively detect drug-resistant pathogens, leading to misdiagnoses and inappropriate treatment. As a result, clinical microbiology laboratories are under pressure to continually update their diagnostic tools and methods to stay ahead of emerging resistance patterns.Patients infected with drug-resistant microorganisms often require extended hospital stays and more complex medical interventions. This has a direct impact on healthcare costs, as longer hospitalization periods translate into higher expenses. The clinical microbiology market plays a crucial role in minimizing these financial burdens by facilitating early and accurate diagnosis.

While the clinical microbiology market is responding to the AMR challenge with the development of new diagnostic technologies, this innovation comes at a cost. Developing and implementing advanced diagnostic methods requires substantial investment in research and development, along with significant resources to validate and integrate these technologies into clinical practice.

Surveillance and research efforts to monitor and combat AMR are resource intensive. Clinical microbiology laboratories and healthcare institutions need to invest in these activities to stay ahead of emerging resistant strains and adapt their diagnostic practices accordingly. Such ongoing research demands financial and human resources, which can strain budgets.

Reimbursement Issues

One of the primary challenges in the clinical microbiology market is the complexity and variability of reimbursement systems across different regions and countries. These systems are often convoluted, with varying levels of coverage and reimbursement rates for diagnostic tests. The lack of a standardized, uniform approach to reimbursement makes it challenging for clinical microbiology laboratories to navigate the landscape effectively.Clinical microbiology is a rapidly evolving field, with constant advancements in diagnostic techniques. Advanced molecular diagnostic tests, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), offer higher accuracy and rapid results. However, the reimbursement rates for these advanced tests often do not align with the costs of developing and performing them. This financial misalignment can discourage laboratories from investing in and offering cutting-edge diagnostic services.

Many clinical microbiology laboratories develop their own in-house diagnostic tests to address specific regional or patient needs. However, the reimbursement of these laboratory-developed tests is a contentious issue. The lack of clarity and consistency in reimbursement policies for LDTs can create uncertainty and financial risks for laboratories, potentially inhibiting their ability to provide innovative solutions.

Reimbursement policies are subject to frequent changes, often driven by government regulations and payer decisions. These ongoing shifts can create instability in the clinical microbiology market. Laboratories must continually adapt to evolving reimbursement guidelines, which can be resource-intensive and time-consuming.

The challenges associated with reimbursement can lead to economic stress for clinical microbiology laboratories. Inadequate reimbursement rates, coupled with the high costs of maintaining advanced diagnostic equipment and skilled personnel, can erode profit margins. This financial pressure can limit investments in infrastructure, research and development, and the expansion of diagnostic services.

Key Market Trends

Automation and Robotics

Automation and robotics have emerged as powerful drivers of growth in the North America clinical microbiology market. Clinical microbiology laboratories are increasingly turning to these technologies to enhance the efficiency and accuracy of their diagnostic processes, making them a critical trend in the field.Automation systems can handle a high volume of samples quickly and consistently, reducing the time required for processing and analysis. This increased efficiency enables laboratories to meet the growing demand for diagnostic tests, especially during infectious disease outbreaks and surges.

Automation and robotics significantly decrease the risk of human error in the diagnostic process. This is crucial for maintaining the quality and reliability of test results, as even a small error can have significant consequences in clinical microbiology. Automation ensures precision and consistency in testing, leading to more accurate diagnoses.

Automation systems can process multiple samples simultaneously, providing high throughput capabilities. This is especially valuable in situations where a large number of tests need to be conducted rapidly, such as in epidemiological investigations, population-level screening, or the diagnosis of infectious disease outbreaks.

Automation solutions optimize the workflow in clinical microbiology laboratories. They can automate various steps in the diagnostic process, from specimen handling and preparation to result reporting. This streamlining of tasks allows laboratory staff to focus on more complex and interpretative aspects of diagnostics.

Automation and robotics can also lead to resource efficiency. Laboratories can operate with fewer staff for routine, repetitive tasks, allowing skilled professionals to concentrate on more specialized activities, such as data analysis, interpretation, and quality control.

Point-of-Care Testing (POCT)

POCT provides real-time diagnostic results, allowing healthcare providers to make immediate treatment decisions. In infectious disease management, this can be critical for initiating appropriate therapies promptly, reducing the spread of infections, and improving patient outcomes. The speed of POCT is particularly valuable during disease outbreaks and emergency situations.POCT devices are often portable and user-friendly, making them suitable for use in various healthcare settings, including remote or resource-limited areas. This accessibility ensures that patients in underserved regions have access to timely and accurate diagnostic services, which is essential for early disease detection and management.

By eliminating the need for transporting samples to a central laboratory and waiting for results, POCT significantly reduces turnaround times. This is particularly important in infectious disease diagnosis, where timely identification of pathogens can mean the difference between containment and an outbreak's uncontrolled spread.

During infectious disease outbreaks, clinical microbiology laboratories may become overwhelmed with a surge in testing demand. POCT devices can relieve this strain by providing immediate on-site testing, allowing centralized laboratories to focus on more complex or high-volume tasks.

POCT enhances the continuity of care by facilitating rapid diagnosis, especially for infectious diseases. This enables clinicians to adjust treatment plans in real-time, closely monitor patient progress, and make necessary interventions promptly, ultimately leading to better patient care.

Many POCT devices offer flexibility in terms of the range of diagnostic tests they can perform. Clinical microbiology laboratories can tailor these devices to meet specific testing needs, whether for the diagnosis of respiratory infections, sexually transmitted diseases, or other infectious diseases prevalent in a particular region or patient population.

While POCT is instrumental in providing immediate results, it often complements the services of centralized clinical microbiology laboratories. In cases where more comprehensive testing or specialized techniques are required, samples can be sent to a central lab for in-depth analysis, ensuring a comprehensive approach to infectious disease diagnosis.

Segmental Insights

Product Insights

Based on the Product, Automated Culture Systems emerged as the dominant segment in the North America Clinical Microbiology Market in 2023. Automated culture systems streamline the cultivation and incubation of microbial samples, reducing the time required to obtain results. Traditional culture methods involve manual handling and monitoring of cultures, which can be time-consuming. Automated systems can handle multiple samples simultaneously, resulting in higher throughput and quicker turnaround times. Automation minimizes the risk of human error in the culture process. Consistency and precision are crucial in clinical microbiology, and automated systems can maintain the necessary conditions for bacterial and fungal growth, ensuring the reliability and reproducibility of results.Country Insights

United States emerged as the dominant country in the North America Clinical Microbiology Market in 2023, holding the largest market share. The country has a strong focus on research and development, leading to continuous innovation in clinical microbiology. United States' companies and institutions are at the forefront of developing cutting-edge diagnostic technologies and solutions, ensuring they remain competitive in the United States market. The country has faced various epidemiological challenges over the years, including infectious disease outbreaks and pandemics. These challenges have driven the demand for clinical microbiology services and diagnostic solutions. The COVID-19 pandemic, in particular, has accelerated investments in clinical microbiology, making it a significant driver of growth in the region.Key Market Players

- bioMérieux, Inc.

- Cepheid Inc.

- Danaher Corporation

- Bruker Corporation

- Becton Dickinson & Company

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Hologic Inc.

- Roche Laboratories Inc.

- Beckman Coulter, Inc.

Report Scope:

In this report, the North America Clinical Microbiology Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Clinical Microbiology Market, By Product:

- Laboratory Instruments

- Automated Culture Systems

- Reagents

North America Clinical Microbiology Market, By Disease:

- Respiratory diseases

- Bloodstream infections

- Gastrointestinal diseases

- Sexually transmitted diseases

- Urinary tract infections

- Periodontal diseases

- Other diseases

North America Clinical Microbiology Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Clinical Microbiology Market.Available Customizations:

North America Clinical Microbiology Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- bioMérieux, Inc.

- Cepheid Inc.

- Danaher Corporation

- Bruker Corporation

- Becton Dickinson & Company

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Hologic Inc.

- Roche Laboratories Inc.

- Beckman Coulter, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2024 |

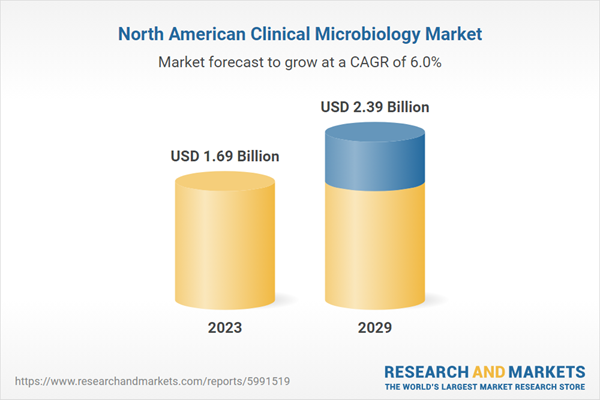

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.69 Billion |

| Forecasted Market Value ( USD | $ 2.39 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |

![Clinical Microbiology Market by Product (Instrument (Incubators), Analyzer (Microscope), Reagent, Kits, Media], Disease Area (Respiratory, Gastrointestinal, STD, UTI), End User (Hospitals, Diagnostic Center, Research Institutes) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/11979/11979906_60px_jpg/clinical_microbiology_market.jpg)