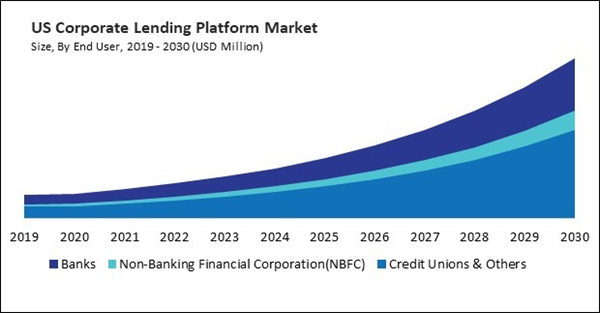

The US market dominated the North America Corporate Lending Platform Market by Country in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $2,679.1 million by 2030. The Canada market is experiencing a CAGR of 25.4% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 24.3% during (2023 - 2030).

The corporate lending platform market has attracted significant interest from investors seeking alternative investment opportunities outside traditional asset classes. Institutional investors, hedge funds, and private equity firms increasingly allocate capital to corporate lending platforms to diversify their investment portfolios, earn attractive risk-adjusted returns, and gain exposure to the growing corporate lending market. The influx of institutional capital into lending platforms enhances liquidity, expands funding sources, and fuels the growth and scalability of these platforms.

Furthermore, corporate lending platforms serve many uses across various industries and contexts, providing businesses access to tailored financing solutions to support their growth, expansion, and working capital needs. Corporate lending platforms offer businesses flexible financing options to effectively manage their working capital needs. Whether businesses require short-term funds to cover operating expenses, purchase inventory, or bridge cash flow gaps, lending platforms provide working capital solutions such as lines of credit, revolving credit facilities, and short-term loans.

Fintech platforms in Mexico diversify lending options for businesses, offering a wider range of loan products, terms, and rates. This enables corporate lending platforms to tailor their offerings to meet the specific needs of borrowers, such as flexible repayment schedules, lower interest rates, or specialized financing solutions for different industries or sectors. In conclusion, the expansion of non-bank credit intermediaries and the increasing fintech industry in the region is propelling the market’s growth.

Based on Offering, the market is segmented into Solution (Loan Origination, Loan Structuring, Underwriting, Collateral Management, Compliance & Regulatory Management, Loan Monitoring & Management and Others) and Services (Professional Services and Managed Services). Based on End User, the market is segmented into Banks, Non-Banking Financial Corporation(NBFC) and Credit Unions & Others. Based on Deployment, the market is segmented into Cloud and On-premise. Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. Based on Lending Type, the market is segmented into Commercial Lending, Microfinance Lending, SME Lending, Agriculture Lending, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- TATA Consultancy Services Ltd.

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- Oracle Corporation

- Finastra Group Holdings Limited (Vista Equity Partners)

- Newgen Software Technologies Limited

- Nelito Systems Pvt. Ltd. (DTS Corporation)

- Wipro Limited

- Comarch SA

- Temenos AG

Market Report Segmentation

By Offering- Solution

- Loan Origination

- Loan Structuring

- Underwriting

- Collateral Management

- Compliance & Regulatory Management

- Loan Monitoring & Management

- Others

- Services

- Professional Services

- Managed Services

- Banks

- Non-Banking Financial Corporation(NBFC)

- Credit Unions & Others

- Cloud

- On-premises

- Large Enterprises

- Small & Medium Enterprises

- Commercial Lending

- Microfinance Lending

- SME Lending

- Agriculture Lending

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- TATA Consultancy Services Ltd.

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- Oracle Corporation

- Finastra Group Holdings Limited (Vista Equity Partners)

- Newgen Software Technologies Limited

- Nelito Systems Pvt. Ltd. (DTS Corporation)

- Wipro Limited

- Comarch SA

- Temenos AG