Epoxy resins are vital in the corrosion-resistant resin market, renowned for their strong adhesion, chemical resistance, and mechanical properties. Used extensively in protective coatings, these resins safeguard structures and equipment in demanding environments like marine, oil and gas, and chemical processing industries. Epoxy resins can withstand extreme temperatures and aggressive substances, enhancing their durability and reliability. The increasing need for long-lasting, corrosion-resistant solutions drives the growth of epoxy resins, as industries prioritize asset protection and maintenance cost reduction. Therefore, by the year 2031, 34.66 kilo tonnes of are expected to be utilized in Canada.

The US market dominated the North America Corrosion Resistant Resin Market by country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $2.31 billion by 2031. The Canada market is experiencing a CAGR of 6.8% during 2024-2031. Additionally, the Mexico market is expected to exhibit a CAGR of 6.2% during 2024-2031.

The market has seen considerable growth in recent years, driven by its wide array of applications across industries such as construction, automotive, aerospace, marine, chemical processing, and many others. As the demand for durable, long-lasting, and high-performance materials continues to rise, corrosion-resistant resins have emerged as key components in manufacturing products designed to withstand harsh environmental conditions. These resins are engineered to offer exceptional resistance against corrosion, making them indispensable in various sectors that require robust materials for safety, performance, and longevity.

Corrosion-resistant resins are specially formulated polymers that offer superior protection against the degradation caused by chemical reactions, moisture, or environmental factors such as temperature fluctuations. In addition, corrosion-resistant resins are commonly used in the construction and infrastructure sector to extend the lifespan of materials exposed to water, salt, and other environmental stressors. They are used in coatings for steel reinforcements, bridges, pipes, and concrete structures. The growth in infrastructure development, especially in coastal areas or regions with high humidity, drives the demand for these resins. Resins such as epoxy and polyester are frequently used to prevent rust and other forms of corrosion in steel and concrete, ensuring the safety and stability of critical structures.

Canada’s marine industry is a key driver of the corrosion resistant resin market. In 2022, the Canadian marine sector contributed significantly to the nation’s economy, generating $1.95 billion in gross domestic product, a 6.3% increase from the previous year. With ports and marine shipping handling over $151 billion of exports and $194 billion of imports, Canada’s marine industry is critical to global trade. Handling over 339 million tons of cargo further underscores the scale of operations. Marine transportation requires robust materials that withstand harsh conditions such as saltwater, chemical corrosion, and wear from constant exposure to the elements.

Corrosion-resistant resins are extensively used in the construction of ships, cargo containers, and marine equipment to prevent degradation and maintain functionality over time. As the marine industry continues to grow, there is an increasing need for materials that offer long-lasting protection against corrosion, fueling the demand for corrosion-resistant resins in this sector. Hence, the growing automotive industry in Mexico and the expanding marine sector in Canada drive the demand for corrosion-resistant resins.

List of Key Companies Profiled

- BASF SE

- Huntsman Corporation

- The Dow Chemical Company

- Solvay SA

- Hexion Inc. (Hexion Intermediate Holding 2, Inc.)

- Sino Polymer Co., Ltd.

- Swancor Holding Co., Ltd.

- Arkema S.A.

- Olin Corporation

- Ashland Inc.

Market Report Segmentation

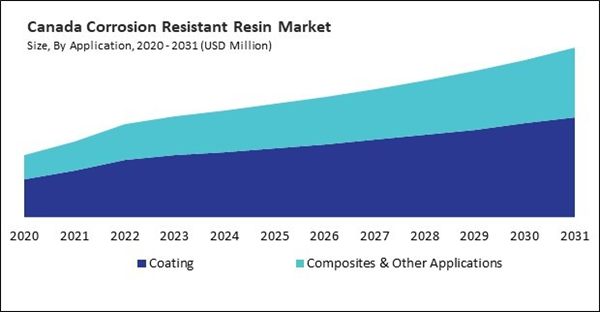

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Coating

- Composites & Other Applications

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Epoxy

- Polyurethanes

- Polyester

- Vinyl Ester

- Other Types

By End User (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Epoxy

- Polyurethanes

- Polyester

- Vinyl Ester

- Other Types

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- BASF SE

- Huntsman Corporation

- The Dow Chemical Company

- Solvay SA

- Hexion Inc. (Hexion Intermediate Holding 2, Inc.)

- Sino Polymer Co., Ltd.

- Swancor Holding Co., Ltd.

- Arkema S.A.

- Olin Corporation

- Ashland Inc.