Growing Incidence of Genetic Disorders Fuels the North America Direct-to-Consumer Genetic Testing Market

The global burden of genetic diseases is increasing. According to an article published in 2022 by The Guardian, ~5% of the world's population is affected by sickle cell disease, and approximately 300,000 babies are born with sickle cell anemia worldwide every year. The World Health Organization estimates that 10 in 1,000 people are affected. This means 70 to 80 million people worldwide live with one of these diseases. In 2020, the Online Mendelian Inheritance in Man (OMIM) resource listed 6,594 diseases with known molecular genetic defects, comprising 4,225 genes. This number is continuously increasing to approximately 50-60 new genetic diseases annually, as per the Orphanet and OMIM databases. The NIH Undiagnosed Diseases Program and Network and the International Rare Diseases Research Consortium are a few initiatives further accelerating the discovery rate of novel genetic diseases.According to the CDC, 1 in 500 African Americans are diagnosed with sickle cell disease, and the autosomal recessive mutation is carried by 1 in 12 African Americans. According to the Alzheimer's Association, by 2023, nearly 6.7 million Americans aged 65 will have Alzheimer's-related dementia. Furthermore, the number is expected to rise to 13.8 million by 2060, with no breakthrough that either slows or cures the disease.

The incidence of genetic disorders in newborns is also increasing. According to the World Health Organization 2022 report, neural tube defects, Down syndrome, and heart defects are a few common severe congenital disabilities. According to the CDC, in the US, Down syndrome affects nearly 6,000 newborn babies yearly, one in 700 babies; and in India, every year, nearly 23,000 to 29,000 children, one in 831, have Down syndrome. According to the report titled "Neural tube defects: Different types and a brief overview of the neurulation process and its clinical implications," published in the Journal of Family Medicine and Primary Care in 2021, more than 300,000 cases of Neural tube defects (NTDs) are recorded worldwide each year. These factors are encouraging the introduction of genetic testing for inherited diseases.

Therefore, the increasing incidence of genetic disorders worldwide boosts the Direct-to-Consumer genetic testing market growth.

North America Direct-to-Consumer Genetic Testing Market Overview

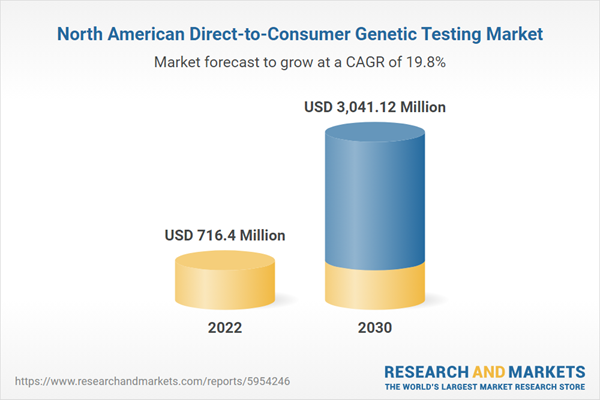

The North America Direct-to-Consumer genetic testing market is segmented into the US, Canada, and Mexico. North America accounts for a significant market share owing to the growing prevalence of genetic diseases, high spending on research and development, product approvals by the US Food and Drug Administration (FDA), and technological advances. The presence of large healthcare businesses and the growing usage of Direct-to-Consumer genetic testing would continue to offer opportunities for market growth in the region during the period 2022-2030. Further, rising support from governments to address growing concerns about genetic diseases favors the Direct-to-Consumer genetic testing market progress in North America.Nort

h America Direct-to-Consumer Genetic Testing Market Revenue and Forecast to 2030 (US$ Million)

North America Direct-to-Consumer Genetic Testing Market Segmentation

The North America Direct-to-Consumer genetic testing market is segmented into test type, technology, distribution channel, and country.Based on test type, the North America Direct-to-Consumer genetic testing market is segmented into ancestry testing, predictive testing, nutrigenomics testing, carrier testing, and others. The ancestry testing market segment held the largest share in 2022.

In terms of technology, the North America Direct-to-Consumer genetic testing market is categorized into whole genome sequencing, single nucleotide polymorphism chips, targeted analysis, and others. The single nucleotide polymorphism chips segment held the largest share in 2022.

Based on distribution channel, the North America Direct-to-Consumer genetic testing market is bifurcated into online and offline. The online segment held a larger share in 2022.

Based on country, the North America Direct-to-Consumer genetic testing market is segmented the US, Canada, and Mexico. The US dominated the North America Direct-to-Consumer genetic testing market in 2022.

Ancestry Genomics Inc, Color Health Inc, Helix Inc, Myriad Genetics, Inc., Living DNA Ltd, 23andMe Inc, Genetic Technologies Ltd, Gene by Gene Ltd, and Full Genomes Corp Inc are some of the leading companies operating in the North America Direct-to-Consumer genetic testing market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America Direct-to-Consumer genetic testing market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America Direct-to-Consumer genetic testing market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- Ancestry Genomics Inc

- Color Health Inc

- Helix Inc

- Myriad Genetics, Inc.

- Living DNA Ltd

- 23andMe Inc

- Genetic Technologies Ltd

- Gene By Gene Ltd

- Full Genomes Corp Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | February 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 716.4 Million |

| Forecasted Market Value ( USD | $ 3041.12 Million |

| Compound Annual Growth Rate | 19.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |