Integration of New Technologies Fuels North America Distributed Control Systems Market

The industrial sector is increasingly adopting Industry 4.0, artificial intelligence (AI), IoT, cloud computing, edge computing, virtualization, decentralization, 5G, IIoT, augmented reality (AR), human-machine interaction (HMI), and other such technologies. The players are significantly investing in the development of industrial robots integrated with artificial intelligence.For instance, in December 2023, TeamViewer, a leading global provider of remote connectivity and workplace digitalization solutions, announced strategic investments in two pioneering companies for smart factory solutions: Sight Machine and Cybus. The company is strengthening its commitment to the digital transformation of industrial working environments and the convergence of Information and Operation Technology (IT & OT).

The landscape of industrial automation is experiencing a transformational evolution. Advancements in technologies such as artificial intelligence (AI), collaborative robots, and IoT integration are a some of the factors driving this evolution. Those businesses that successfully use emerging technologies and automation will have an advantage as labor challenges, tighter budgets, and higher demand, continue to plague businesses. Moreover, developing technologies such as digital twins, generative AI, and 4D vision are creating greater efficiencies in all areas of manufacturing. Businesses of all sizes will continue to invest in these technologies as they become more available.

Artificial intelligence provides a comprehensive understanding of ongoing activities and can forecast equipment breakdowns in manufacturing through data. The synergistic utilization of generative artificial intelligence (AI) and automation holds transformative capabilities for businesses. AI will persist as a valuable resource for product development, while automation will serve as the catalyst to bring these products to life. Furthermore, the integration of digital twins and machine learning, to analyze the vast amount of data generated by automation systems is becoming gradually important.

These software solutions will enable leaders to make better decisions based real-time analysis, improve predictive maintenance, and optimize processes throughout their operations. Thus, the advancements of new technologies such as Industry 4.0, artificial intelligence (AI), IoT, cloud computing, edge computing, virtualization, decentralization, 5G, and IIoT in various industries is anticipated to be a major trend in the distribution control system market.

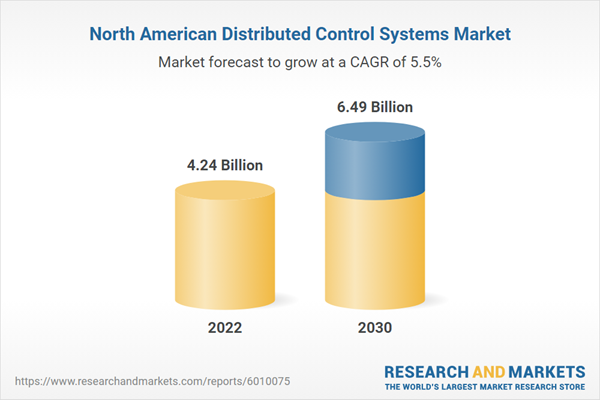

North America Distributed Control Systems Market Overview

North America includes countries such as the US, Canada, and Mexico. The availability of efficient infrastructure in developed nations has enabled manufacturing companies to explore the limits of science, technology, and commerce. The US is a developed country in terms of infrastructure, modern technology, standard of living, and many other factors. Across North America, technological advancements have led to highly competitive markets. North America is a hub of technological developments that hold economically robust countries. Companies in the market are continuously improving their overall business processes in order to satisfy customers' demand for high-quality products and services in the best possible way.The demand for advanced DCS is fueled by the region's continued emphasis on industrial automation, which is motivated by the need for increased operational efficiency and cost reduction. According to the International Federation of Robotics (IFR), in 2022, the total installation of robots in the manufacturing sector rose by 12% and reached 41,624 units.

Established companies in the US, Canada, and Mexico installed 20,391 industrial robots in quantity, an increase of 30% from 2021. In addition, the Industrial Internet of Things (lloT) and digitization are being more widely used, which improves DCS capabilities by providing remote monitoring and real-time data processing, increasing market expansion even more.

For instance, in March 2023, NTT Ltd., one of the leading IT infrastructure and services companies, and Cisco, a worldwide technology provider, announced a partnership to deploy joint solutions that allow organizations to enhance operational efficiencies and advance sustainability goals. NTT's dedicated IoT business unit carried out this Cisco partnership to speed up hundreds of use cases in industries such as healthcare, transportation, and manufacturing. DCS are highly demanded to maintain safe and compliant operations in industries such as oil & gas and power generation due to strict safety and regulatory regulations.

Factors such as an increase in the efficiency of operations, the Industry 4.0 revolution, and product innovations are supporting the growth of the distributed control system market. The escalating importance of high efficiency in automation is driven by the growth in factory and process automation industries. All these factors fuel the efficiency and positively impact the growth of the North America distributed control system market in the current scenario.

North America Distributed Control Systems Market Segmentation

- The North America distributed control systems market is segmented based on component, industry, and country.

- Based on component, the North America distributed control systems market is segmented into hardware, software, and services. The hardware segment held the largest share in 2022.

- In terms of industry, the North America distributed control systems market is segmented into power generation, oil and gas, pharmaceutical, food and beverages, chemicals, and others. The oil and gas segment held the largest share in 2022.

- Based on country, the North America distributed control systems market is categorized into the US, Canada, and Mexico. The US dominated the North America distributed control systems market in 2022.

- Honeywell International Inc, General Electric Co, ABB Ltd, Yokogawa Electric Corp, Toshiba Corp, Siemens AG, Emerson Electric Co, NovaTech LLC, Schneider Electric SE, and Rockwell Automation Inc are some of the leading companies operating in the North America distributed control systems market.

Market Highlights

- Based on component, the North America distributed control systems market is segmented into hardware, software, and services. The hardware segment held 45.9% share of the North America distributed control systems market in 2022, amassing US$ 1.94 billion. It is projected to garner US$ 2.82 billion by 2030 to expand at 4.8% CAGR during 2022-2030.

- In terms of industry, the North America distributed control systems market is segmented into power generation, oil and gas, pharmaceutical, food and beverages, chemicals, and others. The oil and gas segment held 26.6% share of the North America distributed control systems market in 2022, amassing US$ 1.12 billion. It is estimated to garner US$ 1.53 billion by 2030 to expand at 3.9% CAGR during 2022-2030.

- The US held 72.7% share of North America distributed control systems market in 2022, amassing US$ 3.08 billion. It is projected to garner US$ 4.84 billion by 2030 to expand at 5.8% CAGR during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America distributed control systems market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America distributed control systems market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Distributed Control Systems market include:- Honeywell International Inc

- General Electric Co

- ABB Ltd

- Yokogawa Electric Corp

- Toshiba Corp

- Siemens AG

- Emerson Electric Co

- NovaTech LLC

- Schneider Electric SE

- Rockwell Automation Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 4.24 Billion |

| Forecasted Market Value ( USD | $ 6.49 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | North America |

| No. of Companies Mentioned | 11 |