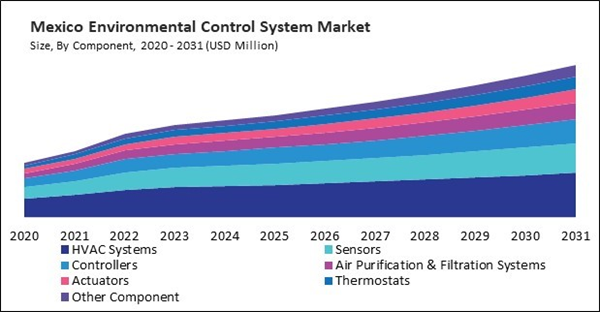

The US market dominated the North America Environmental Control System Market by country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $1.65 billion by 2031. The Canada market is exhibiting a CAGR of 6.9% during 2024-2031. Additionally, the Mexico market is expected to experience a CAGR of 6.6% during 2024-2031.

The booming tourism sector has further fueled this demand, with airlines increasing flight frequencies to popular destinations in Europe, North America, and the Caribbean. Many carriers are purchasing new aircraft and retrofitting older models like the Boeing 767 and Airbus A330 with modern ECS to meet this demand and improve cabin conditions and energy efficiency.

Additionally, niche tourism sectors, such as eco-tourism and adventure tourism, have also driven the need for specialized aircraft like the De Havilland Canada Dash 8 and ATR 72, which serve remote tourist destinations and require reliable ECS for extreme climates. The industry’s focus on sustainability has further encouraged retrofitting, helping airlines reduce their carbon footprint while maintaining passenger comfort, ultimately boosting the market.

Canada's market growth is significantly influenced by its expansive automotive sector. The nation's emphasis on sustainable transportation solutions has resulted in the development of electric and hybrid vehicles, which necessitate sophisticated ECS to regulate battery temperatures and guarantee passenger comfort. Programs like the Zero-Emission Vehicle Infrastructure Program (ZEVIP) support the adoption of eco-friendly vehicles, indirectly stimulating the demand for specialized environmental control systems. Moreover, Transport Canada's vehicle emissions and efficiency regulations encourage automotive manufacturers to integrate state-of-the-art ECS into their designs to comply with national standards.

List of Key Companies Profiled

- Honeywell International Inc.

- Siemens AG

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- 3M Company

- Liebherr-International AG

- Parker Hannifin Corporation

- Curtiss-Wright Corporation

- Merck KGaA

- Schneider Electric SE

Market Report Segmentation

By Product

- Water Treatment Systems

- Air Quality Control Systems

- Waste Management Systems

- Energy Management Systems & Other

By Component

- HVAC Systems

- Sensors

- Controllers

- Air Purification & Filtration Systems

- Actuators

- Thermostats

- Other Component

By End Use

- Manufacturing

- Healthcare

- Automotive

- Aerospace

- Agriculture

- Marine

- Other End Use

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Siemens AG

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- 3M Company

- Liebherr-International AG

- Parker Hannifin Corporation

- Curtiss-Wright Corporation

- Merck KGaA

- Schneider Electric SE