Polytetrafluoroethylene (PTFE) is a popular material for fluoropolymer tubing due to its exceptional chemical resistance, high-temperature stability, and low friction properties. It is widely used in industries like chemical processing, pharmaceuticals, and electronics for transporting corrosive fluids, gases, and high-purity substances. The non-reactive nature of PTFE makes it ideal for applications where contamination is a concern. Thus, the Polytetrafluoroethylene (PTFE) in US market registered a volume of 4,706.9 Tonnes in 2023.

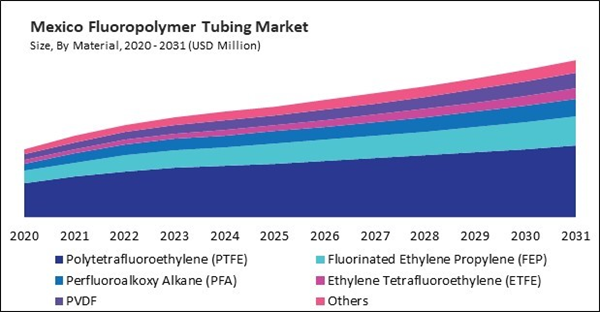

The US market dominated the North America Fluoropolymer Tubing Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $196.70 millions by 2031. The Canada market is experiencing a CAGR of 6.5% during 2024-2031. Additionally, the Mexico market would exhibit a CAGR of 5.9% during 2024-2031.

This has emerged as a versatile and indispensable material in various industries due to its exceptional properties and wide-ranging applications. From industrial processes to medical devices, this offers unparalleled performance, reliability, and durability in demanding environments. The adoption of this has witnessed steady growth over the years, driven by its unique combination of properties that make it ideal for various applications.

In addition, this is highly flexible yet durable, allowing for easy installation, routing, and bending without sacrificing mechanical strength or performance. Its resilience to mechanical stress, abrasion, and impact makes it suitable for demanding automotive, aerospace, and industrial machinery applications. Likewise, this is used in chemical processing industries to convey aggressive chemicals, acids, and solvents. Due to its exceptional chemical resistance and compatibility with a wide range of corrosive substances, it is employed in chemical transfer lines, reaction vessels, and process piping systems.

The healthcare sector in Canada encompasses a wide range of medical device manufacturing companies involved in producing diagnostic equipment, surgical instruments, implantable devices, and medical tubing, among others. This is critical in many medical devices and equipment due to its biocompatibility, chemical resistance, and flexibility. As per the data provided in 2023 by the Government of Canada, to assist provinces and territories in enhancing health care services for Canadians, the government has allocated $196.1 billion over a decade, of which $46.2 billion is new funding. Mexico has emerged as a major manufacturing center for the automotive industry, attracting investments from leading global automakers and suppliers. The country's strategic location, favorable trade agreements, skilled workforce, and competitive production costs have contributed to its prominence in automotive manufacturing. As automotive production continues to grow in Mexico, there will be a corresponding increase in the demand for components and materials, including this tubing. Therefore, North America's rising healthcare and automotive sectors will lead to increased demand for this tubing in the region.

List of Key Companies Profiled

- Saint-Gobain S.A.

- Parker Hannifin Corporation

- TE Connectivity Ltd.

- Ametek, Inc.

- Teleflex Incorporated

- 3M Company

- NewAge Industries, Inc.

- The Chemours Company

- AGC Chemicals Pvt. Ltd

- Arkema S.A.

Market Report Segmentation

By Material (Volume, Tonnes, USD Million, 2020-2031)

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Perfluoroalkoxy Alkane (PFA)

- Ethylene Tetrafluoroethylene (ETFE)

- PVDF

- Others

By Application (Volume, Tonnes, USD Million, 2020-2031)

- Medical

- Energy

- Semiconductor

- Oil & Gas

- Aerospace

- Automotive

- General Industrial

- Fluid Management

- Others

By Country (Volume, Tonnes, USD Million, 2020-2031)

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Saint-Gobain S.A.

- Parker Hannifin Corporation

- TE Connectivity Ltd.

- Ametek, Inc.

- Teleflex Incorporated

- 3M Company

- NewAge Industries, Inc.

- The Chemours Company

- AGC Chemicals Pvt. Ltd

- Arkema S.A.