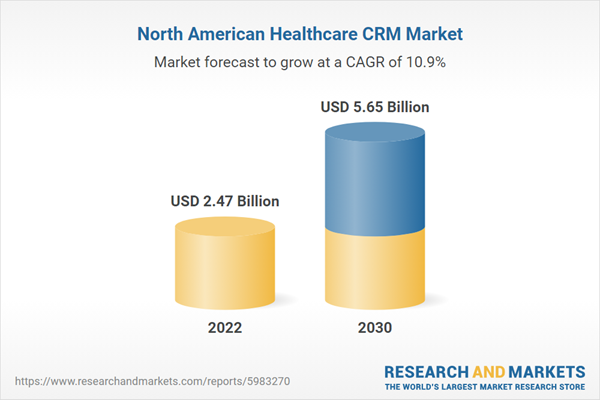

Increasing Demand for Data-Driven Insights, Analytics, and Population Health Management Fuels North America Healthcare CRM Market

The demand for data-driven insights, analytics, and population health management is significantly promoting the development of the healthcare industry, which, in turn, propels the demand for healthcare CRM. This increase in demand can be related to the growing emphasis on value-based care and the demand for healthcare organizations to improve patient outcomes, lower costs, and improve overall care quality.Data-driven insights analytics are critical in healthcare CRM since they allow organizations to examine and evaluate large volumes of patient data to identify trends, patterns, and correlations. This enables healthcare practitioners to understand their patient population better, allowing them to make more accurate decisions about treatment plans, interventions, and resource allocation. Healthcare organizations may also identify high-risk patients, forecast prospective illnesses, and intervene proactively to prevent negative outcomes by employing data-driven analytics. Similarly, population health management is another significant driver of the growing demand for data-driven insights and analytics in the North America healthcare CRM market. Population health management, focusing on improving the health outcomes of entire populations, necessitates healthcare organizations having an extensive understanding of their patient population and the factors that impact their health. Data-driven insights analytics allow healthcare professionals to segment their patient population based on criteria including demographics, clinical problems, and risk factors. This allows them to personalize medical services and treatment plans to the individual requirements of distinct patient groups.

Furthermore, healthcare CRM developers rapidly integrate advanced analytics and population health management capabilities into healthcare CRM platforms. These capabilities enable healthcare organizations to use data to enhance clinical and operational outcomes, resulting in better patient care and lower costs. Thus, the increasing demand for data-driven insights, analytics, and population health management propels the demand for healthcare CRM to improve patient outcomes, reduce costs, and enhance the overall quality of care, which fuels the growth of the North America healthcare CRM market.

North America Healthcare CRM Market Overview

The majority of the hospitals and clinics in the US are experiencing financial and operational stress. Healthcare CRM software is primarily associated with hospitals, clinics, and ambulatory surgical centers to schedule and manage appointments, especially in emergency departments, and inefficient scheduling in outpatient, in-patient, and surgical departments. Efficient patient scheduling management remains an urgent issue for most hospitals and clinics. Due to improper medical scheduling, the patient experiences delays in delivering quality care in public and private healthcare systems. The 2022 survey of Physician Appointment Wait Times and Medicare and Medicaid Acceptance Rates states that there is a waiting period of average of 26 days to schedule a first-time appointment with a physician, an 8% increase since 2017, when the average wait time was ~24 days. This leads to prolonged wait times, scheduling difficulties, and an imbalance of supply and demand in the public and private healthcare sectors. Healthcare CRM software enables hospitals and clinics to track arrival and departure of patients and gain real-time updates on co-pays and cancellations. The use of software reduces the no-shows by 30% with appointment reminder calls. It enhances the entire treatment procedure and improves communication with the patient.Furthermore, the US reports a high prevalence of chronic and acute diseases. According to the"Heart Disease and Stroke Statistics - 2023 Update" by the American Heart Association, in 2020, coronary heart disease (CHD) was a leading cause (41.2%) of deaths associated with CVDs in the US, followed by stroke (17.3%), other CVD (16.8%), high blood pressure (12.9%), heart failure (9.2%), and diseases of the arteries (2.6%). As per the US Centers for Disease Control and Prevention (CDC), ~1 in 20 adults in the US aged 20 and above suffer from coronary artery disease. Thus, a high prevalence of CVDs and other chronic diseases propels the demand for medical scheduling and adoption of healthcare CRM in the US. Also, the rapid adoption of healthcare IT in the US is anticipated to drive the North America healthcare CRM market growth in the future.

North America Healthcare CRM Market Segmentation

The North America healthcare CRM market is categorized into deployment mode, product type, application, and end user, and country.Based on deployment mode, the North America healthcare CRM market is bifurcated cloud based and on-premise. The cloud based segment held a larger market share in 2022.

In terms of product type, the North America healthcare CRM market is categorized into operational CRM, analytical CRM, and collaborative CRM. The operational CRM segment held the largest market share in 2022.

By application, the North America healthcare CRM market is segmented into relationship management, case management, case coordination, community outreach, and others. The relationship management segment held the largest market share in 2022. The case management segment is further sub segmented into disease management and clinical trials relationship management. The case coordination segment is further sub segmented into patient information management and pre-authorizations / eligibility. The community outreach segment is further services outreach/promotion and community health education.

By end user, the North America healthcare CRM market is segmented into providers, payers, and others. The providers segment held the largest market share in 2022.

By country, the North America healthcare CRM market is segmented into the US, Canada, and Mexico. The US dominated the North America healthcare CRM market share in 2022.

International Business Machines Corp, IQVIA Holdings Inc, Microsoft Corp, Oracle Corp, Pegasystems Inc, Pipedrive Inc, Sage Group Plc, Salesforce Inc, SAP SE, ScienceSoft USA Corp, SugarCRM Inc, Veeva Systems Inc, VerioMed Corp, WebMD Ignite Inc, and Zendesk Inc are some of the leading companies operating in the North America healthcare CRM market.

Table of Contents

Companies Mentioned

- International Business Machines Corp

- IQVIA Holdings Inc

- Microsoft Corp

- Oracle Corp

- Pegasystems Inc

- Pipedrive Inc

- Sage Group Plc

- Salesforce Inc

- SAP SE

- ScienceSoft USA Corp

- SugarCRM Inc

- Veeva Systems Inc

- VerioMed Corp

- WebMD Ignite Inc

- Zendesk Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | May 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.47 Billion |

| Forecasted Market Value ( USD | $ 5.65 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 15 |