Insurance companies are encouraged by the carriers choosing to stay the course with their insurance providers and even speed things up. Insurance Industry has made well pedestrians in the Health, Motor, and other Insurance; also, other segments, including property and crop insurance, have scope for more penetration. However, while carriers are committed to the innovative projects and insurtech partners, they're already involved with; they are less likely to take risks on new, unknown insurtech companies.

For new B2B insurtechs trying to build relationships and get a foot in the door with potential customers, it's likely to be a highly challenging business environment and an unbalanced market in the near term. As the Insurtech landscape evolved, many players seemed to be pushing the limits of product innovation, offering newer value-added services, and expanding rapidly to build large eco-system plays.

COVID-19 had negatively impacted the insurtech industry across North America, the insurance industry, the technology platforms, and other industries. But, there was a rise in touchless experiences to increase safety. This coronavirus pandemic prompted a significant increase in the prioritization of technology initiatives, leading to an urgency around deploying digital solutions at insurers in North American countries.

North America Insurtech Market Trends

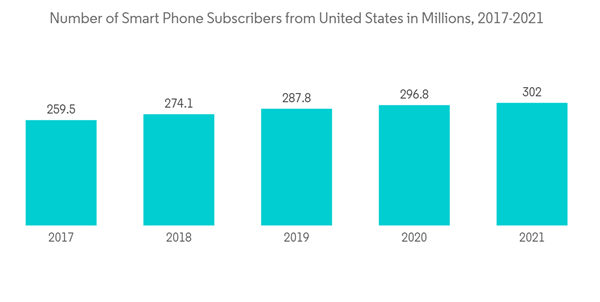

Increasing Number of Smart Phone Subscribers in United States Witnessing Growth in North America Digitized Insurance Trend

The smartphone market in the United States is one of the world’s largest, with more than 302 million smartphone users. In line with the overall growth of the smartphone market across North America, the smartphone penetration rate in the United States has continuously risen over the past 10 to 15 years to more than 80%. Thus, the growth in the number of Smart Phone Users in the United States is one of the biggest key drivers of the transformation of Physical Insurance Policy Activities to the InsurTech, which is more easy, safe, and less time-consuming in nature for clients without any intermediaries or agent fee, thus yielding North America InsurTech Trend growing upwards.North America Signifying Maximum Insurtech Funding Transaction

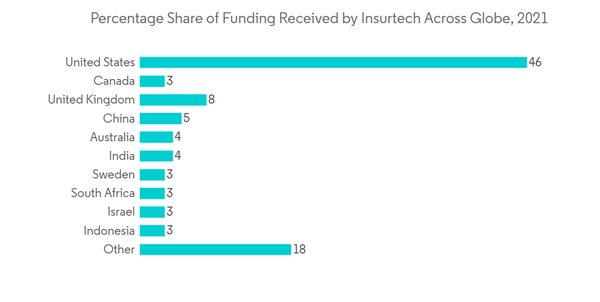

Private capital continued to flood the Insurance Industry in 2021, driving total investments in insurtechs to new heights across all insurance types, investment stages, and regions. To meet the demands of customers seeking smarter and more efficient products and services and to compete more effectively with insuretechs many insurance incumbents are fast tracking next generation operating models that combine the best of human and technological capabilities.North america is Witnessing the maximum share of insurtech funding transaction throughout the Globe. Over fifty percent of funding transaction in Insurtech is funded from North American Countries signifying that the increasing demand for end-to-end digital financial solutions is propelling the regional market growth and also this is expected to gro further till theforecast period.North America Insurtech Industry Overview

The North America Insurtech Market is highly competitive and fragmented as various international and regional vendors provide new technology to various end-use industries to expand the market. The key players are emerging to improve their products and delivery through manufacturing techniques and enhancing their products to have a competitive edge over others. Furthermore, the companies are involved in acquisitions and expansion to improve their product offerings and increase the production process. They undergo partnerships and collaborations with leading automotive manufacturers to address the demand and strengthen their presence across North America. The report highlights the numerous strategic initiatives, such as new business deals and collaborations, mergers & acquisitions, joint ventures, product launches, and technological upgradation, implemented by the leading market contenders to set a firm foot in the market. Hence, this section. They include the company profiles of the key players and industry analysis. The Insurtech industry across North America is offered by groups such as Lemonade, Gusto, Oscar Health, CareCloud, and Amwell.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Lemonade

- Gusto

- Oscar

- CareCloud

- America Well

- Bright Health

- Clover Health

- Root Insurance

- Next Insurance

- GoHealth*