Increasing Geriatric Population Fuels North America Opioids Market

The majority of older people live with chronic pain, resulting in reduced strength to carry out their daily routine. The geriatric population widely suffers from bone and joint disorders, arthritis, cancer, and other chronic disorders causing pain. According to the World Health Organization (WHO) data from February 2018, the geriatric population is estimated to grow by 22% by 2050 compared with 12% in 2015. The data also stated that low- and middle-income countries would account for nearly 80% of this surge.Developed countries such as the US, Canada, the UK, France, Germany, and Japan, and developing countries such as China, India, and South Korea are also experiencing significant growth in the geriatric population, which is driven by improved healthcare facilities and better healthcare services; this has resulted in increased life expectancy in these regions.

According to NCBI Journal, strong opioid prescribing is more prevalent in the aging population, growing at the fastest rate in this age group. As per the Agency for Healthcare Research and Quality, 12.8% of adults aged 65 and older, on average, had at least one outpatient opioid prescription, and 4.4% had four or more opioid prescriptions during 2020-2021 in the US.

Furthermore, older adults qualifying under the poor category (6.1%), low-income category (6.6%), and middle-income category (5.2%) were more likely than those grouped under the high-income category (2.6%) to get four or more opioid prescription fills during 2020-2021. Thus, the growing geriatric population across the world drives the growth of the North America opioids market.

North America Opioids Market Overview

Opioid-based pain medications are a cornerstone of orthopedic care for patients with moderate to severe arthritis pain. As per data released by the Centers for Disease Control and Prevention (CDC) in October 2023 on arthritis prevalence, nearly 21.2% of adults in the US (i.e., 53.2 million people) had doctor-diagnosed arthritis during 2019-2021, and the number is projected to reach 78.4 million by 2040. The demand for opioids is increasing for pain management with the growing cases of arthritis.On the other hand, the surging cases of opioid overdose are affecting the growth of the North America opioids market. As per the World Health Organization (WHO) statistics on opioid overdose, there were 70,630 deaths due to drug overdose in 2019 in the US. The CDC also estimated that ~280,000 people in the country died from the overdose of prescription opioids during 1999-2021. In 2021, nearly 21% of all opioid overdose deaths in the country involved a prescription opioid. Due to the increasing number of cases and mortality rate from opioid overdoses, the CDC labeled the situation as a nationwide Public Health Emergency in 2017.

This situation was also referred to as the opioid crisis, which included the rapid increase in overuse, misuse/abuse, and overdose deaths attributed to the class of opioid drugs. To tackle the situation of opioid crisis and prevent intentional misuse, the Food and Drug Administration (FDA) is encouraging the development of prescription opioids with abuse-deterrent formulations (ADFs). The FDA approved hydrocodone bitartrate in March 2021. It is the first FDA-approved generic opioid with an ADF, and the medication has properties that are expected to reduce the misuse of the drug when chewed and then taken orally, crushed and snorted, or injected.

Further, to address the unmet medical needs, there has been an increase in medication approval in the US. Thus, the North America opioids market players have been focusing on strategies such as product approvals and advancements to broaden their product portfolio, and expansions and mergers to improve their market share. In March 2020, Trevena, Inc. received FDA approval for OLINVYK (oliceridine), an opioid agonist indicated for the management of moderate to severe acute pain in adults, especially when the pain is severe enough to require an intravenous opioid.

North America Opioids Market Segmentation

The North America opioids market is categorized into product, application, route of administration, distribution channel, and country.- Based on product, the North America opioids market is bifurcated immediate release short acting opioid and extended release long acting opioid. The immediate release short acting opioid segment held a larger market share in 2022. The immediate release short acting opioid is further sub segmented into oxycodone, hydrocodone, tramadol, codeine, propoxyphene, and others. The extended release long acting opioid is further sub segmented into oxycodone, fentanyl, morphine, methadone, and others.

- In terms of application, the North America opioids market is categorized into pain management, anesthesia, diarrhea suppression, cough suppression, de-addiction, and others. The pain management segment held the largest market share in 2022.

- By route of administration, the North America opioids market is segmented into oral, injectable, and transdermal patch. The oral segment held the largest market share in 2022.

- By distribution channel, the North America opioids market is bifurcated into hospital pharmacies and retail pharmacies. The hospital pharmacies segment held a larger market share in 2022.

- By country, the North America opioids market is segmented into the US, Canada, and Mexico. The US dominated the North America opioids market share in 2022.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America opioids market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America opioids market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America opioids market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Opioids Market include:- Purdue Pharma LP

- Endo International plc

- Mallinckrodt Plc

- Collegium Pharmaceutical Inc

- Neuraxpharm Pharmaceuticals SL

- Hikma Pharmaceuticals Plc

- Rusan Pharma Ltd

- Trevena Inc

- Teva Pharmaceutical Industries Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | November 2024 |

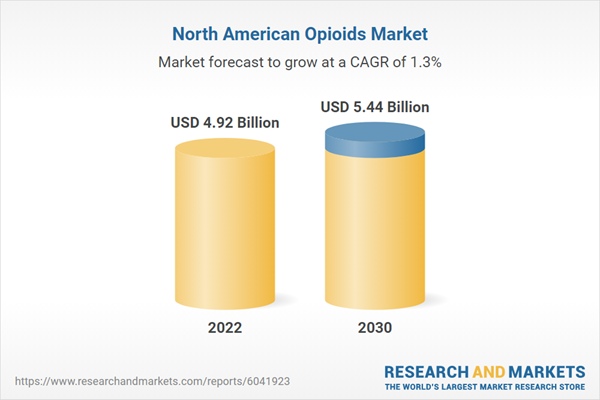

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 4.92 Billion |

| Forecasted Market Value ( USD | $ 5.44 Billion |

| Compound Annual Growth Rate | 1.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |