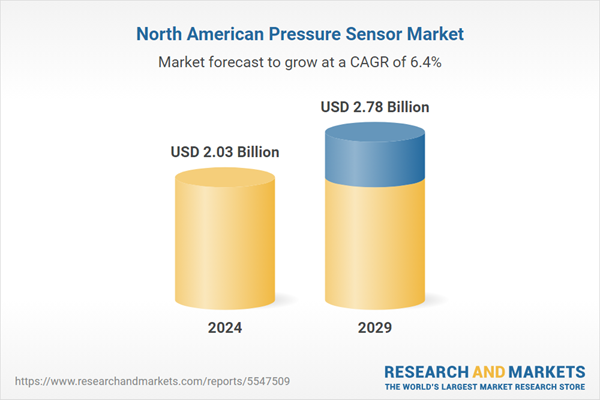

The North American pressure sensor market is projected to grow at a CAGR of 6.43% over the forecast period, from US$2.03 billion in 2024 and is expected to reach US$2.78 billion by 2029.

A pressure sensor is a mechanism tool that converts applied pressure into an electrical signal. It's a small transducer that measures the pressure applied per unit area on a surface. When force is exerted, it fills a fixed chamber and pushes on a pressure-sensitive component, which can be a diaphragm or strain gauge. The sensor converts this physical alter into an electrical signal, either analog (voltage shifts with pressure) or digital (changed over to a numerical value). They are extensively utilized in diverse industrial applications.One of the major drivers for the growing market size of the North American pressure sensor is that the industrial sector in the region intensely depends on pressure sensors in manufacturing, oil & gas, and power generation. Moreover, the consumer electronics industry also fuels pressure sensor demand in smartphones, wearables, and smart home gadgets. Automation adoption and advancements in pressure sensor technology led to higher precision and wider pressure ranges, thus developing the market growth in the years ahead.

The United States has reliably produced more crude oil than any other country for six consecutive years, with an average daily production of 12.9 million barrels per day (b/d) in 2023. This figure broke the previous record of 12.3 million b/d set in 2019. The average monthly production was evaluated at a record high of over 13.3 million barrels per day in December 2023.

Further, Mexico and PEMEX committed to removing burning and scheduling venting in oil and gas operations at the Summit of North American Countries in 2021, with an evaluated $2 billion venture and an execution plan until 2030. Mexico, moreover, vowed to recapture methane gas produced during oil and gas production and reuse it (98%) by 2024. This pressure sensor guarantees safety and optimal performance by monitoring pressure in wells, pipelines, and processing equipment in oil and gas production, increasing market expansion.

Additionally, the increasing technological advancements, rising industrial automation, and growing demand for IoT-enabled devices are expected to propel market growth in the coming years. Moreover, several OEMs have started using microelectromechanical system (MEMS) pressure sensors in smartphones, tablets, and wearables, which are anticipated to positively impact market growth in the projected period.

NORTH AMERICA PRESSURE SENSOR MARKET DRIVERS:

The Rising demand in the automotive industry is predicted to bolster the demand for pressure sensors in North America.

The region's pressure sensor market is gaining momentum due to the rising adoption of automation in automotive industries, which need sensors for mechanized processes, monitoring frameworks, and data collection. The automotive sector requires high-precision, reliable pressure sensors, which drive the advancement in the pressure sensor industry in North America. Moreover, with the rise in production and demand for automated motor vehicles, the utilization of advanced features like pressure sensors will also grow in demand.As per ACEA data on the World Motor Vehicle Production Report of May 2023, North America witnessed an increment in the production of vehicles from 13.59 million units in 2021 to 14.90 million units in 2022. Moreover, present-day vehicles intensely depend on pressure sensors for basic functions, as well as progressing safety features like Tire Pressure Monitoring Systems (TPMS) and the effectiveness and execution of their engines.

Additionally, stricter directions concerning emissions and safety benchmarks will fuel the adoption of pressure sensors in vehicles among consumers and automotive manufacturers. This propels the pressure sensor industry’s expansion in the coming years.

NORTH AMERICA PRESSURE SENSOR MARKET GEOGRAPHICAL OUTLOOK

The United States region is predicted to have a significant market share.

The United States pressure sensors market is anticipated to grow moderately in the projected period, owing to the increasing use of pressure sensors in various end-use industries such as automotive, healthcare, and consumer goods. Moreover, the increasing use of Internet of Things (IoT) connected devices is anticipated to fuel market growth, as pressure sensors are being used to transform the development of smart cities, smart homes, and smart factories.Additionally, the growing sales of automotives in the country is one of the major reasons boosting the market growth in the coming years. According to the U.S. Energy Information Administration (EIA), combined sales of battery electric vehicles (BEV), plug-in hybrid vehicles, and hybrid vehicles rose to 16.3% of the total new-light duty vehicles in 2023 in the United States.

North America Pressure Sensor Key Market Players:

- ABB Group- ABB Group, founded in 1988, is a merger of two companies, ASEA and BBC. The company is one of the technology leaders in automation and electrification, trying to achieve a more sustainable and resource-efficient future. It has more than 1,05,000 employees, and approximately 7,000 of them are in the research and development team.

- Schneider Electric SE- Schneider Electric SE is a global industrial technology leader focused on digitalization, automation, and electrification in smart industries. The company has over 1,50,000 employees and operates in over 100 countries.

- Baker Hughes Company- Baker Hughes Company is a leading energy technology company that designs, manufactures, and provides services for transformative technologies to help move energy forward. The company is present in more than 120 countries and achieved 199 HSE days in 2023.

Market Segmentation:

The North American Pressure Sensor Market is segmented and analyzed as below:

By Type

- Absolute Pressure Measurement

- Differential Pressure Measurement

- Gauge Pressure Measurement

By Technology

- Piezoresistive Pressure Sensor

- Electromagnetic Pressure Sensor

- Optical Pressure Sensor

- Resonant Solid State Pressure Sensor

- Capacitive Pressure Sensor

By End-Users

- Energy and Power

- Oil and Gas

- Healthcare

- Manufacturing

- Consumer Electronics

- Automotive

- Others

By Country

- United States of America

- Canada

- Mexico

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- ABB Group

- Siemens AG

- NXP Semiconductors

- Rockwell Automation, Inc.

- Schneider Electric SE

- Honeywell International, Inc.

- PCB Piezotronics

- Baker Hughes Company

- TE Connectivity

- STMicroelectronics

- Infineon Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 98 |

| Published | August 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 2.03 Billion |

| Forecasted Market Value ( USD | $ 2.78 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | North America |

| No. of Companies Mentioned | 12 |