Increasing Demand for Radiation Protection Apron in Hospitals Fuel North America Radiation Protection Apron Market

Expanding volume of radiology procedures, heightened awareness of radiation safety, and prioritization of personnel and patient well-being are among the multifaceted factors propelling the demand for radiation protection aprons, particularly within the context of hospitals and healthcare facilities. Hospitals, as central hubs for medical imaging, interventional radiology, and other radiation-intensive procedures, are primary contributors to the escalating demand for radiation protection aprons.The growing utilization of diagnostic imaging modalities, such as X-ray, fluoroscopy, and computed tomography (CT), has increased the need for personalized radiation protection solutions, including lead aprons, lead-free, lead-equivalent materials, and other radiation shielding equipment. Moreover, the rising prevalence of minimally invasive interventional procedures, such as cardiac catheterization and fluoroscopically guided interventions, has amplified the requirement for radioprotective gear to mitigate radiation exposure among healthcare personnel and patients.

The awareness of radiation safety, regulatory requirements, and the need to safeguard healthcare professionals from occupational radiation exposure have further accentuated the demand, fostering the adoption of advanced radiation protection solutions within hospitals and medical imaging centers, thereby promoting the integration of cutting-edge technology in the designing and manufacturing of radiation protection aprons that contribute to enhanced protective capabilities and user comfort.

North America Radiation Protection Apron Market Overview

The number of certified radiologic technicians, rising safety consciousness, an increase in orthopedic and spine procedures, and an increase in PET/CT scans are the key reasons propelling the expansion of the US radiation protection aprons market. Furthermore, the US plays a significant role in the healthcare sector, investing a substantial amount of money in medical treatment and diagnostics. Nearly seven out of ten Americans will receive a medical or dental imaging picture in 2021, according to the US FDA's 2021 overview on X-rays. In December 2020, a paper published in the Journal of Radiology demonstrated the significance of radiology in the US healthcare systems.The paper also included several recommendations for potential improvements in how radiography influences treatment choices, patient results, and societal advantages. During the projected period, the radiation protection apron market is anticipated to grow due to rising awareness of the importance of radiology and the growing number of radiologists working in the healthcare industry.

North America Radiation Protection Apron Market Segmentation

- The North America radiation protection apron market is segmented based on type, material, end user, and country. Based on type, the North America radiation protection apron market is categorized into vest & skirt apron, front protection apron, and others. The vest & skirt apron segment held the largest market share in 2022.

- In terms of material, the North America radiation protection apron market is categorized into lead apron, light lead composite apron, and lead-free apron. The lead apron segment held the largest market share in 2022.

- Based on end user, the North America radiation protection apron market is categorized into hospitals, clinics & radiology centers, research laboratories, and others. The clinics & radiology segment held the largest market share in 2022.

- By country, the North America radiation protection apron market is segmented into the US, Canada, and Mexico. The US dominated the North America radiation protection apron market share in 2022.

- BLOXR Solutions LLC, Infab LLC, Epimed International Inc, Shielding International Inc, Protech Medical, Wolf X-Ray Corp, Alimed Inc, Burlington Medical LLC, and Barrier Technologies LLC are some of the leading companies operating in the North America radiation protection apron market.

Market Highlights

- Based on type, the North America radiation protection apron market has been categorized into vest & skirt apron, front protection apron, and others. The vest & skirt apron segment held 58.4% share of North America radiation protection apron market in 2022, amassing US$ 34.11 million. It is projected to garner US$ 52.01 million by 2030 to expand at 5.4% CAGR during 2022-2030.

- In terms of material, the North America radiation protection apron market has been categorized into lead apron, light lead composite apron, and lead-free apron. The lead apron segment held 38.0% share of North America radiation protection apron market in 2022, amassing US$ 22.21 million. It is projected to garner US$ 31.78 million by 2030 to expand at 4.6% CAGR during 2022-2030.

- The clinics & radiology centers segment held 48.3% share of North America radiation protection apron market in 2022, amassing US$ 28.22 million. It is projected to garner US$ 42.86 million by 2030 to expand at 5.4% CAGR during 2022-2030.

- This analysis states that the US captured 83.2% share of North America radiation protection apron market in 2022. It was assessed at US$ 48.61 million in 2022 and is likely to hit US$ 73.08 million by 2030, exhibiting a CAGR of 5.2% during 2022-2030.

- In April 2022, Infab, LLC announced the complete acquisition of the glove division of International Biomedical, Ltd. The acquisition has expanded Infab LLC's product portfolio to reduce radiation exposure during surgical procedures.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America radiation protection apron market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America radiation protection apron market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America radiation protection apron market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Radiation Protection Apron market include:- BLOXR Solutions LLC

- Infab LLC

- Epimed International Inc

- Shielding International Inc

- Protech Medical

- Wolf X-Ray Corp

- Alimed Inc

- Burlington Medical LLC

- Barrier Technologies LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

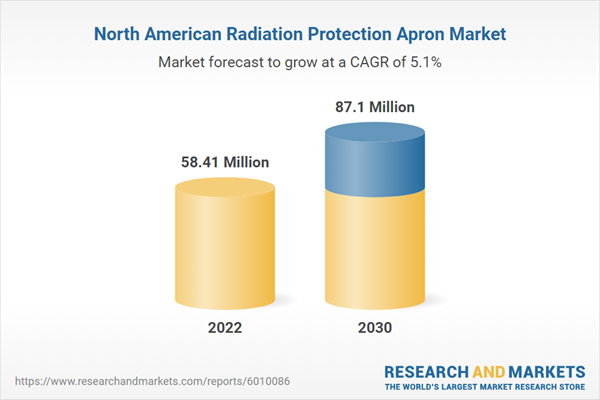

| Estimated Market Value ( USD | $ 58.41 Million |

| Forecasted Market Value ( USD | $ 87.1 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |