Increase in Generation of Medical Waste Fuels North America Sharps Containers Market

Healthcare facilities are primarily responsible for collecting, separating, and disposing of the medical, infectious, and hazardous waste they generate. Increasing prevalence of infectious diseases, rising number of hospital visits and admissions, and growing demand for diagnostic and clinical testing contribute to the generation of large amounts of single-use waste. The resulting medical waste is excluded from general waste disposal and must be disposed of effectively. According to the World Health Organization, 16 million injections are used worldwide each year, but there need to be proper disposal options. In the US, with its advanced healthcare facilities, exposure to bloodborne pathogens from needles and other sharp objects is a serious problem, resulting in 385,000 incidents yearly. 85% of all medical waste generated is general non-hazardous waste, and the remaining 15% is hazardous waste containing harmful microorganisms. Therefore, medical waste disposal is the need of the hour, which is increasing the demand for sharps containers worldwide.In addition, large-scale vaccination programs are being carried out in different parts of the world to counteract the further emergence and spread of the pandemic, which is expected to have a significant impact on the market under study. For example, according to the World Health Organization's Coronavirus Dashboard, ~12.5 billion vaccines were administered worldwide by the end of August 2022, which generated a significant number of syringes as waste. Therefore, the COVID-19 pandemic impacted the North America sharps container market significantly.

The generation of a large amount of medical waste is increasing the demand for sharps containers for the proper disposal of these medical wastes, thereby boosting the market growth.

North America Sharps Containers Market Overview

The North America sharps containers market is segmented into the US, Canada, and Mexico. The region holds a significant share of the North America sharps containers market. The North America sharps containers market is expected to witness significant growth during the forecast period due to the rising prevalence of chronic diseases such as diabetes and cardiac diseases. Moreover, a rise in hospitalization and surgeries is likely to offer growth opportunities to the market during the forecast period. In the US, there is a standard practice for patients to deposit their needles, syringes, and other medical waste products with their curbside trash. Medical waste from hospitals and healthcare organizations is highly regulated in the US. Medical waste is collected only by certified medical waste hauling and disposal companies; the waste is then autoclaved and placed in a landfill.According to an article titled"Summary of Information on The Safety and Effectiveness of Syringe Services Programs (SSPs)," published in the Centers for Disease Control and Prevention (CDC) - the US has seen an increase in injection drug use, primarily the injection of opioids. Outbreaks of hepatitis C, hepatitis B, and HIV infections have been correlated with these injection patterns and trends. The majority of new hepatitis C virus (HCV) infections are due to injection drug use, and the nation has witnessed an exponential increase in reported cases of HCV from 2010 to 2019. Furthermore, the incidences of 5 new HCV virus infections are increasing rapidly among young people, with the majority of cases being among individuals aged 20-39 years.

Moreover, the prevalence of chronic illnesses such as Crohn's disease and diabetes, which can be treated with self-injectable medication, is rising across the US. Major corporations such as BD and Smiths Medical are also making syringes, such as BD's Hypak SCF PRTC glass pre-fillable syringe, specifically for the treatment of chronic diseases to strengthen their market positions. Additionally, in May 2021, BD stated that it plans to expand its Diabetes Care division into a distinct, publicly traded company. BD Diabetes Care, which supports ~30 million patients annually and produces approximately 8 billion injection devices, has been a significant driver of the adoption of insulin syringes and other products in the country.

Therefore, the rising cases of diabetes and needlestick injuries and growing government initiatives are expected to boost the North America sharps containers market growth in the US during the forecast period.

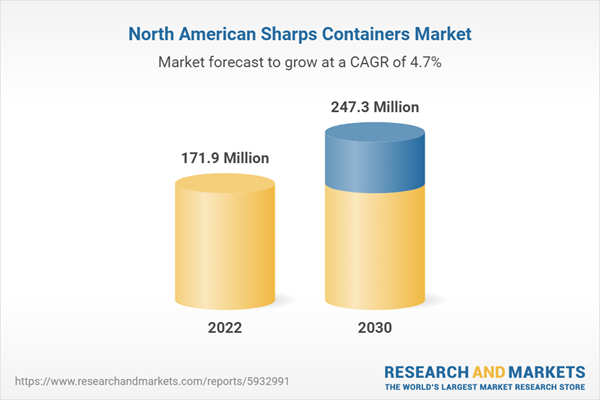

North America Sharps Containers Market Revenue and Forecast to 2030 (US$ Million)

North America Sharps Containers Market Segmentation

The North America sharps containers market is segmented into product, usage, waste type, waste generators, container size, distribution channel, and country.Based on product, the North America sharps containers market is segmented into multipurpose containers, patient room containers, and phlebotomy containers. The multipurpose containers segment held the largest share of the North America sharps containers market in 2022.

Based on usage, the North America sharps containers market is segmented into reusable containers and disposable containers. The reusable containers segment held a larger share of the North America sharps containers market in 2022.

Based on waste type, the North America sharps containers market is segmented into infectious waste and non-infectious waste. The infectious waste held a larger share of the North America sharps containers market in 2022.

Based on waste generators, the North America sharps containers market is segmented into hospitals, pharmaceutical companies, laboratories, clinics & physician’s offices, and others. The hospitals held the largest share of the North America sharps containers market in 2022.

Based on container size, the North America sharps containers market is segmented into 1-3 gallons, 4-6 gallons, 7-8 gallons, and others. The 1-3 gallons held the largest share of the North America sharps containers market in 2022.

Based on distribution channel, the North America sharps containers market is segmented into medical supply companies, pharmacies, online sale, and others. The medical supply companies held the largest share of the North America sharps containers market in 2022.

Based on country, the North America sharps containers market is segmented int o the US, Canada, and Mexico. The US dominated the North America sharps containers market in 2022.

Becton Dickinson and Co, Bemis Co Inc, Bondtech Corp, EnviroTain LLC, GPC Medical Ltd, Mauser Group NV, Stericycle Inc, and The Harloff Co are some of the leading companies operating in the North America sharps containers market.

Table of Contents

Executive Summary

At 4.7% CAGR, the North America Sharps Containers Market is speculated to be worth US$ 247.28 million by 2030.According to this research, the North America sharps containers market was valued at US$ 171.90 million in 2022 and is expected to reach US$ 247.28 million by 2030, registering a CAGR of 4.7% from 2022 to 2030. Increase in generation of medical waste and growing use of multipurpose containers are among the critical factors attributed to the North America sharps containers market expansion.

Multipurpose containers can easily store a variety of sharps as they are relatively larger than other sharps containers. Multipurpose containers are widely used in the market owing to their versatility in various applications, availability in various sizes and shapes, and demand by healthcare providers, research institutes, and hospitals. Multipurpose containers are not space or function-specific; they can be easily used in different environments and are easy to assemble and inexpensive. In addition, they offer maximum safety for medical professionals and are environmentally friendly. These containers can be easily disinfected and reused. Various companies offer multipurpose containers, including Cardinal Health; Becton Dickinson and Co; and EnviroTain.

Growing medical waste and the rising need for proper disposal are among the main factors expected to drive the demand for multipurpose containers, as they are the preferred choice of multiple medical institutions. Therefore, the growing volume of medical waste, multiple surgeries, and the advantages of multipurpose containers over other types are expected to provide growth for the multipurpose containers, thereby boosting the North America sharps containers market.

On the contrary, lack of awareness about proper methods of sharps waste containment & disposal hampers the North America sharps containers market.

Based on product, the North America sharps containers market is segmented into multipurpose containers, patient room containers, and phlebotomy containers. The multipurpose containers segment held 42.6% share of the North America sharps containers market in 2022, amassing US$ 73.15 million. It is projected to garner US$ 108.13 million by 2030 to expand at 5.0% CAGR during 2022-2030.

Based on usage, the North America sharps containers market is segmented into reusable containers and disposable containers. The reusable containers segment held 63.7% share of North America sharps containers market in 2022, amassing US$ 109.44 million. It is projected to garner US$ 153.39 million by 2030 to expand at 4.3% CAGR during 2022-2030.

Based on waste type, the North America sharps containers market is segmented into infectious waste and non-infectious waste. The infectious waste segment held 71.5% share of North America sharps containers market in 2022, amassing US$ 122.86 million. It is projected to garner US$ 179.23 million by 2030 to expand at 4.8% CAGR during 2022-2030.

Based on waste generators, the North America sharps containers market is segmented into hospitals, pharmaceutical companies, laboratories, clinics & physician’s offices, and others. The hospitals segment held 46.2% share of North America sharps containers market in 2022, amassing US$ 71.74 million. It is projected to garner US$ 108.99 million by 2030 to expand at 5.4% CAGR during 2022-2030.

Based on container size, the North America sharps containers market is segmented into 1-3 gallons, 4-6 gallons, 7-8 gallons, and others. The 1-3 gallons segment held 39.9% share of North America sharps containers market in 2022, amassing US$ 68.55 million. It is projected to garner US$ 101.99 million by 2030 to expand at 5.1% CAGR during 2022-2030.

Based on distribution channel, the North America sharps containers market is segmented into medical supply companies, pharmacies, online sale, and others. The medical supply companies segment held 46.4% share of North America sharps containers market in 2022, amassing US$ 79.83 million. It is projected to garner US$ 117.04 million by 2030 to expand at 4.9% CAGR during 2022-2030.

Based on country, the North America sharps containers market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US captured 77.3% share of North America sharps containers market in 2022. It was assessed at US$ 132.92 million in 2022 and is likely to hit US$ 191.94 million by 2030, exhibiting a CAGR of 4.7% during 2022-2030.

Key players operating in the North America sharps containers market are Becton Dickinson and Co, Bemis Co Inc, Bondtech Corp, EnviroTain LLC, GPC Medical Ltd, Mauser Group NV, Stericycle Inc, and The Harloff Co, among others.

Companies Mentioned

- Becton Dickinson and Co

- Bemis Co Inc

- Bondtech Corp

- EnviroTain LLC

- GPC Medical Ltd

- Mauser Group NV

- Stericycle Inc

- The Harloff Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 87 |

| Published | December 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 171.9 Million |

| Forecasted Market Value by 2030 | 247.3 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |