Growing Cyberattack Incidents Across Various Industries Fuels North America SOC as a Service Market

In recent years, several organizations across various industries have faced several cyberattacks. According to AAG IT Services, ~236.1 million ransomware attacks took place globally in the first half of 2022. Such growing cyberattacks are affecting various organizations' brand value, which is compelling various large organizations and small & medium enterprises to opt for SOC as a service (SOCaaS) to protect consumer information and improve organization security. This factor is helping the players operating in the SOC as a service market to capitalize their customer base and revenues. A few of the data breach incidents that occurred in recent years are mentioned below:- In January 2021, Parler, the conservative social media app, witnessed that a hacker scraped its data. Approximately 70 TB of information was leaked, which included 99.9% of messages, posts, and video data containing EXIF data. In addition, Parler's Verified Citizens, or the users who had verified their identity by uploading their photo IDs, including driver's licenses, among others, were also exposed.

- In February 2021, Nebraska Medicine announced that through a malware attack, a hacker accessed and copied files containing the personal, along with medical information, of 219,000 patients.

- In March 2021, SITA, a global IT company that supports 90% of the world's airlines, confirmed that it fell victim to a cyberattack, exposing the personally identifiable information (PII) of various airline passengers.

- In May 2021, various law offices of Bailey & Galyen faced a cyberattack that exposed the personal information of an undisclosed figure of clients and employees.

- In June 2021, Wegmans Food Markets, a US supermarket chain, alerted an undisclosed number of customers that their critical data was exposed to the public after two of its cloud-based databases were misconfigured and made accessible online.

North America SOC as a Service Market Overview

The US, Canada, and Mexico are among the major economies in North America. North America SOC as a service market is witnessing growth owing to the wide presence of key market players such as Fortinet, Inc.; Verizon; AT&T; Arctic Wolf Networks Inc.; and Cloudflare, Inc. These players continuously develop and expand their service portfolio to attract new customers. For instance, in April 2023, Fortinet, Inc. launched FortiOS 7.4 to support organizations in building cybersecurity platforms across endpoint security, SOC automation, application security, identity and access, and threat intelligence. FortiOS 7.4 has new real-time response and automation capabilities that help the user increase effectiveness, improve efficacy, and accelerate time to resolve sophisticated attacks. In addition, Fortinet, Inc. expands Fortinet Security Fabric by adding new and enhanced products and capabilities that allow its users to advance threat prevention and coordinate response for a self-defending ecosystem across networks, clouds, and endpoints. Moreover, implementing IoT in business operations makes hyperconnectivity affordable to enterprises, which increases the demand for IoT among enterprises. According to Cisco, the US is expected to register 13.6 billion per capita IoT devices and connections by the end of 2023. The adoption of IoT devices and connections adds complexity for the SOC team to detect cyberattacks. The security team is already dealing with the ever-changing cybersecurity industry, implementing IoT in business operations, and creating challenges for the SOC team to understand patterns of cyberattacks.Increasing government investment in advanced innovations in the technologies is driving the market. For instance, in December 2022, the Government of the US plans to turn the Middle American metro area into a hub for tech innovation. The government invested US$ 500 million in the Regional Technology and Innovation Hub program to convert countries of Middle America into essential centers of innovation. These centers are focused on research and development of new technologies such as IoT, AI, and ML to promote automation in the business. These technologies are highly vulnerable to cyberattacks and data breaches, which increases the demand for SOC as a Service among users to protect their data.

North America SOC as a Service Market Segmentation

The North America SOC as a service market is segmented into service type, enterprise size, application, industry, and country.Based on service type, the North America SOC as a service market is segmented into prevention service, detection service, and incident response service. The prevention service segment held the largest share of the North America SOC as a service market in 2022.

In terms of enterprise size, the North America SOC as a service market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the North America SOC as a service market in 2022.

By application, the North America SOC as a service market is segmented into network security, endpoint security, application security, and cloud security. The endpoint security segment held the largest share of the North America SOC as a service market in 2022.

In terms of industry, the North America SOC as a service market is segmented into BFSI, IT and telecom, manufacturing, retail, government and public sector, healthcare, and others. The BFSI segment held the largest share of the North America SOC as a service market in 2022.

Based on country, the North America SOC as a service market is segmented into the US, Canada, and Mexico. The US dominated the North America SOC as a service market in 2022.

Arctic Wolf Networks Inc, AT&T Inc, Atos SE, Cloudflare Inc, Fortinet Inc, NTT Data Corp, Thales SA, and Verizon Communications Inc are some of the leading companies operating in the North America SOC as a service market.

Table of Contents

Companies Mentioned

- Arctic Wolf Networks Inc

- AT&T Inc

- Atos SE

- Cloudflare Inc

- Fortinet Inc

- NTT Data Corp

- Thales SA

- Verizon Communications Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 96 |

| Published | May 2024 |

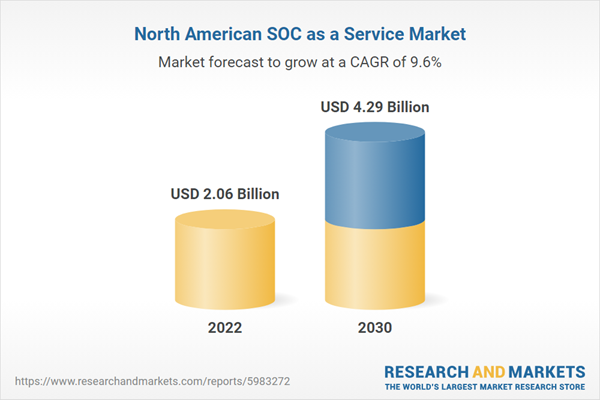

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.06 Billion |

| Forecasted Market Value ( USD | $ 4.29 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |