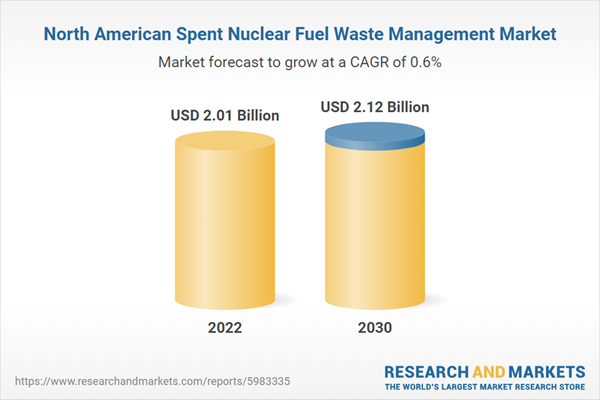

Key Role of Nuclear Power in Future Energy Transition Fuels North America Spent Nuclear Fuel Waste Management Market

Nuclear power can indeed play a vital role in the future energy transition and energy mix. Its low carbon emissions make it a valuable advantage against climate change, as it can provide consistent, emission-free electricity. Lowering carbon emissions is especially important as many countries across the globe are taking several measures to lower their dependence on fossil fuels and transition to cleaner energy sources. Nuclear power's ability to provide baseload power ensures grid stability when renewable sources such as wind and solar are intermittent, thereby contributing to a more reliable energy supply. Moreover, nuclear power enhances energy security by reducing dependence on fossil fuel imports, which can be geopolitically unstable. Its long-term energy supply potential, with advanced reactor designs and fuel recycling, offers sustainability in meeting global energy demands. However, challenges such as safety concerns, radioactive waste management, and high capital costs must be effectively addressed to realize this potential. Public perception, regulatory support, and technological innovations will determine the extent to which nuclear power is integrated into the future energy mix. Nuclear power is expected to be one of the key sources of electricity generation in the future. Nuclear power is a sustainable source of power generation, provides low carbon emissions, and fulfills the demand for future power consumption. Hence, role of nuclear power in future energy transition will fuel the demand for nuclear power plants to achieve the power generation targets of future which in turn is anticipated to drive the growth of the market in the coming years.North America Spent Nuclear Fuel Waste Management Market Overview

The North America spent nuclear fuel waste management market is segmented into countries including the US, Canada, and Mexico. Nuclear power generation in North America accounted for 864.18 TWh in 2022, and the US is the major producer of nuclear power generation in the region, with 772.0 TWh in 2022. Nuclear power generation from the plants results in spent nuclear fuel generation; thus, there is a rising need for proper nuclear waste management in the region. In addition, North America faces several challenges while managing spent nuclear fuel waste such as political, social, and technological barriers which are expected to retrain the market for spent nuclear fuel waste management. In the US and Canada, the primary strategy involves on-site storage at nuclear power plants, typically in pools or dry cask storage. However, a long-term solution still needs to be formulated due to political, environmental, and logistical challenges. In the US, the proposed Yucca Mountain repository in Nevada has faced extensive opposition and is currently in a state of uncertainty. Meanwhile, the search for alternative disposal sites continues. Canada, on the other hand, has made progress with the concept of adaptive phased management, which includes the construction of a deep geological repository for high-level waste in Ontario. However, this initiative also faces public and indigenous community concerns. Efforts in North America revolve around securing nuclear waste, advancing disposal solutions, and increasing public engagement to ensure the safe, long-term management of spent fuel waste. The US is leading the spent nuclear fuel waste management market in North America. According to the World Nuclear Association, as of 2022, the US had 92 operable nuclear reactors, including 61 pressurized water reactors and 31 boiling water reactors, which are responsible for the spent nuclear fuel waste in the country. According to the US Energy Information Association (EIA), the country generated about 772 TWh of electricity in 2022 from nuclear power plants. Spent nuclear fuel waste management in the US is driven by several key factors. Foremost among these is the imperative to establish secure and safe storage and disposal methods, given the inherent environmental and safety risks posed by long-lasting radioactive waste. Political and regulatory pressures also exert a significant influence as both federal and state governments grapple with addressing public con, ensuring compliance with legal mandates, and aligning waste management strategies with existing laws. Economic considerations, including the costs of storage and potential liabilities, underscore the need for sustainable, cost-effective, and efficient solutions.North America Spent Nuclear Fuel Waste Management Market Segmentation

The North America spent nuclear fuel waste management market is segmented into reactor type, disposal type, and country.Based on reactor type, the North America spent nuclear fuel waste management market is bifurcated into pressurized water reactor and boiling water reactor. The pressurized water reactor segment held a larger share of the North America spent nuclear fuel waste management market in 2022.

In terms of disposal type, the North America spent nuclear fuel waste management market is bifurcated into deep surface disposal and near surface disposal. The deep surface disposal segment held a larger share of the North America spent nuclear fuel waste management market in 2022.

Based on country, the North America spent nuclear fuel waste management market is segmented into the US, Canada, and Mexico. The US dominated the North America spent nuclear fuel waste management market in 2022.

Perma-Fix, US Ecology Inc, Veolia Environnement SA, EnergySolutions, BHI Energy, Waste Control Specialists LLC, and Bechtel Corp are some of the leading companies operating in the North America spent nuclear fuel waste management market.

Table of Contents

Companies Mentioned

- Perma-Fix

- US Ecology Inc

- Veolia Environnement SA

- EnergySolutions

- BHI Energy

- Waste Control Specialists LLC

- Bechtel Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 60 |

| Published | May 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.01 Billion |

| Forecasted Market Value ( USD | $ 2.12 Billion |

| Compound Annual Growth Rate | 0.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 7 |