As a thermoplastic polymer, polycarbonate offers a unique combination of properties, making it a preferred choice for applications requiring thermal management, such as LED lighting, automotive components, and electronics enclosures. Its inherent flame resistance and high impact strength add to its appeal in demanding environments. Despite facing competition from other thermally conductive materials, polycarbonate stands out for its optical clarity and dimensional stability, allowing for versatile design possibilities. Thus, in Canada, 327.2 tonnes of Polycarbonate thermoplastic utilized in 2023.

The US market dominated the North America Thermally Conductive Plastics Market by Country in 2023, and is forecast to continue being a dominant market till 2031; thereby, achieving a market value of $102.63 millions by 2031. The Canada market is exhibiting a CAGR of 15.1% during (2024 - 2031). Additionally, The Mexico market is projected to experience a CAGR of 14.2% during (2024 - 2031).

The market refers to the industry involved in the production, distribution, and utilization of plastics that possess thermal conductivity properties. These plastics are engineered to efficiently transfer heat away from electronic components, machinery, and other applications where effective thermal management is crucial.

The applications of thermally conductive plastics are diverse and widespread, spanning various industries where efficient heat dissipation and lightweight solutions are critical. Electronics manufacturers frequently utilize thermally conductive plastics to provide heat sinks for gadgets like computers, tablets, smartphones, and LED lighting fixtures. These materials help dissipate heat generated by electronic components, preventing overheating and prolonging the device’s lifespan.

Thermally conductive plastics can be integrated into circuit board substrates to enhance thermal management in electronic devices. By embedding thermally conductive fillers within the polymer matrix, manufacturers can improve heat dissipation and optimize the performance of electronic circuits.

With high automotive production in Mexico, there would likely be a greater demand for thermally conductive plastics. These materials are used in various automotive components, such as LED lighting systems, engine cooling systems, battery thermal management systems, and electronic control units (ECUs). As the automotive sector expands, so does the need for these components, thus driving the demand for thermally conductive plastics.

According to the International Trade Administration (ITA), Mexico is the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually. Eighty-eight percent of vehicles produced in Mexico are exported. Mexico is the world’s fifth-largest manufacturer of heavy-duty vehicles for cargo, hosting 14 manufacturers and assemblers of buses, trucks, and tractor trucks, as well as two manufacturers of engines. Therefore, the region’s robust auto industry and rising healthcare budget drive growth.

List of Key Companies Profiled

- Celanese Corporation

- SABIC (Saudi Arabian Oil Company)

- BASF SE

- Koninklijke DSM N.V.

- DuPont de Nemours, Inc.

- Lanxess AG

- Ensinger GmbH

- Toray Industries, Inc.

- Kaneka Corporation

- Covestro AG

Market Report Segmentation

By Type (Volume, Tonnes, USD Million, 2020-2031)- Polyamide

- Polycarbonate

- Polyphenylene Sulfide

- Polyetherimide

- Polybutylene Terephthalate

- Polysulfones

- Others

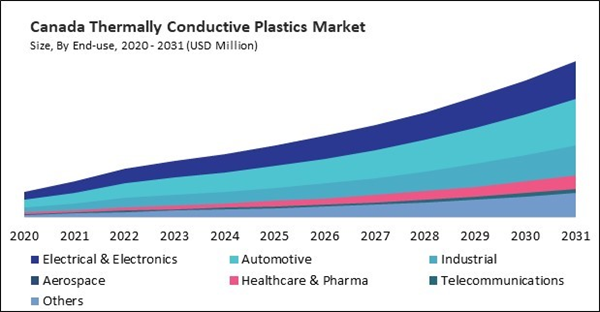

- Electrical & Electronics

- Automotive

- Industrial

- Aerospace

- Healthcare & Pharma

- Telecommunications

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Celanese Corporation

- SABIC (Saudi Arabian Oil Company)

- BASF SE

- Koninklijke DSM N.V.

- DuPont de Nemours, Inc.

- Lanxess AG

- Ensinger GmbH

- Toray Industries, Inc.

- Kaneka Corporation

- Covestro AG