North America Tumor Ablation Market Analysis

Tumor ablation is a minimally invasive technique in which interventional radiologists guide a needle-tipped catheter directly into a tumor, followed by applying extreme heat or cold to destroy or shrink the tumor. Imaging techniques are generally used to precisely find the tumor location. The ability of tumor ablation treatment to shrink tumors can increase the longevity of patients, relieve pain, and even in some cases, cure cancer. The technical success of the treatment and its minimally invasive nature is expected to drive the North America tumor ablation market demand in the coming years.Cancer ranks as the second leading cause of mortality in the United States. American Cancer Society estimated around 2,001,140 new cancer cases and 611,720 deaths are projected to affect the United States population in 2024. The rising cancer burden directly impacts the demand for effective treatment approaches to tackle the mortality rate caused by the disease. Thus, the growing prevalence of cancer is expected to positively influence the North America tumor ablation market share in the region.

The market is witnessing a surge in approvals from health regulatory authorities such as the United States Food and Drug Administration (FDA). In March 2024, United States based Medtronic plc announced FDA 501 (k) clearance for its bone tumor ablation system called OsteoCool 2.0. The upgraded design of the radiofrequency ablation system allows efficient treatment of benign bone tumors and painful bone metastases. The device can use four internally cooled probes at the same time and delivers 20W per channel, with the company claiming it as the most powerful bone tumor ablation on the market. Further, the company plans to introduce the product in the United States market this year. The launch of such innovative ablation systems is likely to augment the North America tumor ablation market growth in the forecast period.

The market is witnessing technological innovation in the field of tumor ablation systems which are increasing treatment precision and improving patient outcomes. In September 2023, the United States Food and Drug Administration (FDA) granted approval to ablation treatment planning and confirmation software, VisAble.IO, developed by Techsomed, an Israeli-based medical device company. The software uses the company's artificial intelligence-driven technology called BioTrace and facilitates image-guided ablation therapy, offering various advantages such as three-dimensional visualization of the ablation target. The rising integration of artificial intelligence in tumor ablation treatment is expected to optimize patient care and fuel market growth.

Other factors that drive the market share include the rising investment from the public and private sectors, heightened public awareness regarding the benefits of the technique, and the expanding applications of tumor ablation systems.

North America Tumor Ablation Market Segmentation

North America Tumor Ablation Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Breakup by Technology

- Radiofrequency (RF) Ablation

- Microwave Ablation

- Cryoablation

- Irreversible Electroporation

- Others

Breakup by Mode of Treatment

- Surgical Ablation

- Laparoscopic Ablation

- Percutaneous Ablation

- Others

Breakup by Application

- Liver Cancer

- Lung Cancer

- Kidney Cancer

- Bone Metastasis

- Others

Breakup by End User

- Hospital and Clinics

- Specialty Centers

- Others

Breakup by Region

- United States of America

- Canada

North America Tumor Ablation Market: Competitor Landscape

The key features of the market report include patent analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Sonacare Medical

- Medtronic Plc

- EDAP TMS

- Angiodynamics

- Healthtronics, INC

- Johnson & Johnson

- Boston Scientific Corporation

- Misonix, INC

- Biotronik

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Sonacare Medical

- Medtronic Plc

- EDAP TMS

- Angiodynamics

- Healthtronics, Inc.

- Johnson & Johnson

- Boston Scientific Corporation

- Misonix, INC

- Biotronik

Table Information

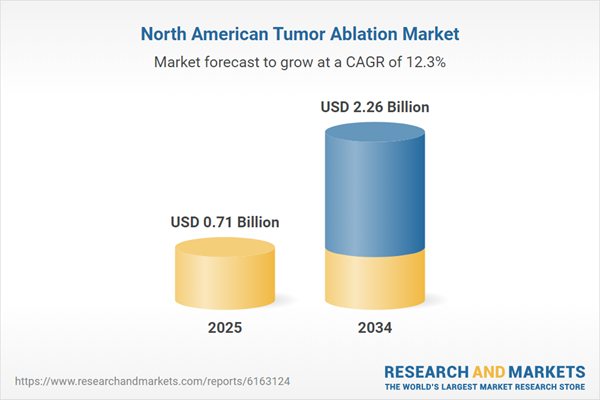

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 0.71 Billion |

| Forecasted Market Value ( USD | $ 2.26 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |