The North America virtual pipeline equipment market is segmented into equipment type, gas, and application. Based on equipment type, the market is divided into decompression units, compression units, transportation units, and dispensing units. In terms of gas, the market is categorized into CNG, hydrogen, RNG, and others. By application, the market is divided into utility pipeline/pipeline repair, industrial, transportation, commercial & residential, and fracking.

Chesapeake Utilities Corp, Stabilis Solutions Inc, Algas-SDI International LLC, ANGI Energy Systems LLC, Broadwind Inc, Cobey Inc, Cryopeak LNG Solutions Corp, Galileo Technologies SA, Quantum Fuel Systems LLC, Hexagon Composites ASA, Kinder Morgan Inc, Xpress Natural Gas, LLC, Aggreko Ltd, Fiba Technologies Inc, CMD Alternative Energy Solutions, Plum Gas Solutions LLC, and Chart Industries Inc are among the key players operating the North America virtual pipeline equipment market.

According to the US Energy Information Administration Annual Energy Outlook 2023, all forms of energy consumption in the US are projected to increase from 0% to 15% between 2022 and 2050 due to population outbursts and economic growth. The energy sector in the US is majorly divided into four major end-use sectors - industrial, transportation, residential, and commercial. Energy consumption in the industrial sector is expected to rise by 5% to 32% from 2022 to 2050.

In the transportation sector, energy consumption is expected to fall by 10% between 2022 and 2050 or increase by 8%. Economic growth projections heavily influence both sectors; as the economy expands, more energy is consumed. Therefore, various market players are reaching out to virtual pipeline equipment providers to deliver oil and gas. For example, in May 2022, Quantum Fuel Systems (Quantum), a fully integrated alternative energy company, was selected by Certarus Ltd. ("Certarus") to deliver industry-leading virtual pipeline trailers for natural gas with a total value of ~US$ 22 million. The trailers were delivered in Q3 and Q4 2022.

Based on gas, the North America virtual pipeline equipment market has been segmented into CNG, hydrogen, RNG, and others. The CNG segment held the largest share in the North America virtual pipeline equipment market in 2023. Hydrogen gas can be transported through a virtual pipeline equipment. Transporting gaseous hydrogen through existing pipelines is a low-cost option to deliver large volumes of hydrogen. Further, rapidly expanding hydrogen delivery infrastructure to deliver pure hydrogen requires the reinforcement of natural gas infrastructure. The world is focused on decarbonization, which has led to the investment and focus on the production and supply of hydrogen. The continuous R&D in hydrogen and the rise in demand for hydrogen for applications such as hydrogen fuel cell vehicles would create opportunities for the increased trading activities of hydrogen in the coming years. This factor generates the demand for virtual pipeline equipment for the transportation of hydrogen. The North America virtual pipeline equipment market is experiencing growth as the region is one of the leaders in hydrogen production. According to Invest in Canada, Canada has one of the clean hydrogen facilities across the world, and the country is among the top 10 hydrogen producers worldwide. Increasing investments in hydrogen production is likely to create substantial opportunity for the segment during the forecast period. As to deliver the hydrogen to end consumers, there will be substantial demand for virtual pipeline equipment.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America virtual pipeline equipment market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America virtual pipeline equipment market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table of Contents

Companies Mentioned

- North America Virtual Pipeline Equipment Market

- Chesapeake Utilities Corp

- Stabilis Solutions Inc

- Algas-SDI International LLC

- ANGI Energy Systems LLC

- Broadwind Inc

- Cobey Inc

- Cryopeak LNG Solutions Corp

- Galileo Technologies SA

- Quantum Fuel Systems LLC

- Hexagon Composites ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | August 2024 |

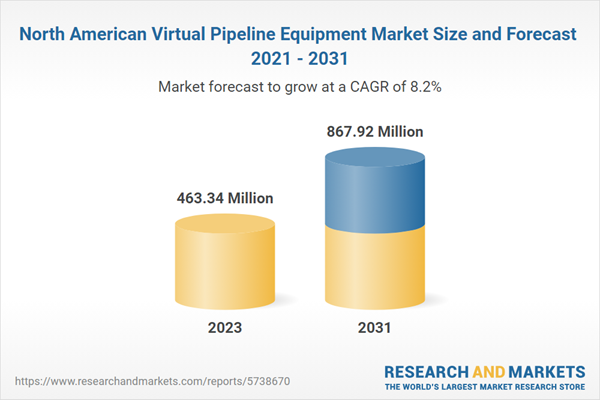

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 463.34 Million |

| Forecasted Market Value by 2031 | 867.92 Million |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | North America |

| No. of Companies Mentioned | 11 |